Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 14, 2015

Activist shorts frackers as oil rises

The price of crude oil has continued to recover in 2015 with WTI up by 33% year to date, but high cost producers are under increased scrutiny as an activist investor promotes the merits of short selling the sector at the Sohn Conference.

- $1.2bn of outflows recorded from oil tracking ETFs in the last eight weeks

- Currently the USO oil ETF more in demand to short sell than Einhorn's 'five' frackers

- Pioneer Resources ranks poorly and the stock has materially declined this last week

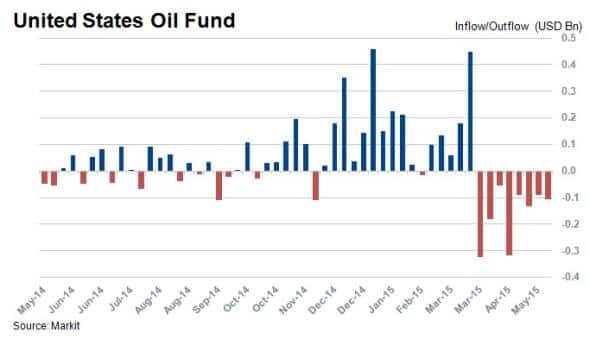

US oil fund flows reverse

ETF investors have been relatively patient about oil prices in the face of the recent selloff, but the recent rebound in oil prices has seen a marked reversal in ETF fund flows. Almost $1.2bn has flowed out of the United States Oil Fund (USO) since the end of March, taking its AUM to $2.4bn. These eight consecutive weeks of outflows have occurred after more than $3bn of inflows since September of last year when prices started to retreat in earnest.

The USO ETF provides investors with pure, unlevered exposure to oil prices and tracks the movements of light, sweet crude oil (West Texas Intermediate or WTI). Specifically, the fund tracks June 2015 oil futures contracts and is currently trading north of $60, up almost 30% from its mid-March lows.

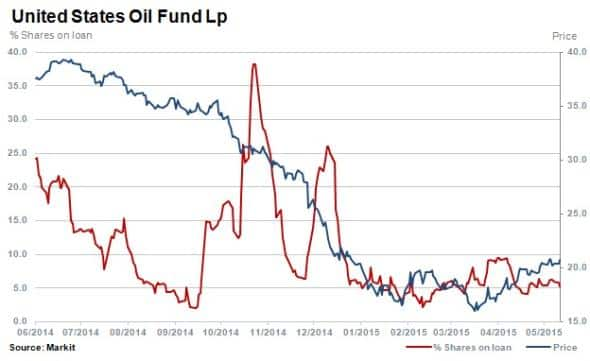

Investors continue to take advantage of the USO ETF as a vehicle to gain short exposure to oil price movements, which was particularly apparent during the recent oil price collapse.

The percentage of shares outstanding on loan for USO increased to over 35% in November last year before declining alongside the price of oil. The proportion of the fund's shares outstanding on loan stand at 5.3%. The current demand to short sell USO remains strong, with the cost to borrow currently at ~1%, near the ETFs' long term average.

Einhorn attacks high cost frackers

Despite the recent oil price recovery, David Einhorn (Greenlight Capital), who gained notoriety for short selling Lehman Brothers before its demise, recently gave a scathing presentation about the destruction of value occurring in the fracking industry.

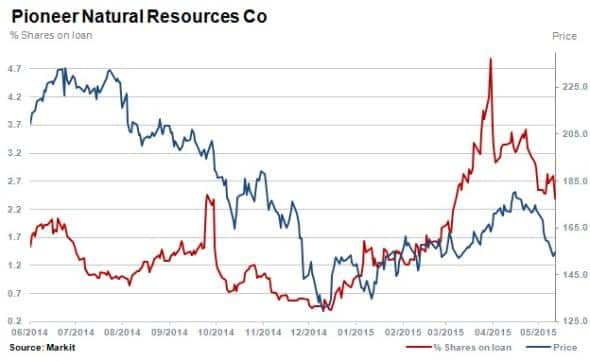

Five single names were mentioned in the presentation, but attracting the most attention was Pioneer Natural Resources. One of Greenlight's estimates of intrinsic value for the stock (and thus motivation to short), places Pioneer's shares at $78, on a best case discounted cash flow scenario. This represents less than half the stocks' value, which stood at $172 before the presentation.

Since the presentation, the stock has declined by a substantial 10% while shares outstanding on loan have decreased by 6% to 2.4%.

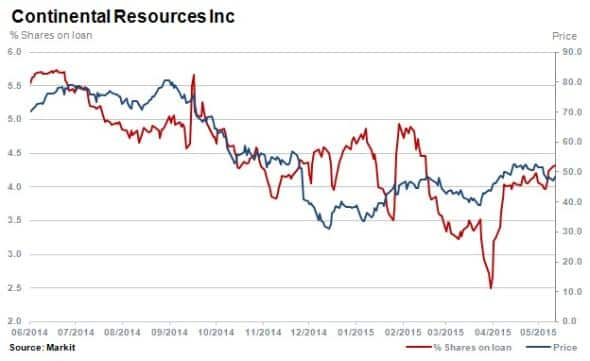

Continental Resources' shares have declined by 6% in the last week since the presentation, while shares out on loan have increased by 6% to 4.3%; making it the most short sold out of the five highlighted stocks.

Other stocks mentioned whose prices have not moved substantially include; Whiting Petroleum, EOG Resources and Concho Resources.

The conclusion to Einhorn's presentation is that investors, who want positive exposure to rising oil prices, should simply invest in oil.

An example of this would be the USO oil ETF. This strategy would have proved correct over the last month, as while all five fracking stocks declined on average by 4% (even as oil prices rose), USO's NAV actually increased by 10%.

Interestingly, demand to borrow the USO oil ETF remains strong and is five times higher than the most in demand of the five 'Greenlight frackers'.

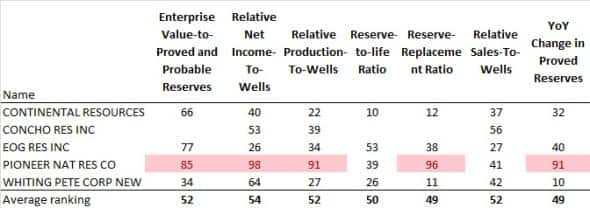

Research Signal's Oil & Gas factor rankings reveal that Pioneer Resources ranks unfavourably across many factors compared to industry average ranks and the other five frackers discussed.

- Pioneer ranks particular unfavourably according to the following Research Signals' factors, in line with Greenlight's focus on Pioneer;

- Enterprise value to prove and probable reserves

- Relative net income to wells

- Relative production to wells

- Reserve replacement ratio

- Yoy change in reserves

Pioneer is a clear outlier relative to peers, ranking negatively on key operating metrics which reinforces the short selling case presented by Greenlight.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Equities-Activist-shorts-frackers-as-oil-rises.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Equities-Activist-shorts-frackers-as-oil-rises.html&text=Activist+shorts+frackers+as+oil+rises","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Equities-Activist-shorts-frackers-as-oil-rises.html","enabled":true},{"name":"email","url":"?subject=Activist shorts frackers as oil rises&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Equities-Activist-shorts-frackers-as-oil-rises.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Activist+shorts+frackers+as+oil+rises http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14052015-Equities-Activist-shorts-frackers-as-oil-rises.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}