Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 27, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings in the coming week

- Cal-Maine remains the most shorted firm despite recent covering

- Perrigo short sellers multiply ahead of earnings

- Chinese car stocks see heavy shorting activity ahead of earnings

North America

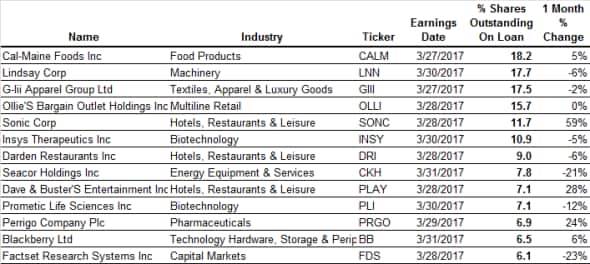

The first quarter earnings season is winding down, however short sellers still have plenty to keep them busy in the coming week as 13 companies announcing earnings next week have more than 6% of their shares outstanding on loan.

Top among next week's high conviction short targets is egg producer Cal-Maine which has over 18% of its shares on loan to short sellers. While high, it's worth noting that the current shorting activity is much lower than that registered 12 months ago when short sellers had borrowed more than 30% of the firm's shares. The covering could indicate that sceptics are starting to warm up to Cal-Maine after a string of disappointing earnings which have driven the firm's 40% off the value of the firm's shares.

Restaurant stocks are another key focus of short sellers in the coming week as three of the sector's firms are among the list of heavily shorted companies leading up to earnings. The most shorted of the lot is drive in operator Sonic which has just under 12% of its shares out on loan. Sonic's short interest trend is also significant as it has grown by a massive 60% over the last month which indicates a massive deterioration in investor sentiment leading up to earnings.

The other two high conviction restaurant short targets announcing earnings this week are Darden and Dave & Buster's which have 9% and 7% of their shares out on loan respectively.

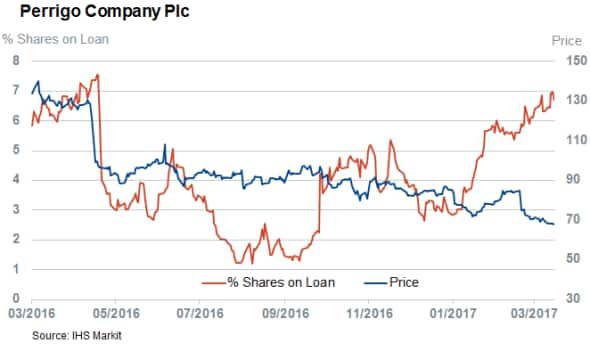

Another firm seeing a large increase in shorting activity ahead of earnings is genericsdrug maker Perrigo as demand to borrow its shares has surged by a quarter in the last four weeks. Short sellers are betting that the slide in Perrigo's share price, which started in earnest in 2015, may have some more room to run as shorting activity is nearing the all-time highs set back in April of last year.

Europe

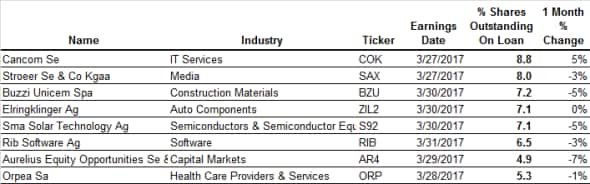

German IT company Cancom is the most shorted of a relatively small pack of short targets announcing earnings next week as it has just under 9% of its shares out on loan. A portion of Cancom's short interest is likely to be driven by desire to hedge exposure to its senior convertible which matures next year and which represents 6.5% of the company's shares outstanding.

Asia

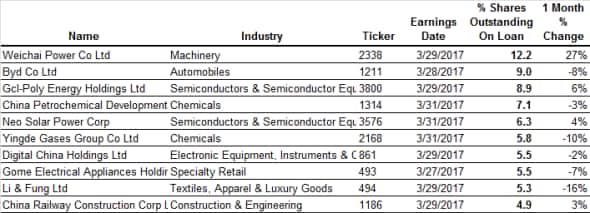

Carmakers are the hot short trade among companies announcing earnings this week as component maker Weichai Power and OEM BYD find themselves at the top of the list of the most shorted companies announcing earnings this week.

The former of the two isn't likely to be driven by directional short selling however as Weichai's mainland listed A shares trade at a discount to the Hong Kong listed H shares. This provides an attractive opportunity for arbitrageurs who can profit from the conversion by shorting Weichai's Hong Kong traded H shares while purchasing A shares on the mainland.

The 9% of BYD shares out on loan are unlikely to have been borrowed by arbitrageurs as borrow demand spiked in the wake of slump which saw shares lose 30% off the highs set in the early September. BYD shares have gone on to rally in recent weeks which has prompted short sellers to trim their positions from 11% of shares outstanding to the current 9%.

Solar also continues to be a favourite topic for short sellers and this week sees GCL-Poly Energy and Neo Solar Power make the list of the heavily shorted companies announcing earnings.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}