Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 19, 2016

Technology short sellers target hardware makers

Slowing technology hardware sales have seen short sellers target both technology hardware as well as the semiconductor firms which supply the components.

- Short interest in S&P 500 semiconductor constituents up by a quarter ytd to highest in 2 years

- Microchip continues to see high demand to borrow despite a recent share price rebound

- ETF investors have piled into sector despite recent underperformance in hardware shares

Apple's disappointing first quarter earnings were underpinned by a 16% fall in demand for the company's iPhone compared to the same period last week. This weak demand for phones, which is not isolated to Apple, speaks to the growing smartphone penetration which when combined with the relative lack of innovation in the hardware space has ensured that physical technology shares have largely underperformed both their peers and the wider stock market.

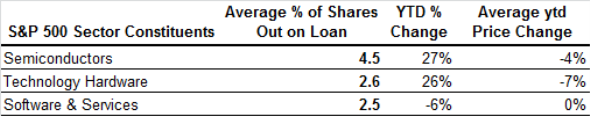

Technology hardware and semiconductor constituents of the S&P 500 index, which have felt the slowing hardware sales most directly, are down by 7.1% and 4.4% ytd on average respectively. This puts these sectors firmly behind their software peers in the tech space which have seen their shares trade flat for the year so far.

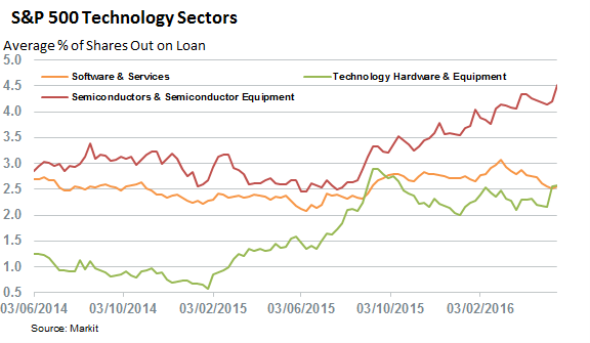

Short sellers have been keen to add to their positions in the wake of this underperformance as the average short interest in both the semiconductor and technology hardware sectors has jumped by over a quarter since the start of the year.

Semiconductor firms targeted

Semiconductor firms, which have seen sales fall by over 5% in the first quarter, have proved to be the high conviction short in recent months as the sector sees 4.5% of shares shorted on average after the recent spike in demand to borrow which is the highest in over two years. This means that the sector is nearly twice as shorted on average to that of the other two tech sectors which have 2.5% of shares shorted on average.

The increase in shorting activity across semiconductor firms has been pretty much universal given that 13 of the 16 of the S&P 500 semiconductor constituents have seen a rise in short interest since the start of the year.

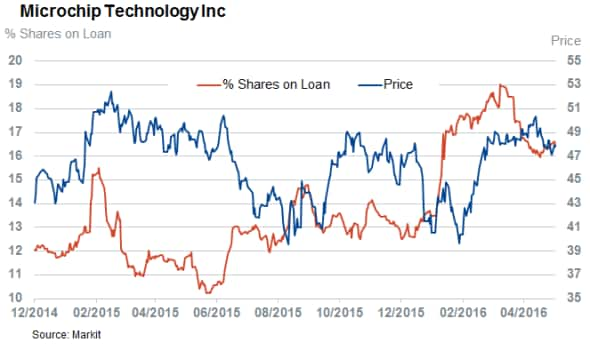

Microchip Technology continues to top the sector's most shorted list with 16.4% of its shares now out on loan to short sellers, 31% more than at the start of the year. This name has proven to be a tough one for short sellers to call given that its shares have rallied by 20% from the lows seen earlier in the year but short sellers seem to be willing to stay the course given that current demand to borrow the firm's shares is still near the recent three year high.

The lagging semiconductor constituent of the S&P 500 index, Micron Technology, has also seen short sellers target the firm as demand to short the firm's shares has climbed by a third ytd to 3.1% of outstanding shares.

ETF investors not giving hope

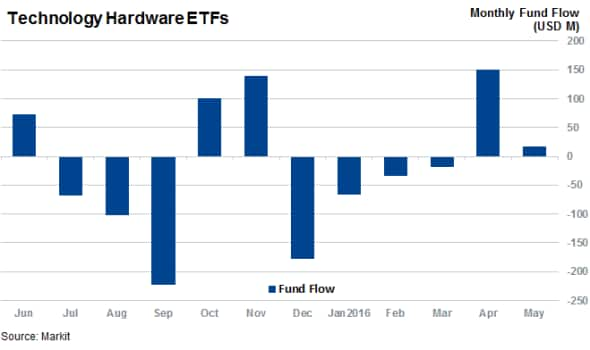

The weakness felt by hardware and semiconductor shares and the associated jump in short interest does not look to have put off short sellers. However, as technology hardware and equipment ETFs, which includes semiconductor funds, have seen inflows over the current earnings cycle. These 13 such funds have seen $168m of inflows so far in the second quarter. These inflows snapped a four month outflow streak which when combined with the sector's falling share prices saw these funds lose a third of their AUM.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052016-equities-technology-short-sellers-target-hardware-makers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052016-equities-technology-short-sellers-target-hardware-makers.html&text=Technology+short+sellers+target+hardware+makers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052016-equities-technology-short-sellers-target-hardware-makers.html","enabled":true},{"name":"email","url":"?subject=Technology short sellers target hardware makers&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052016-equities-technology-short-sellers-target-hardware-makers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Technology+short+sellers+target+hardware+makers http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052016-equities-technology-short-sellers-target-hardware-makers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}