Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 14, 2015

High yield bonds resilient amid market volatility

US High yield bonds have managed to hold on to most of their yearly gains while their higher rated investment grade peers have slipped into the red during recent market volatility.

- US high yield bonds have returned over 3% year to date, investment grade down 0.5%

- Yield difference between investment grade and high yield is lowest since November 2014

- Recent slump in investment grade has been almost entirely driven by benchmark bonds

US high yield bonds have enjoyed a good start to the year so far. Primary market issuance remains resolute, with Northern Oil & Gas and Restaurant Brand Inc. the latest corporations to dip into the market. Spreads over treasuries have fallen across every sector, with the energy and consumer based sectors faring particularly well. Most significantly, the asset class has continued to perform well in the face of the recent bond market slump.

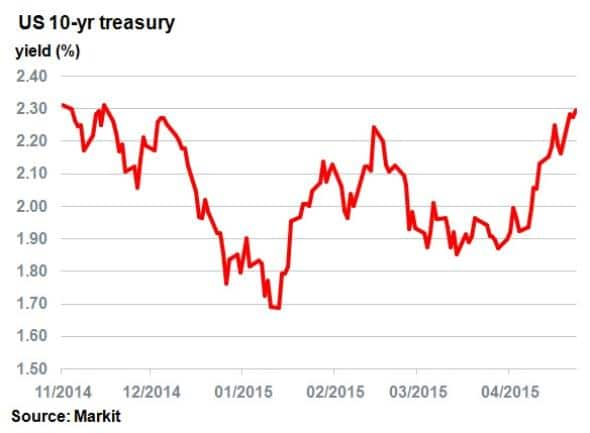

The last three weeks have seen a sell off of government bonds in Europe; a trend which has also extended into US treasuries, with the 10-yr rising 40bps. This reversal of fortunes means that the benchmark US treasury is now trading with the highest yield since November last year.

Investment grade hit by bearish sentiment

This slump has also been reflected in corporate bonds, but interestingly the supposedly less volatile investment grade bonds have borne the brunt of the bearish news.

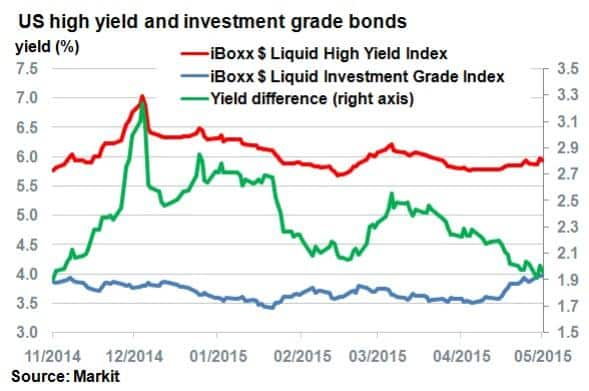

US investment grade bonds have lost almost all their total return this year to date, as represented by the iBoxx $ Liquid Investment Grade Index. Total returns for the asset class stood at 3% in mid-April, but these bonds are now down 0.5% for the year.

Conversely, US high yield bonds have remained resilient; the iBoxx $ Liquid High Yield Index has returned over 3% this year and is only 0.5% off the recent highs seen in April.

The diverging performance between the two sets of bonds is exemplified by the yield difference between the two indices. This figure has been on a steady decline since last December when it touched over 3%. April and May this year has further squeezed the difference and the yield difference now sits at a six month low of 1.96%.

The iBoxx $ Liquid Investment Grade Index now yields around 4%, up from around 3.5% before the latest slump. But the asset class' spreads over treasuries have remained relatively flat, indicating that the higher yields were a consequence of the government bond slump, rather than a deteriorating credit profile

In contrast, yields on the iBoxx $ Liquid High Yield Index have remained above 5.5%, but it's worth nothing that these were as high as 7% last December.

The divergence between US high yield and investment grade can be attributed to two factors. The recent Treasury bond selloff has had much more of an impact on investment grade yields, whose yield spreads are made up largely of underlying interest rates, as opposed to high yield bonds that have a greater credit component. Recent rising oil prices have also increased credibility among high yield corporations in the energy space.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Credit-High-yield-bonds-resilient-amid-market-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Credit-High-yield-bonds-resilient-amid-market-volatility.html&text=High+yield+bonds+resilient+amid+market+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Credit-High-yield-bonds-resilient-amid-market-volatility.html","enabled":true},{"name":"email","url":"?subject=High yield bonds resilient amid market volatility&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Credit-High-yield-bonds-resilient-amid-market-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=High+yield+bonds+resilient+amid+market+volatility http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Credit-High-yield-bonds-resilient-amid-market-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}