Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 22, 2015

Week Ahead Economic Overview

In a week that sees first estimates of fourth quarter GDP numbers for Spain, the UK and the US, the Federal Reserve's Federal Open Market Committee also announces its latest interest rate decision. Moreover, flash inflation figures for January and latest unemployment data are released in the euro area and Markit's flash US Services PMI will be published.

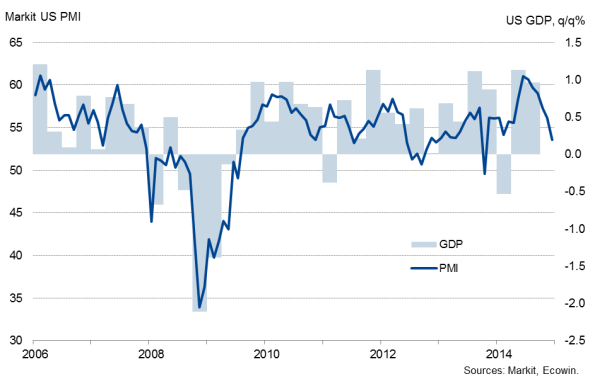

Economists have revised down their fourth quarter GDP estimates for the US in recent weeks, after weak retail sales data and disappointing business survey results added to growth worries in the world's largest economy. The Markit US Composite PMI Index fell to a 14-month low in December and suggests that the pace of economic growth will have slowed in the final three months of 2014, down to around 2-2.5% annualised. No change is therefore expected what's likely to be a dovish FOMC meeting, especially as wage growth remains disappointing at 1.7% and lower oil prices add leeway for interest rates to remain on hold for longer.

US GDP and the PMI

An uncertainty is the extent to which lower oil prices will foster strong economic growth, so important insights into how the US economy is performing at the start of 2015 will be provided by Markit's flash US Services PMI.

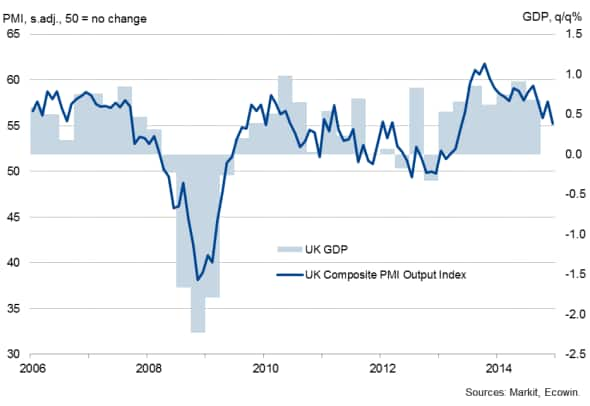

Both official data and survey evidence suggest that the rate of UK economic growth slowed at the end of last year. Industrial production fell 0.1% in November, with construction output down 2.0% and the PMI surveys signalled a loss of momentum towards the end of the year. The all-sector PMI was the weakest in over one-and-a-half years in December. It is therefore widely expected that GDP growth eased from 0.7% in the third quarter to 0.5% or 0.6% at best in the final three months of 2014.

UK GDP and the PMI

Consumer prices in the euro area fell compared to a year ago in December, as oil prices more than halved over the past six months. Consumer prices were down 0.2% at the end of last year and it is likely that deflation will intensify at the start of 2015 as lower oil prices feed through to consumers.

Eurozone consumer prices

Unemployment numbers for the currency bloc will also be updated. Little change is expected after the jobless rate held steady at 11.5% in November, as an improvement in Spain was offset by stronger job cuts in France and Italy.

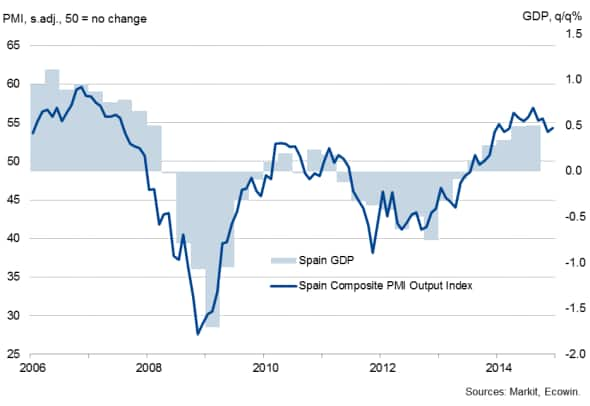

Meanwhile, fourth quarter GDP figures are updated for Spain. Survey data suggest that the Spanish economy will have remained in expansion territory in the fourth quarter of 2014, but overall growth may come in a little softer than in the previous two quarters at 0.4%.

Spanish GDP and the PMI

Data watchers will also keep an eye on the Japanese markets, with a fleet of economic data out during the week. Trade data, retail sales, industrial production, inflation and unemployment numbers will all be watched to see if they corroborate recent survey data. Markit's PMIs showed an acceleration in economic growth at the year-end, suggesting that the country pulled out of recession in the fourth quarter, after the economy shrank 1.7% and 0.5% in the second and third quarters, respectively.

Monday 26 January

In Japan, trade data for December are out.

Meanwhile, Nationwide release latest house price numbers for the UK.

In Germany, Ifo publish business climate data, while retail sales figures are issued for the currency bloc by Eurostat.

Russia sees the release of industrial production numbers.

Consumer confidence data are meanwhile released in Brazil.

Tuesday 27 January

The National Australia Bank's Business Conditions Index for December is published.

In Germany, retail sales and import price numbers are out, while France sees the release of business confidence data.

The Office for National Statistics publishes its first estimate of Q4 GDP growth for the UK.

Meanwhile, inflation figures are issued in Russia.

Durable goods orders data, consumer confidence numbers, the S&P/Case-Shiller Home Price Index and the latest Markit Flash US Services PMI are all out in the US.

Wednesday 28 January

Inflation numbers are published in Australia.

Consumer confidence data are released by Gfk for Germany and by INSEE for France.

Russia meanwhile issues latest unemployment numbers.

The Federal Reserve's Federal Open Market Committee announces its latest interest rate decision.

Thursday 29 January

In Australia, trade prices are out, while Japan sees the release of retail sales numbers.

The South African Reserve Bank and the Reserve Bank of New Zealand announce their latest interest rate decision, while producer prices are also out in the former.

The Bank Austria Manufacturing PMI results for January are released by Markit.

Unemployment and inflation numbers are issued in Germany, while Spain sees the release of retail sales figures.

Business climate data are published for the euro area.

Consumer spending numbers are meanwhile out in France.

In Italy, wage inflation figures are out and producer price data are issued in Greece.

The Confederation of British Industry publishes its latest Distributive Trades Survey results.

Brazil sees an update on unemployment figures.

Initial jobless claims data are out in the US.

Friday 30 January

Producer price data are out in Australia, while Japan sees the release of inflation and industrial output numbers, unemployment figures and housing starts data.

In South Africa, M3 money supply data and trade balance numbers are out.

Flash inflation numbers for January and unemployment data for December are out for the eurozone.

Meanwhile, Spain issues Q4 GDP figures alongside current account data.

In Greece, retail sales numbers are published, while France and Italy see the release of producer price data.

Gfk issues consumer confidence data for the UK.

The Bank of Russia announces its latest monetary policy decision.

In the US, the first estimate of fourth quarter GDP will be the highlight, with the Reuters/Michigan Consumer Sentiment Index also out.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22012015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}