Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 29, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to the companies due to announce earnings in the week to come.

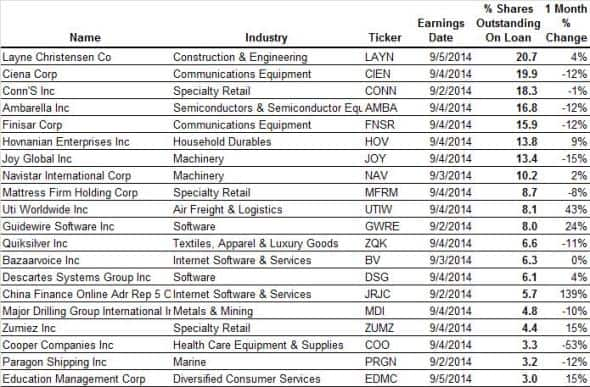

- Water firm Layne Christensen is the most shorted company announcing results next week

- Helvetia is the most shorted European name announcing results after its proposed takeover of Nationale Suisse

- Chemical company China Lumea is the most borrowed Asian company

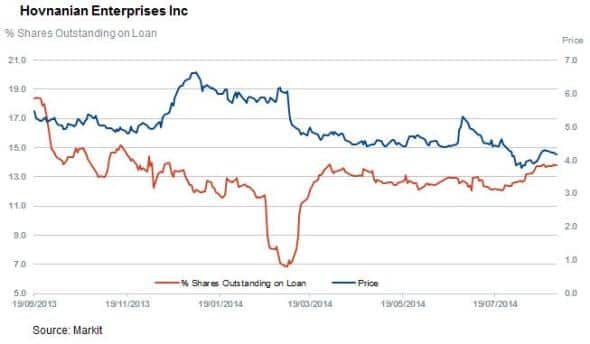

North America

The second quarter results season starts to wind down this week in the wake of the labor day weekend, with 86 companies announcing results with any short interest next week.

Layne Christensen comes in as the most shorted company announcing results next week with 20.7% of its shares out on loan. The current demand to borrow represents an all-time high for the firm after its shares fell by over a third since the start of the year. The indebted firm has seen its business come under pressure after a decline in mineral exploration. Investors in LAYN seem to be losing patience with management, with its largest investor recently coming public with calls for the company to restructure in order to address its current headwinds.

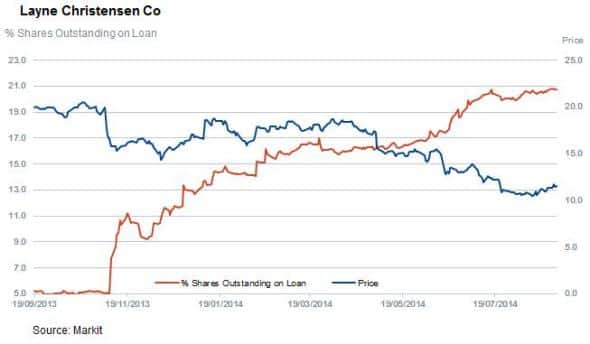

A spate of specialty retailers also make this week's list of heavily shorted shares with homeware firm Conn's topping the list with 18.3% of shares out on loan. Conn's has seen shorts circle in recent months after lowering its target for the coming year. Despite the recent shorting activity, shares in Conn's have gone a long way to recover ground lost earlier in the year.

Another company to see heavy shorting activity is Mattress Firm which has 8.7% of its shares on loan. The upcoming results have little in the way of mystery as the company preannounced its results which sent its shares up sharply as short sellers retreated.

Teen retailers Zumiez and Quicksilver group round out the list of retailers seeing heavy short interest in the build up to results and the back to school shopping period.

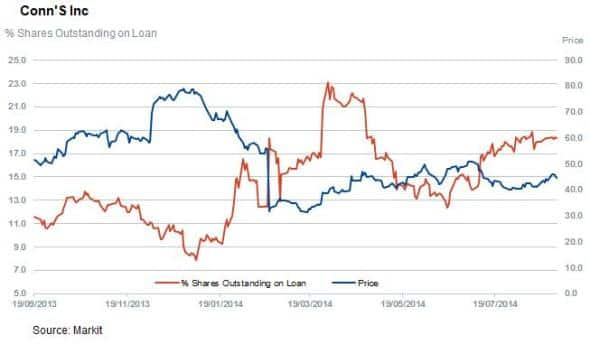

Another company to see interesting activity in the last few weeks is homebuilder Hovanian Group which has seen shorts increase by 9% in the last months to a new annual high. HOV has been the victim of a stagnating US homebuilding market which has seen it miss two straight quarterly sales and profit forecasts.

Europe

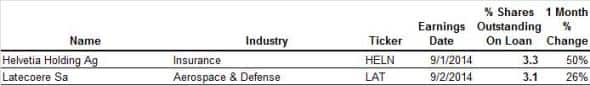

Europe sees light earnings activity next week with only two firms seeing 3% or more of their shares out on loan ahead of results.

Swiss insurer Helvetia Group is the most borrowed of the two names, although the current demand to borrow seems driven by its recent offer to purchase shares in competitor Nationale Suisse. The cash and shares tender offer has seen demand to borrow shares in Helvetia shoot up by 50% in the last four weeks.

The other company to see heavy demand to borrow is French aircraft component manufacturer Latecoere which has 3.1% of shares out on loan, a new three year high for the firm after it announced a large loss in February.

Asia

Asia also sees relatively low earnings activity with seven firms seeing more than 3% of shares out on loan ahead of earnings.

Chemical company China Lumena Materials is the most shorted of this week's Asian lot, with 5.3% of shares out on loan. Note that trading in shares in the company is currently suspended after the firm became the target of activist shorts which have levelled claims of accounting irregularities against the firm.

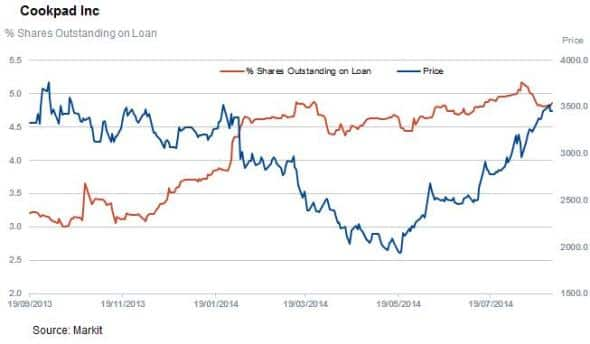

Japanese cooking website Cookpad is the second most shorted company with just under 5% of its shares out on loan. Shorts have steadily increased their bets in Cookpad over the last couple of months despite the fact that its shares have rallied from a slump earlier in the year.

Retailer Havey Norman is the only Australian firm to make this week's screen for the region with 3.7% of shares out on loan. Shorts have steadily been paring their positions in HVN as analysts covering the firm started to predict better results for the company in the upcoming earnings announcement.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082014Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082014Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082014Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082014Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082014Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}