Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 29, 2015

Glencore/Anglo decimate basic materials bonds

Glencore and Anglo American have dragged the basic materials sector to record losses, with credit markets showing little relief.

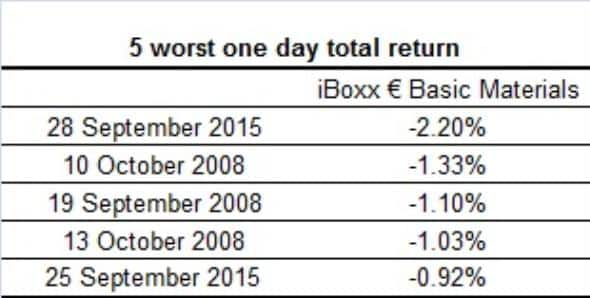

- Markit iBoxx € Basic Materials index suffered its biggest one day loss on record of -2.2%

- Investment grade Glencore bonds now imply a B rating, while the CDS market implies CCC

- Anglo American's 5-yr CDS spread continues to widen, surpassing 600bps intraday

Investors in the European corporate bonds market have suffered considerable losses over the past week and none more so than in the basic materials sector, led by commodity house Glencore.

In fact yesterday was the worst day on record for the Markit iBoxx € Basic Materials index. The index, made up of 79 investment grade bonds spanning mining, chemicals and steel, saw a -2.2% total return in a single day. Among the list of the top five largest single day losses incurred for the Markit iBoxx € Basic Materials index, three were from 2008, during the financial crisis. But even the largest loss during that period, -1.33%, looks tame compared to yesterday's bloodbath.

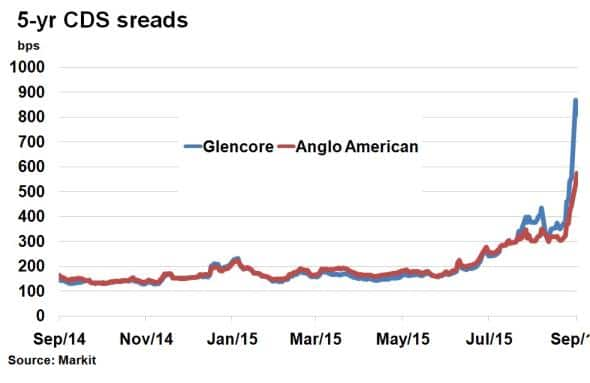

The losses represent the extent to which investors are fretting over weak commodity prices and the potential spill over effects, especially among more leveraged names like Glencore and Anglo American. Their bonds make up around 25% of the Markit iBoxx € Basic Materials index by weighting and exhibit considerable clout over index returns. Both names have seen credit risk surge over the past week in tandem.

Investment grade threat

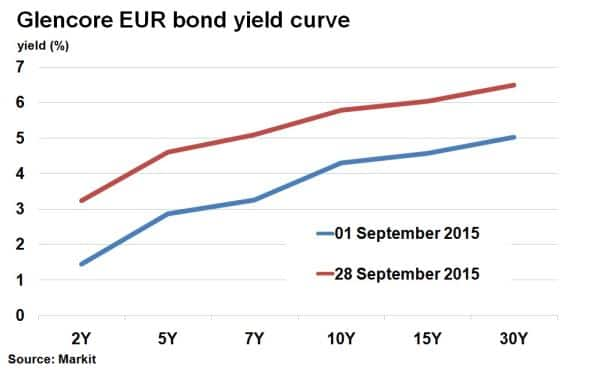

Any further losses in the basic materials sector are highly dependent on names such as Glencore and Anglo American and how they manage to restore confidence among credit investors. Glencore has seen a considerable shift in its yield curve over the past month as market sentiment turned negative.

Glencore's five year 3.375% euro denominated bond has seen its yield double over the past day to surpass 10% on an intraday basis. According to Markit's iBoxx EUR High Yield indices, this would imply that Glencore's bonds trade at a B rating, with yields fast approaching average CCC yields of 14.32%. CDS spreads are already implying a CCC rating, which would no doubt put further pressure on Glencore's investment grade status and bond returns in the sector.

Some respite

While Glencore's stock price has risen today, CDS spreads remain under pressure from investors looking to protect themselves from a possible default. Glencore's 5-yr CDS widened a further 64bps this morning before Glencore's management finally broke its silence and proclaimed that the company has no solvency issues. Latest levels indicate tighter CDS levels than yesterday's close, but little relief.

Meanwhile Anglo American, which has not been as heavily scrutinised as its peer in the last couple of days, has continued to see its credit spread widen. Latest levels surpassed 600bps on an intraday basis, in junk territory.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092015-Credit-Glencore-Anglo-decimate-basic-materials-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092015-Credit-Glencore-Anglo-decimate-basic-materials-bonds.html&text=Glencore%2fAnglo+decimate+basic+materials+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092015-Credit-Glencore-Anglo-decimate-basic-materials-bonds.html","enabled":true},{"name":"email","url":"?subject=Glencore/Anglo decimate basic materials bonds&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092015-Credit-Glencore-Anglo-decimate-basic-materials-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Glencore%2fAnglo+decimate+basic+materials+bonds http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092015-Credit-Glencore-Anglo-decimate-basic-materials-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}