Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 14, 2014

Singapore in risk on mode

- The STI index has rebounded by over 11% from its February lows, this has seen shorts cover

- Singapore exposed ETPs are on track for their strongest quarterly inflows in five years

- Investors focus on the historically more volatile end of the market as these shares have outperformed their peers by over 10% YTD

After an early stumble which saw its main index retreat by 4% in the opening month of the year, the Singaporean market has proven resilient in the subsequent six months, which has seen the STI index climb by over 11% from its January lows. This bullishness looks to have been well warranted as the country's economy managed to grow by a healthy 3.5% in the first half of the year. In the face of such buoyant markets, Markit has seen buoyant investor sentiment towards the country's equities.

Advancing equity levels see shorts retreat

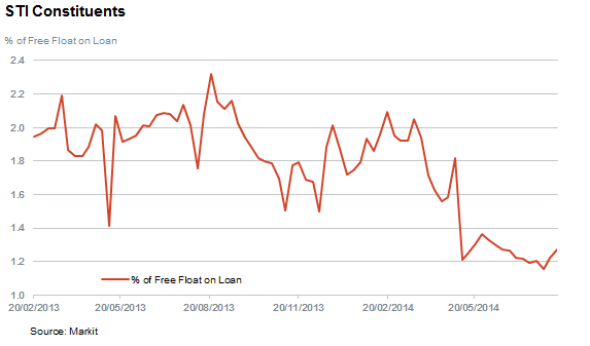

The recent share price surge has seen shorts retreat to their lowest level in over 18 months. The current average of free float out on loan across constituents of the STI index is now at 1.27%, just off the recent lows of 1.15% reported at the end of last month. While shorts appeared to have increased their positions slightly at the start of the year as the country's market stumbled, the recent rebound has seen shorts cover 40% of their positions since a yearly high in February.

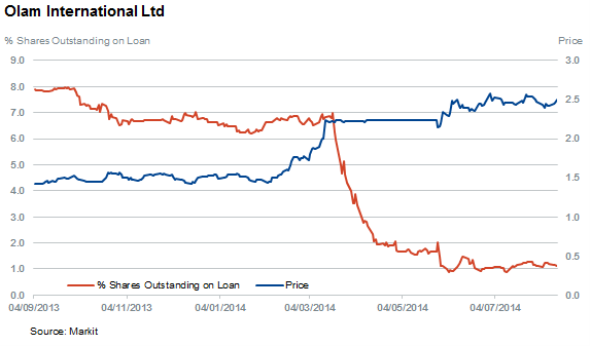

As ever, heavily shorted shares have seen the majority of the covering with agricultural firm Olam International seeing the lion's share of the covering. The company looks to have put the recent Muddy Waters allegations behind it as its shares have shot past their pre allegation levels. Short sellers also look to have given up on the firm as the current demand to borrow Olam shares is down by 80% since the start of the year, taking the company from the second to the eighth most shorted constituent of the STI index.

Chinese firm Yangzijiang Shipbuilding has also seen short covering in recent months as its shipbuilding business showed signs of recovering. Its current short interest is a third lower than at the start of the year.

ETF investors pile in

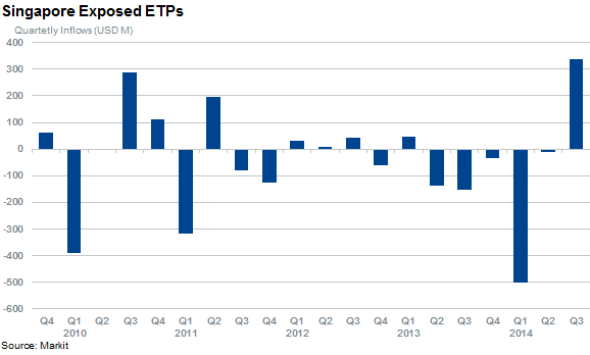

The recent bullish mood has not been missed by ETF investors, as Singapore focused ETPs are on track to see their best quarterly inflows in over five years in the current quarter. The 10 funds that track Singapore have seen over $338m of net inflows in the opening six weeks of the quarter, helping them snap a five quarter streak of outflows which saw their AUM fall by 40% from where it was at the start of 2013.

Volatile shares outperform

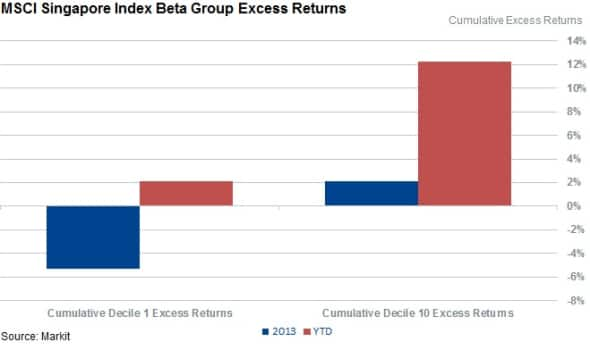

Another bullish sign for risk assets in the country has been the fact that investors have preferred to focus their attention on historically more volatile shares in the market. So far this year, the 10% of constituents of the MSCI Singapore Index with the highest beta have outperformed the rest of their peers by over 12%.

This strong performance puts the most volatile Singaporean shares on track to beat last year's outperformance when the more volatile shares outperformed the rest of the index by 2%. Shares amongst this group currently include Singapore Post and newly listed Super Group.

Interestingly, the shares with the lowest beta are also on track to beat the index this year as they have returned 1% more than the index on average so far this year. Last year these shares, which count shipping giant Cosco Corporation amongst their current rank, lagged behind the index by 5.3%.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014singapore-in-risk-on-mode.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014singapore-in-risk-on-mode.html&text=Singapore+in+risk+on+mode","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014singapore-in-risk-on-mode.html","enabled":true},{"name":"email","url":"?subject=Singapore in risk on mode&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014singapore-in-risk-on-mode.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Singapore+in+risk+on+mode http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014singapore-in-risk-on-mode.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}