Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 19, 2016

UK QE fails to spark rush to currency hedged funds

The pound's depreciation since the Brexit vote hasn't herded investors towards sterling-hedged UK exposed ETFs despite their large outperformance.

- Pound-hedged MSCI UK ETFs 20% ahead of their conventional peers ytd

- Post referendum inflows only represent 15% of the new assets gathered by sterling hedged ETFs in the last 12 months

- US investors stick to unhedged funds despite recent underperformance

Playing quantitative easing (QE) driven currency depreciations through currency hedged products have been some of the most popular ETF trades of the last few years. However the UK's revamped QE program, which was implemented in the wake of the EU referendum, has so far failed to ignite the frenzy to hedge sterling volatility through currency-hedged UK exposed ETFs seen at the onset of QE in Japan and the eurozone.

While aggregate post referendum inflows into the ten sterling-hedged UK exposed ETFs is still positive at $144m, these inflows are less than a quarter of the record one day $630m haul gathered by last year's most popular currency-hedged play, the WisdomTree Europe Hedged Equity Fund.

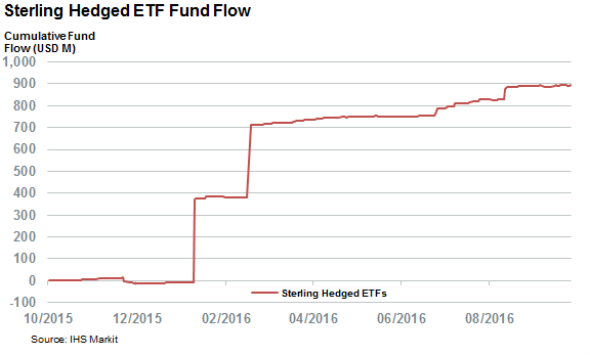

In fact the post referendum inflows into sterling-hedged ETFs have only been responsible for 16% of the $900m gathered by sterling-hedged ETFs in the last 12 months. Even the pre referendum flows are hard to tie down to momentum in the leave campaign as two largest inflow days, $381m on January 28th and a $330m day on March 7th occurred over three months prior to the vote.

This tepid post referendum buying comes despite the fact that the sterling's devaluation has driven the FTSE 100 index, whose constituents are somewhat insulated from sterling's fall due to their overseas exposure, to within striking distance of the all-time highs set last year after a 12.4% post referendum surge.

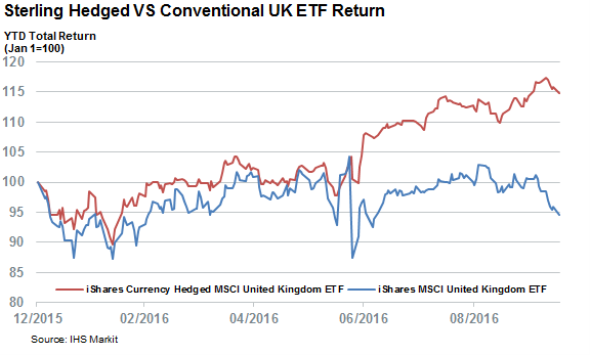

Unhedged overseas investors have failed to see any of this post referendum rally as the pound's slump has driven a 19% wedge between year to date returns delivered by the iShares MSCI United Kingdom ETF, the largest overseas listed UK fund and its sterling hedged peer, the iShares Currency Hedged MSCI United Kingdom ETF.

US investors stick to pound

US investors, which have bought the lion's share of the post referendum sterling currency hedging through the iShares Currency Hedged MSCI United Kingdom ETF have yet to fully commit to the currency-hedged trade as the assets managed by this fund, $113m still pales in comparison to the $1.9bn managed by its unhedged peer, the iShares MSCI United Kingdom ETF.

Interestingly, the latter saw its largest inflow day in over two years earlier this month when investors bought $96m of unhedged UK equity exposure. These inflows, which trimmed the fund's post Brexit out flows by nearly two thirds, indicate that investor faith in the sterling still remains, even in light of the recent headwinds faced by the currency.

Simon Colvin, Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102016-equities-uk-qe-fails-to-spark-rush-to-currency-hedged-funds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102016-equities-uk-qe-fails-to-spark-rush-to-currency-hedged-funds.html&text=UK+QE+fails+to+spark+rush+to+currency+hedged+funds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102016-equities-uk-qe-fails-to-spark-rush-to-currency-hedged-funds.html","enabled":true},{"name":"email","url":"?subject=UK QE fails to spark rush to currency hedged funds&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102016-equities-uk-qe-fails-to-spark-rush-to-currency-hedged-funds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+QE+fails+to+spark+rush+to+currency+hedged+funds http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102016-equities-uk-qe-fails-to-spark-rush-to-currency-hedged-funds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}