Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 27, 2017

Short sellers steer away from auto trades

Short sellers have given both auto loan and carmaker stocks a wide berth despite rising default rates in subprime auto loans.

- Short sellers only targeting one of the three largest car financing firms

- Short sellers steering clear of automakers, which have seen covering

- Chinese OEMs buck the trend as Great Wall and BYD targeted

Short sellers have proved to be some of the canniest investors when it comes to getting ahead of a large rise in credit defaults. Be it the energy slump last year or the real estate crash of the last decade, any surge in default rates from an industry over reliant on credit is sure to draw more than its fair share of shorting activity. Interestingly, despite the recent credit woes felt in the US auto sector, this trade has so far remained off their list of targets. US subprime auto loan defaults have recently climbed to the highest level since the financial crisis yet short sellers are staying on the sideline as the three listed originators of such loans haven't registered any significant increases in the demand to borrow their shares over the last few weeks.

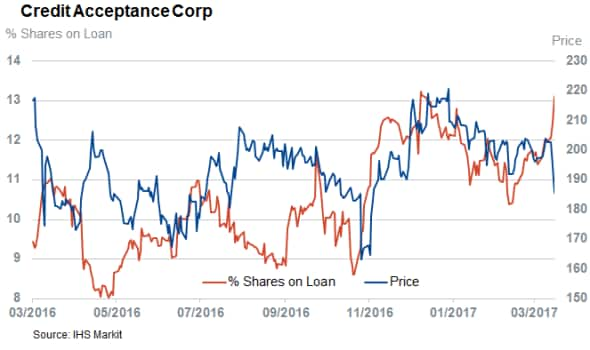

Bearish sentiment has remained concentrated in the smallest of the three listed auto loan originators, Credit Acceptance Corp, which now has 12% of its shares out on loan. The recent spike in defaults hasn't sparked much interest from short sellers as the demand to borrow Credit Acceptance shares has remained range bound between 10% and 12% of its shares outstanding for the last 12 months. This number could be driven by an inability to source Credit Acceptance shares in lending programs as the current borrow represents over four fifths of shares in lending programs, however the fee charged to short sellers has halved over the last 12 months - indicating short sellers are relatively less eager to get their hands on them.

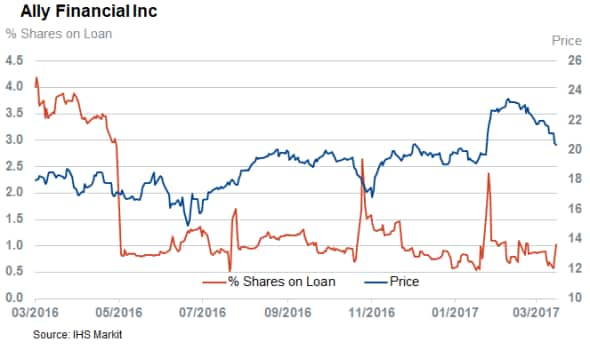

Short interest in Credit Acceptance's larger peers, Santander Consumer USA and Ally Financial, has gone the other way as demand to borrow both firms now hovers near the yearly lows despite the slew of recent negative headlines in the sector. Ally has seen the largest covering in the sector as demand to borrow its shares has fallen from a significant 6% of shares outstanding 12 months ago to less than 1% as of latest count.

Investor sentiment among automakers has also been relatively unaffected despite a string of recent earnings setbacks for the sector. Ford's recent quarterly update pretty much sums up the industry's recent woes which fall into three categories including rising input cost, falling volumes from once dependable fleet sales, and a rising dollar which prompted the firm to slash its guidance. While this sent the firm's shares down sharply, short sellers didn't profit from this setback as the demand to borrow Ford shares had fallen by over 80% from the recent yearly highs set last summer.

General Motors shares have also underperformed in recent weeks yet short sellers remain equally uninspired as the current demand to borrow its shares stands at less than half a percent of all issued shares.

China stands out

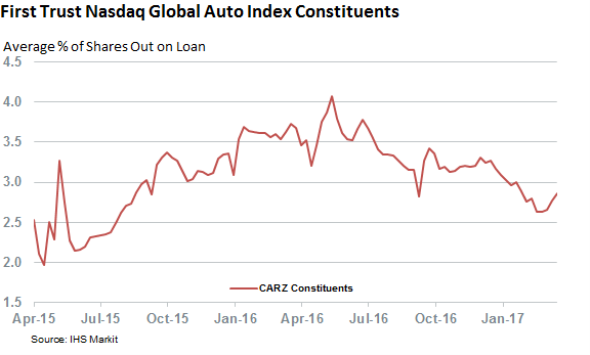

Short covering isn't limited to Ford and GM however as global automakers which feature in First Trust Nasdaq Global Auto Index have also seen a steady decrease in the demand to borrow their shares in the last few months.

The two notable exceptions to this trend are Chinese carmakers Great Wall and BYD which are the second and third most shorted automakers globally. Demand to borrow both firms has surged past the 9% of shares outstanding mark in recent weeks as the growth Chinese car sales fell significantly.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-Equities-Short-sellers-steer-away-from-auto-trades.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-Equities-Short-sellers-steer-away-from-auto-trades.html&text=Short+sellers+steer+away+from+auto+trades","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-Equities-Short-sellers-steer-away-from-auto-trades.html","enabled":true},{"name":"email","url":"?subject=Short sellers steer away from auto trades&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-Equities-Short-sellers-steer-away-from-auto-trades.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+steer+away+from+auto+trades http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27032017-Equities-Short-sellers-steer-away-from-auto-trades.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}