Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 24, 2015

Greece contagion fears recede

The Greek government's willingness to concede to international creditors has seen CDS spreads tighten in both Greek and periphery countries' credit.

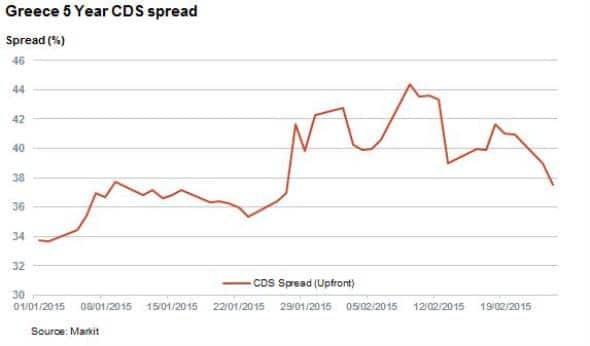

- Greek CDS spreads have tightened to their lowest point since the January election

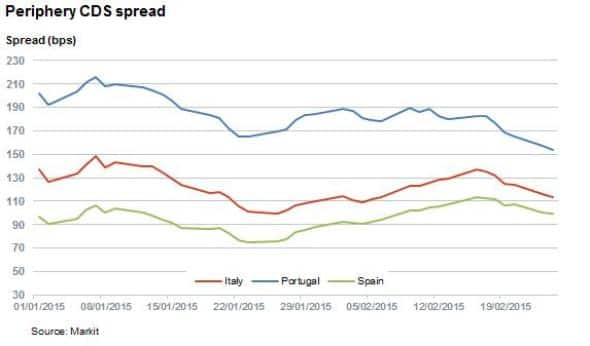

- Spreads in Spain, Italy and Portugal have also tightened

- CDS spreads in Spain and Italy are still much wider than just prior to the Greek election

The latest Greek crisis appeared to be nearing a resolution this week when Germany and Greece agreed to a four month bailout extension. The latest deal will see Greece continue to receive funding from its exiting bailout partners in exchange for a host of concessions which include privatisation of state assets, pension reform and crackdown on tax evasion.

Early indications that the final terms of the deal will likely be enough to reach agreement on have seen credit markets treat Greece with less suspicion than at any time since the recent election. But fears over contagion seem to be founded as Italian and Spanish CDS spreads have widened over the last two weeks.

Greek spreads tighten sharply

The news of the recent deal has been well received by credit markets as Greek CDS spreads tightened significantly on Monday February 23rd. Greek 5 year CDS spreads finished Monday at 39% upfront, a fall of 2% from Friday's close. The final terms of the deal came through in the late hours of Monday night and Greek CDS spreads have continued to tighten ahead of a meeting of European finance ministers which would pave the way for final approval. Spreads in the early hours of Tuesday morning were 1.5% tighter than on Monday; a level not seen since the start of the recent spike.

Periphery also tighter

While the recent Greek saga has largely been contained within the country, the last four weeks have seen a widening of spreads across southern Europe with Spain, Portugal and Italy all seeing their spreads increase in the four weeks after the Greek electorate went down the populist route.

Spreads in all three countries tightened significantly as the prospects of a deal increased on Monday, a trend which continued on Tuesday as a resolution looked likely.

Populist contagion

While the market has reacted positively to the recent Greek developments, spreads in Italy and Spain are still some way off the lows they registered ahead of the Greek vote on the January 23rd. This could potentially indicate unease in the credit markets regarding the potential of a further spread of populist parties such as Spain's Podemos, which recently saw a surge in popularity capitalising on austerity fatigue.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Credit-Greece-contagion-fears-recede.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Credit-Greece-contagion-fears-recede.html&text=Greece+contagion+fears+recede","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Credit-Greece-contagion-fears-recede.html","enabled":true},{"name":"email","url":"?subject=Greece contagion fears recede&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Credit-Greece-contagion-fears-recede.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greece+contagion+fears+recede http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24022015-Credit-Greece-contagion-fears-recede.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}