Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 21, 2015

Shorts ride commodities dive

As the price of precious metals dives further, short sellers are aggressively rotating into basic resource and mining stocks as the prospect of higher interest rates continue to send commodity prices lower.

- Mining, coal, iron ore and steel firms see short interest spike by third in last month

- Shorts take aim at iron ore as Kumba shelves its dividend for the first time since 2006

- Short sellers take a $0.5bn dollar position in commodities trader Glencore

A precious slump

Precious metals, energy stocks and now broad based commodity plays are getting hit from all sides. A stronger dollar and decreased demand emanating from China has short sellers repositioning as markets digest a 2015 interest rate hike in the US, providing more momentum for further dollar strength.

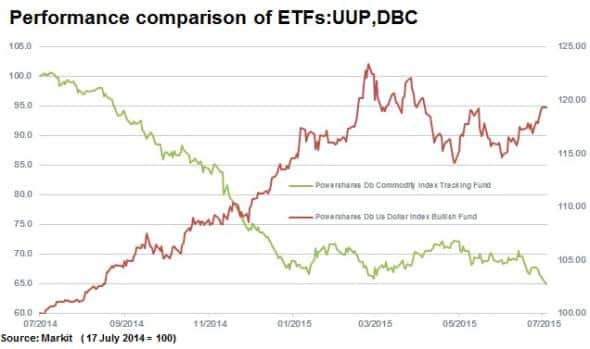

The Powershares Db commodity tracking fund holds precious metals, energy, industrial metals and soft commodities and has decreased by 15% over the last 12 months, while the Powershares Db US Dollar Index Bullish ETF has increased by 20% over the same time period.

Subsector shorts rotation

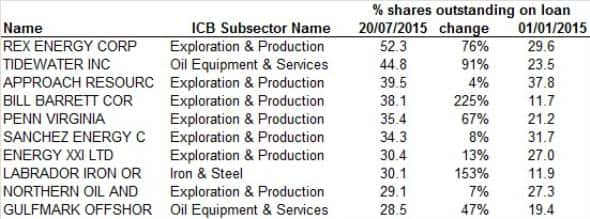

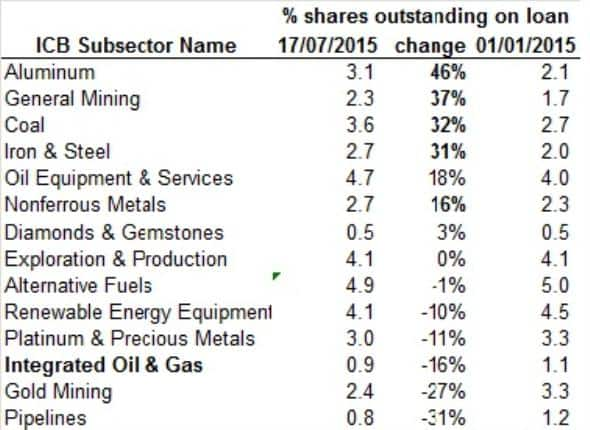

In the last month, analysing global oil & gas and basic materials stocks with at least $100m in market cap reveals that short sellers have trimmed exposure to integrated oil & gas companies by 16% while increasing positions in oil equipment and services firms. Oil has come under pressure once again with the lifting of sanctions on Iran likely to increase output levels. Average short interest for equipment and services firms in the oil sector has jumped 18% in the last month. Exploration firms still continue to suffer the most however, making up the majority of the top ten most shorted stocks across oil & gas and basic materials sectors.

The lower oil prices have seen short sellers return to Rex Energy with short interest climbing to 52% in the last three months while the share price dropped by another 33%. The stock is down 77% over the last 12 months.

Commodities misery

The largest sector increases in average short interest in the last month has highlighted that short sellers are increasing efforts to target iron & steel, coal, general mining and aluminium firms with large increases seen in the last month of 31% to 46%.

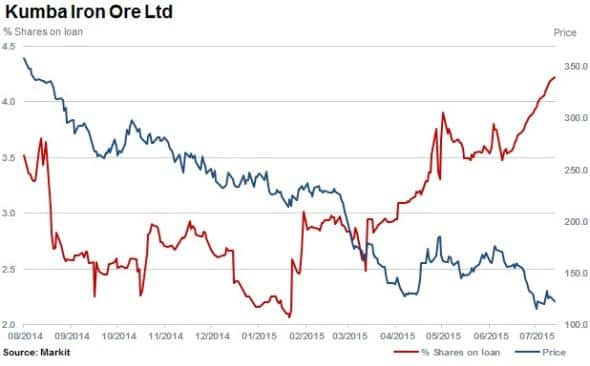

Kumba Iron Ore has axed its dividend for the first time since beginning trading in 2006. Africa's largest iron ore producer like others is battling against falling demand from china amid strong supply expected from Australia and Brazil.

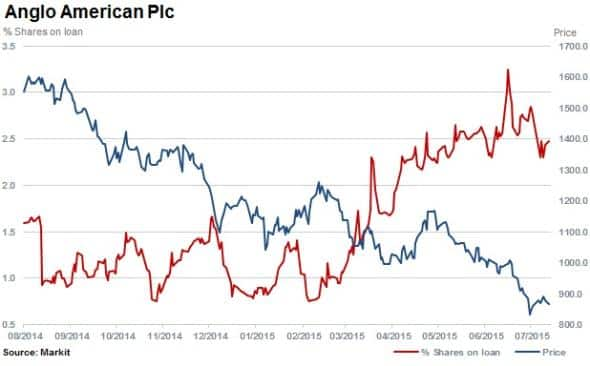

Both Kumba and major shareholder Anglo American have seen their share prices fall dramatically by 66% and 44% respectively. This occurred while short sellers increased positions in the stocks by 100% in the last six months.

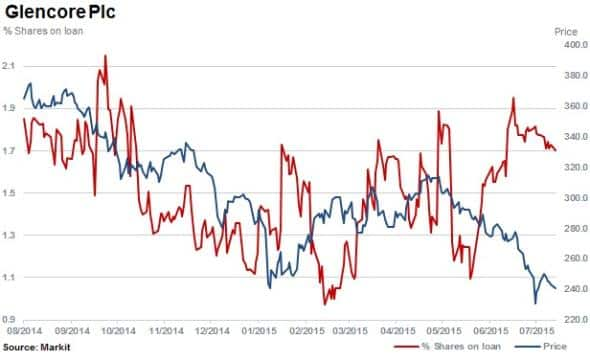

It's not just the producers that have been affected; commodities trader Glencore has seen a sharp jump in shorting activity, albeit off a small base. However the large short value on loan of $489m (representing less than 2% of shares outstanding) does represent a significant short position in the sector.

Safe haven no more

Investors have continued to flee gold ETFs, with the largest outflows of this year occurring in the last week with almost $500bn of outflows from the SPDR GLD ETF. Gold's industrial cousin platinum, which is down over 15% year to date, has seen short sellers increasing positions in platinum miner Lonmin.

Short interest in Lonmin is at the highest level since the Marikana mine tragedy in 2012, with 10% of shares outstanding on loan. The miner's shares are down over 63% over the last 12 months and short sellers' demand has increased to short the stock, with the cost to borrow rising in the last month to above 5%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072015-equities-shorts-ride-commodities-dive.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072015-equities-shorts-ride-commodities-dive.html&text=Shorts+ride+commodities+dive","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072015-equities-shorts-ride-commodities-dive.html","enabled":true},{"name":"email","url":"?subject=Shorts ride commodities dive&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072015-equities-shorts-ride-commodities-dive.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+ride+commodities+dive http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072015-equities-shorts-ride-commodities-dive.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}