Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 18, 2015

The rise of equity evergreen repos

Tri party repo market participant are increasingly adopting a funding structure that enables them greater operational efficiencies to term out funding and meet regulatory requirements.

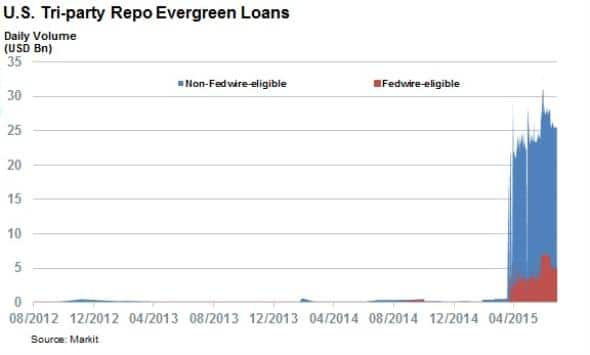

- Daily volume of evergreen repo trades has surged to $25bn, from a standing start in March

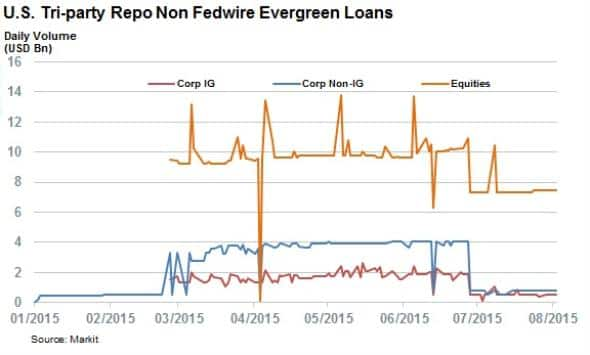

- Non fedwire eligible assets make up the vast majority of trades termed above 30 days

- Equity collateral has proved the most popular asset class used in evergreen trades

Ensuring that banks have ample funding in the event of any market squeeze had been one of the key aims of the slew of regulation passed in the wake of the financial crisis. One such measures to suit this goal was the liquidity coverage ratio (LCR) enshrined in Basel III which requires banks to hold enough high quality liquid assets (HQLA) to cover cash outflows over a 30 day period.

Since its implementation earlier this year, the Markit Tri Party dataset has seen banks clamour to meet their LCR requirements through evergreen repo transactions. These transactions, which are essentially daily resetting trades over a pre-determined window, have surged in popularity in the last few months as they offer a low maintenance way of guaranteeing access to the type of assets for the timeframe required by LCR.

To this end, the daily volume of evergreen repo trades in the Markit tri party repo dataset has jumped to $25bn since the start of March. Prior to the recent surge popularity, evergreen trades were literally non-existent as no one trading day registered more than $100m of evergreen repo trades.

Non fedwire assets in favour

The types of assets posted in evergreen tri party transactions also shows their role in ensuring that banks have meet LCR requirement as the majority of current trades are collateralized against non fedwire eligible assets. Banks can therefore turn their non HQLA assets and lock in funding for the duration required by LCR. This is also evidenced in the fact that the entirety of evergreen trades collateralized against non fedwire eligible assets in the last six month have been over the 30 day notice period mandated by LCR regulations.

A further dig into the types of non fedwire eligible assets pledged in Tri party evergreen repos shows that equities have been the most popular collateral type with trade terms generally far exceeding the 30 day maturity threshold.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-equities-the-rise-of-equity-evergreen-repos.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-equities-the-rise-of-equity-evergreen-repos.html&text=The+rise+of+equity+evergreen+repos","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-equities-the-rise-of-equity-evergreen-repos.html","enabled":true},{"name":"email","url":"?subject=The rise of equity evergreen repos&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-equities-the-rise-of-equity-evergreen-repos.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+rise+of+equity+evergreen+repos http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-equities-the-rise-of-equity-evergreen-repos.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}