Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 22, 2014

UK government finances disappoint as deficit rises 10% on last year

So much for austerity. UK government borrowing was "1.6 billion higher in September compared to last year. Halfway through the 2014-15 financial year and borrowing excluding the nationalised banking groups is so far up some "5.4 billion (or 10%) higher than the same period of the 2013-14 financial year, standing at "58.0 billion over the past six months.

The deteriorating finances are a disappointment to the government, which had set out to reduce borrowing by 10% to "95.5 billion this year.

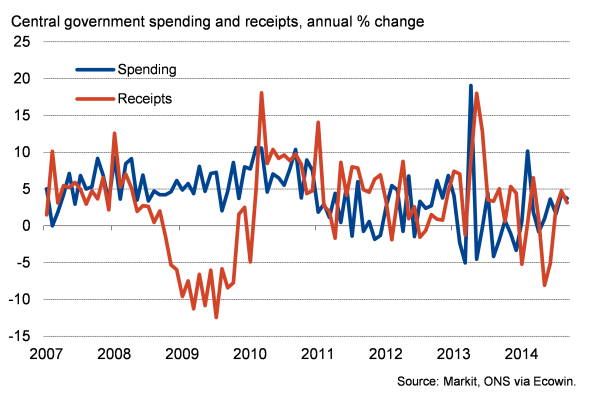

Spending up, revenues down

Delving deeper into the data from the Office for National Statistics, it seems that almost everything has not gone to plan as far as the borrowing figures are concerned.

Looking first at spending, government expenditure has risen by 3% over the first six months of the financial year, rising to "344.1 billion. Welfare spending is up by 2.9% (or "2.8 billion), largely as a result of higher state pension payments. Departmental spending is up 1.6% ("3.3 billion), driven by higher spend on goods and services, and debt interest payments are 2.6% ("0.6 billion) higher than last year. Investment spending is also higher, up 25.7% (or "3.3 billion).

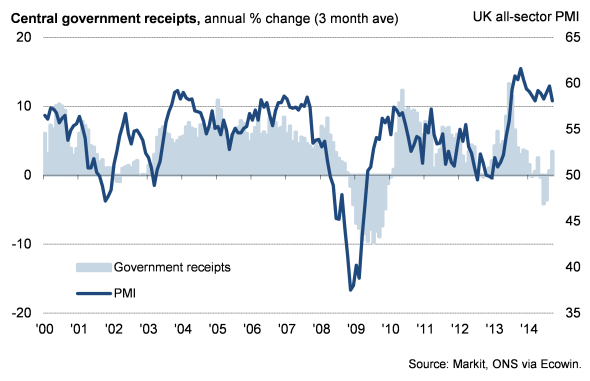

While spending has risen - counter to a planned reduction as part of the government austerity plan "- tax revenues have disappointed. However, what's odd is that a lower than expected tax take has not been due to an absence of economic growth or recovery. On the contrary, economic growth has been surprisingly strong over the past year. Instead, tax revenues have fallen well short of what one would have expected to see, given the pace of economic growth (see charts).

Tax revenues are in fact "1.0 billion (0.4%) lower than in the first six months of last year. That's despite an economy having grown by 0.9% in the second quarter of the year and PMI survey data suggesting the third quarter saw a similarly strong expansion of 0.8%.

Spending and revenues

Tax revenues v economic growth (PMI)

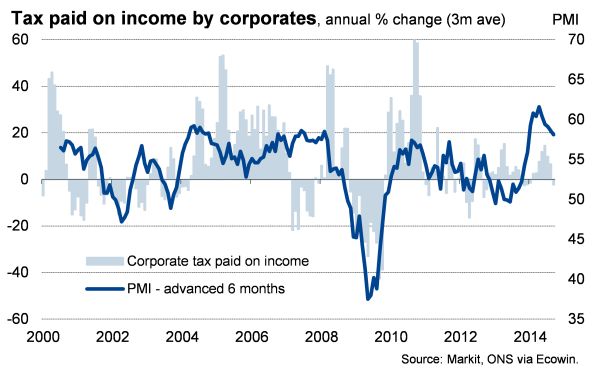

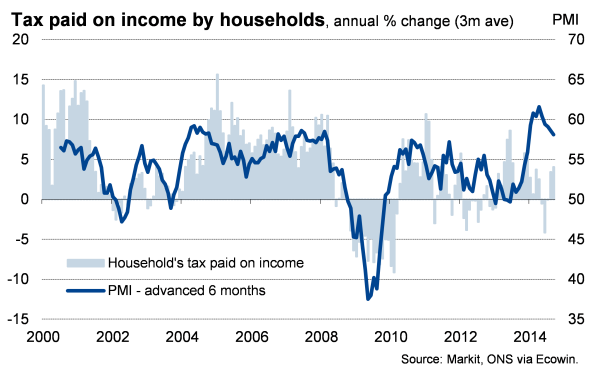

The pace of economic growth has helped buoy VAT receipts by 3.9% (or "2.3 billion) so far this financial year, while income-related taxes are up a mere 0.1% ("0.1 billion) and corporation tax is 5.4% higher (a gain of "0.9 billion). Far larger increases in income tax and, to a lesser extent, corporation tax would be anticipated given the pace of economic growth.

If it wasn't for a "1.5 billion jump in stamp duty over the financial year to date, related to the surging property market, the public finances would be in an even worse state.

Distorted wage data?

In seeking to explain the revenue shortfall, the ONS suggest that income tax payments were affected by firms delaying employee bonuses in 2012-2013 to take advantage of the reduction in the top tax rate in 2013-14, which has made this year's figures look low by comparison.

Others also suggest that the recovery is only generating low paid jobs which, combined with an increase in the personal allowance, has led to disappointing income tax receipts.

Another explanation could be that the UK has seen an explosion of self-employment since the financial crisis. Perhaps the income tax revenues will therefore not fully reflect economic activity until self-assessment tax submissions are completed later in the year.

Whatever the explanation, the cold facts are that the government is left with a far worse borrowing position than it has been expecting, meaning there is little scope for pre-election giveaways in the Autumn Statement.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-Economics-UK-government-finances-disappoint-as-deficit-rises-10-on-last-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-Economics-UK-government-finances-disappoint-as-deficit-rises-10-on-last-year.html&text=UK+government+finances+disappoint+as+deficit+rises+10%25+on+last+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-Economics-UK-government-finances-disappoint-as-deficit-rises-10-on-last-year.html","enabled":true},{"name":"email","url":"?subject=UK government finances disappoint as deficit rises 10% on last year&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-Economics-UK-government-finances-disappoint-as-deficit-rises-10-on-last-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+government+finances+disappoint+as+deficit+rises+10%25+on+last+year http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22102014-Economics-UK-government-finances-disappoint-as-deficit-rises-10-on-last-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}