Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 15, 2016

Prime property shorts in China

Burnt by falling equities, Chinese investors' increased appetite for prime urban real estate has pushed prices even higher in 2016. However a recent spike in short interest adds to growing sentiment that sector is cooling.

- Average short interest in Chinese property developers spike by a quarter from May lows

- Shenzhen and Guangzhou developers see material jumps in short interest in past week

- Even after significant covering year to date, largest firms lead short interest rankings

Big city life

As the MSCI snubs Chinese A-shares for the second year in a row, Hong Kong listed Chinese property stocks, which proved too hot for short sellers in early 2016, have seen a jump in shorting activity as insatiable investor demand drives prime urban real estate prices higher.

Property speculation has also been bolstered by an increase in peer-to-peer lending, a major source of shadow financing. After being burnt by the stock market collapse in 2015, retail investors have found a new fondness for bricks and mortar and have a clear preference for urban centres where price growth has outstripped smaller locations.

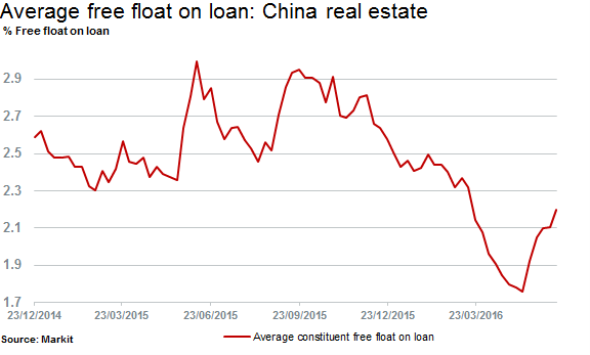

While stock prices of some key developers have moderated so far this year, with shorts covering, property prices have continued to rise. Recently however average short interest (measured by the percent of free float shares on loan) across Chinese real estate companies has surged by over a quarter.

Linking Hong Kong to the mainland, the tech oriented city of Shenzen has posted some impressive property price gains in recent years, but analysts have started to call for a correction as the government steps in to cool the sector through the introduction of home buying restrictions.

Highlighting these fears of a correction, in recent days there has been an aggressive spike in short interest in Shenzhen Investment and Kwg Property. Shenzhen Investment is a state owned property company, focused on top-tier developments. Short interest in the firm surged to 8.8%, from just under 0.5% only in the past week. Short interest has however fallen back down to 5.9%, but remains elevated.

Kwg Property is a major developer in Guangzhou, a port city northwest of Hong Kong. Short interest surged from negligible levels to 10.3%, also falling subsequently to 8.1% currently as shares have slid 13%.

There has also been a spike in the second largest property stock, China Vanke. Short interest has increased almost two fold in the past week, rising to 5.1%.

This is the first time short sellers have bulked up positions in the company since the start of the year, when almost one fifth of the firm's shares were sold short.

The largest short by value and percentage of free float out on loan is Evergrande with almost a fifth of shares outstanding on loan representing $354m.

Soho China's CEO stated in 2015 that she was concerned about foreign property valuations, and it looks as if short sellers have the same concerns about the local Chinese market. Short interest at the firm has climbed back towards 52 week highs of 2.4%; making the firm among top ten most shorted Chinese property companies.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-equities-prime-property-shorts-in-china.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-equities-prime-property-shorts-in-china.html&text=Prime+property+shorts+in+China","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-equities-prime-property-shorts-in-china.html","enabled":true},{"name":"email","url":"?subject=Prime property shorts in China&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-equities-prime-property-shorts-in-china.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Prime+property+shorts+in+China http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-equities-prime-property-shorts-in-china.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}