Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 29, 2014

Russia struggles to keep BRIC status

Russia's CDS has suffered from the conflagration in Ukraine, but India has performed strongly from a relatively weak position

- Geopolitical risk has caused Russia's CDS to widen

- India has rallied and is now growing at its fastest rate for more than two years

- Markit iTraxx Europe and Markit iTraxx Senior Financials have converged

Russia and India have long had a close relationship, going back to the days of Nehru and Khrushchev. But, though links between the two countries remain tight, the same can't be said of their relative creditworthiness.

The conflagration in the Ukraine has pushed Russia's CDS spreads significantly wider this year. The sovereign is now quoted at 255bps, almost 100bps wider than where it started the year. After a brief lull, the conflict has escalated, with Russia accused of crossing the border into south-east Ukraine - an invasion by any other name. Russia's denials were given short shrift by western governments, and Ukraine has declared its intention to join NATO, a move that will surely daw the ire of President Putin and inflame the situation further.

BRICs shrug off Russia

So far, the markets are nonplussed by the worsening picture in eastern Europe. The other members of the BRIC group are all tighter than where they 12 months ago. India's spreads have rallied by 177bps over this period, and at 178bps are now 77bps tighter than Russia (they were 150bps wider in August last year).

India's economy grew 5.9% during the second-quarter, its fastest rate for more than two years. The rally in the sovereign's spreads accelerated in May, when Prime Minister Modi was elected. However, it should be noted that India's economy as in a trough (by its standards) this time last year, and it remains to be seen whether Modi can deliver the market-friendly reforms he has promised.

Russia and India's spreads have diverged, but the other BRICs - Brazil and China - have been stable in comparison. Brazil's spreads have rallied to 130bps this year, but news that it has fallen into recession highlighted the inherent problems in the government's economic model.

China trades tighter than the rest, but has seen little improvement this year. A hard landing for China is not the most likely scenario, but given the property bubble and the concurrent build-up of debt in the shadow banking sector, it is a scenario that can't be discounted.

Of course, all emerging markets are benefitting from QE in the US and Japan, and bond yields are staying low as a result. But investors should be cognisant that it is not a homogeneous asset class, and position themselves accordingly when the monetary policy cycle turns.

Corporates and banks converge

The ECB might soon join the other major central banks and implement QE. Inflation figures for August indicated that the eurozone is heading towards a Japan-like deflationary spiral, and with the austerity brakes still on it will be the responsibility of the ECB to prevent such an outcome. QE is therefore more likely than it was a few months ago, though the conservative nature of the ECB will probably mean that it will wait to see the effects of the TLTROs later this year.

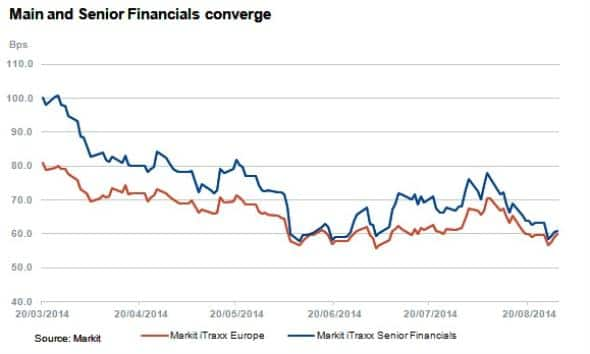

Activity in the CDS market may pick up as the summer months come to an end. The next few weeks, though, will be dominated by the upcoming introduction of the 2014 ISDA definitions. The basis between the Markit iTraxx Europe and Senior Financials index has closed, and the relationship between the various financial index will be closely watched before and after the September 22 roll.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082014Russia-struggles-to-keep-BRIC-status.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082014Russia-struggles-to-keep-BRIC-status.html&text=Russia+struggles+to+keep+BRIC+status","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082014Russia-struggles-to-keep-BRIC-status.html","enabled":true},{"name":"email","url":"?subject=Russia struggles to keep BRIC status&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082014Russia-struggles-to-keep-BRIC-status.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russia+struggles+to+keep+BRIC+status http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29082014Russia-struggles-to-keep-BRIC-status.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}