Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 18, 2016

UK insurers shrug off taxes, Brexit and floods

UK insurers are facing metaphorical and literal storms after years of healthy dividend growth. With the June referendum clouding the current outlook, strong expected dividend growth indicates that insurers may have considered their risks appropriately.

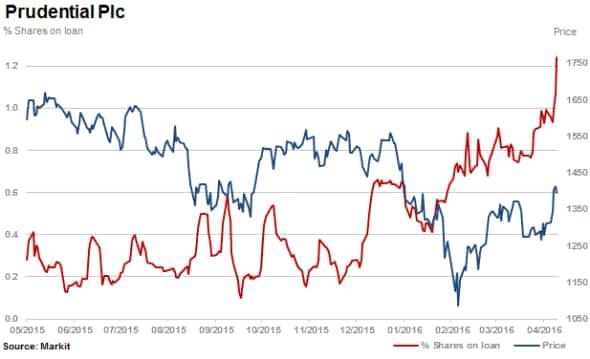

- Ahead of June referendum, Prudential sees short interest climb 95% in 2016

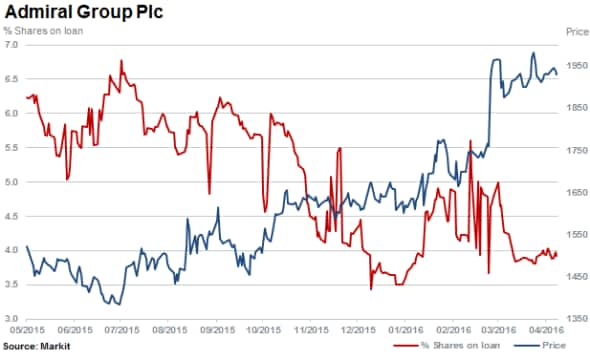

- Shorts cover positions in Lancashire and Admiral, the most short sold UK insurers currently

- Regular dividends by insurers to grow by 9% after a bumper 19% growth for 2015

UK insurers and investors alike have had to contend with floods, taxes and the prospect of Brexit, which has also sent mixed signals to short sellers.

The floods that occurred during the Christmas of 2015 led to an economic loss close to "2.8bn. Despite this impact and the recent changes to the Insurance Premiums Tax (IPT) to fund flood defences to the tune of "700m, UK insurers on balance remain resilient. While dividend growth for the sector is expected to remain strong, short sellers have increased positions on aggregate by 14% year to date.

Solvency II, a set of European rules governing the funding requirements of insurers, is now in effect. Designed to de-risk insurers by specific company profile, large diversified groups were expected to reap the majority of benefits with the rules expected to drive further consolidation throughout a harmonised Europe.

However, the prospect of Brexit has somewhat reversed this outlook. Potentially creating additional (and perhaps costly), new hurdles for pan European insurers. Scenarios may now in fact benefit smaller, monoline focused insurers in the UK.

After a flat performance in 2015, shares of Prudential, the largest UK insurer by market capitalisation, have fallen 9% thus far in 2016. Short sellers have increased positions by 95% to a relatively low 1.2% of shares sold short but these represent a substantial $455m in total value.

The most short sold insurer in the UK is Lancashire Holdings with 4.3% of shares outstanding on loan. The specialist (re)insurer operates in property, energy, marine and aviation sectors.

In the past year short sellers have almost halved positions in Lancashire, covering by 40% while the stock declined by 15%.

Short sellers have also covered more than two thirds of positions in the second most shorted UK insurer currently, Admiral Group. Shares in the firm are up by more than a fifth during the same time. The company insures and derives the majority of its revenue from over 1.2m cars insured in the UK.

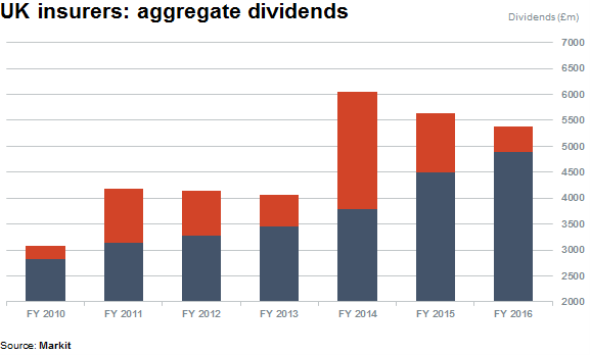

Markit Dividend Forecastingexpects healthy regular dividend growth across a universe of 20 companies classified as UK insurers. Growth of 9% is forecast in 2016 after growing by 19% in 2015 (the highest rate seen in five years). This follows six years of consecutive positive dividend growth.

Special dividends are expected to decrease by over 50% in 2016 with total dividends declining by 4.6% after a 6.7% decline in 2015 and a 48.5% jump in 2014. In particular, 2014 was impacted by Standard Life, which distributed a large payment in FY14 following the sale of its Canadian business.

While special dividend curtailments may have been dampened by floods, regulations and politics, insurers have delivered consistent growth in regular dividend payment over the past six years.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18042016-equities-uk-insurers-shrug-off-taxes-brexit-and-floods.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18042016-equities-uk-insurers-shrug-off-taxes-brexit-and-floods.html&text=UK+insurers+shrug+off+taxes%2c+Brexit+and+floods","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18042016-equities-uk-insurers-shrug-off-taxes-brexit-and-floods.html","enabled":true},{"name":"email","url":"?subject=UK insurers shrug off taxes, Brexit and floods&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18042016-equities-uk-insurers-shrug-off-taxes-brexit-and-floods.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+insurers+shrug+off+taxes%2c+Brexit+and+floods http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18042016-equities-uk-insurers-shrug-off-taxes-brexit-and-floods.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}