Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 23, 2014

China flash PMI signals near-stagnant factory activity, falling prices and job losses

Business conditions were largely unchanged at China's factories for a third straight month in October. While exports remained a key source of new business growth, output barely rose and employment was cut as firms struggled in the face of subdued domestic demand. Prices also fell at an increased rate, highlighting concerns about growing deflationary forces in the manufacturing supply chain.

The subdued PMI data follow news that economic growth slowed to an annual rate of 7.3% in the third quarter, down from 7.5% in the second quarter and the weakest since the start of 2009. Though still relatively weak, the manufacturing PMI data have picked up from the contraction signalled earlier in the year, providing some hope that the rate of growth of industrial production may pick up in the fourth quarter.

That said, the ongoing fall in employment and prices will add to pressure on the authorities to implement further targeted stimulus measures to help prop up an economy that is struggling with weak global demand as well as a rapidly cooling domestic property market.

Business conditions stagnate

The HSBC Flash China Manufacturing PMI, compiled by Markit, rose from 50.2 in September to 50.4 in October. With the index only marginally above the 50.0 no-change level, the survey pointed to a third consecutive month of near-stagnant business conditions in the goods-producing sector.

Output growth slackened off to the weakest in five months, with companies only reporting a marginal increase in production compared to September.

New orders meanwhile grew at a pace largely unchanged on the meagre rate seen in the prior two months, dampened in particular by weak domestic demand. New export order growth slowed compared to September but still showed one of the largest monthly gains since the 2008-9 financial crisis.

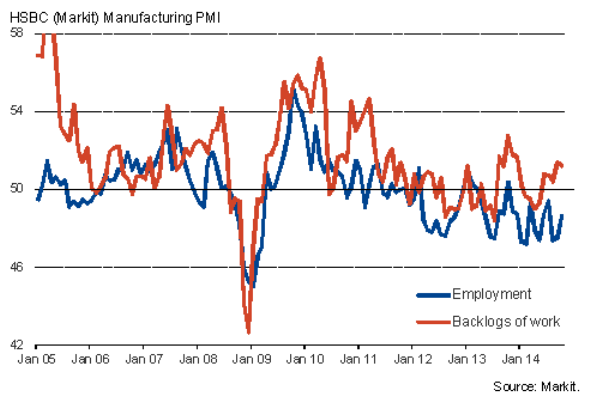

The overall paucity of new order book growth led manufacturers to reduce headcounts, albeit with the rate of job losses easing slightly. Employment has nevertheless been cut continually over the past 12 months.

Manufacturing payrolls and backlogs of work

Deflationary pressures

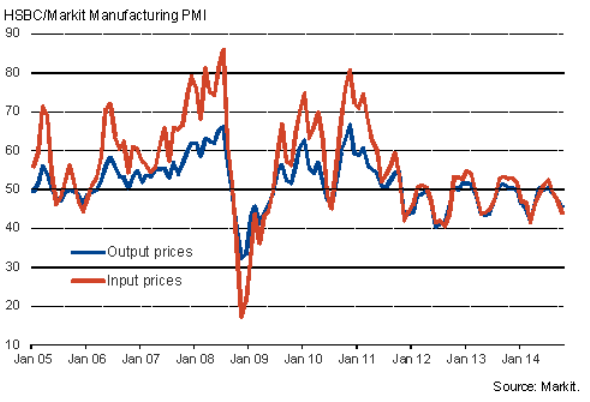

Prices fell as manufacturers and their suppliers sought to boost sales. Average prices charged by factories for goods and average input prices both fell at the fastest rates since March.

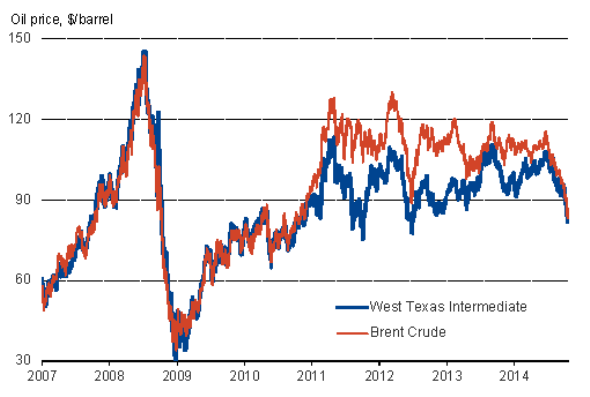

Some of the price fall can be attributed to lower global oil prices. Brent crude is down 10% in October so far, suggesting oil prices will continue to bear down on factory costs in November as well. The survey results therefore suggest that consumer price inflation, already down to 1.6% in September, may have further to fall in coming months unless domestic demand revives.

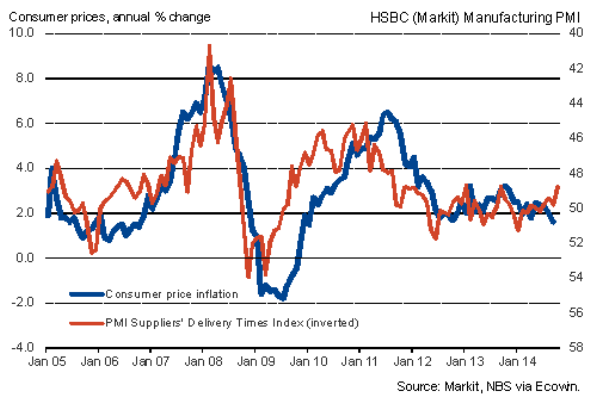

There was some evidence of suppliers' delivery times lengthening, which in the past typically feeds through to higher input costs and ultimately higher inflation, but at the moment, it seems that lower global commodity prices, especially oil, are dominating the inflation picture.

Factory prices

Oil prices

Consumer prices and capacity constraints

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-China-flash-PMI-signals-near-stagnant-factory-activity-falling-prices-and-job-losses.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-China-flash-PMI-signals-near-stagnant-factory-activity-falling-prices-and-job-losses.html&text=China+flash+PMI+signals+near-stagnant+factory+activity%2c+falling+prices+and+job+losses","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-China-flash-PMI-signals-near-stagnant-factory-activity-falling-prices-and-job-losses.html","enabled":true},{"name":"email","url":"?subject=China flash PMI signals near-stagnant factory activity, falling prices and job losses&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-China-flash-PMI-signals-near-stagnant-factory-activity-falling-prices-and-job-losses.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+flash+PMI+signals+near-stagnant+factory+activity%2c+falling+prices+and+job+losses http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-China-flash-PMI-signals-near-stagnant-factory-activity-falling-prices-and-job-losses.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}