Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 29, 2015

UK debt market calm heading into election

Despite the growing possibility of another coalition government of uncomfortable bedfellows, the debt market's perception of UK credit has remained fairly stable.

- UK CDS spreads have remained flat for the year at 21bps

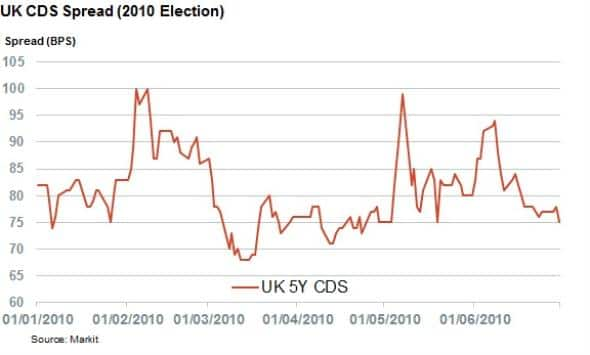

- Conversely, CDS spreads spiked after the 2010 election

- Gilts have remained stable across the maturity curve

With the UK election fast approaching, the prospect of another coalition government is growing increasingly likely. While the scenario of a hung parliament is nothing new following five years of Liberal Democrat-Conservative co-governance, the growth of smaller parties such as the SNP and UKIP brings a new dimension of uncertainty.

Despite this potential political instability, the credit market has been relatively calm in the weeks leading up to the May 7th election

CDS spreads flat

CDS spreads have shown little sign of stress running up to the upcoming election as the current 5 year spread of 21bps has been flat for much of the last three months. This could be driven by the fact that both of the major parties have largely committed to fiscal restraint.

Interestingly, the rise of the more spend free SNP in Scotland has not prompted much reaction from the CDS market, despite the fact that this party may be set to hold the keys to a future coalition.

Market calmer than previous election

The current UK CDS spread is over two thirds lower than the level seen in the 2010 election, when the spread was 77bps in the week prior to the election. While the general trend of falling CDS spreads reflects the UK's improving fiscal picture heading into the election, it's worth noting that this are also indicative of the healthier macroeconomic climate.

The CDS market was largely reactionary to the last election, with the UK spread widening by 13bps in the two days following the election. Whether the market reacts the same way this time around remains to be seen, but it's safe to assume that any potential widening would be largely driven by concerns over the influence of minority parties over a potential coalition.

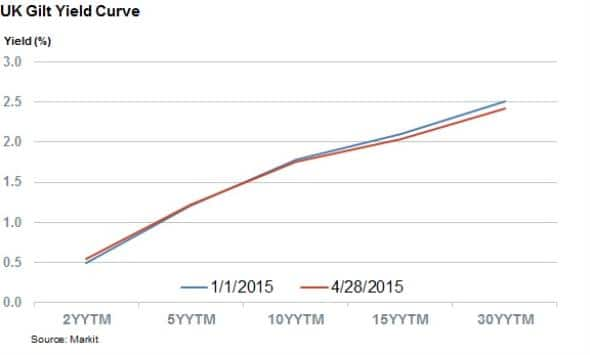

Gilt yields steady

The market's relative indifference heading into the election is also reflected in the bond market as Gilt yields have continued to hover at the levels seen at the start of 2015.

Unlike the CDS market, the Gilt yields remained relatively stable in the days following the 2010 general election, with the most volatile 30 year bond only registering a 3bps rise in the two days following the election. Indeed, the 2, 5, 10 and 15 year reference yields actually fell slightly.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042015-credit-uk-debt-market-calm-heading-into-election.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042015-credit-uk-debt-market-calm-heading-into-election.html&text=UK+debt+market+calm+heading+into+election","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042015-credit-uk-debt-market-calm-heading-into-election.html","enabled":true},{"name":"email","url":"?subject=UK debt market calm heading into election&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042015-credit-uk-debt-market-calm-heading-into-election.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+debt+market+calm+heading+into+election http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042015-credit-uk-debt-market-calm-heading-into-election.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}