Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 29, 2015

US home builders flying higher

On average short sellers have covered positions in US home builders as the housing market continues on an almost five year rally. However, certain names have seen a recent rise in shorting activity.

- Average short interest across US homebuilding declines to an eight year low

- Hovnanian is the most short sold homebuilder with almost a fifth of shares shorted

- Despite solid earnings, largest homebuilders Lennar and D.R. Horton see rise in shorting

Shorts struggle to build in US housing

Calling the top of the US housing market has proven tricky for short sellers since 2008. The sector's recovery and that of the US economy in general has seen stocks continue to perform in recent years, underpinned by record low interest rates and quantitative easing.

Positive sentiment in US property and home builders has surged as confidence levels reach multi year highs and US housing prices continue to rise as measured by the US National Home Price Index. This has seen even the largest firms positing double digit increases in new orders and net income.

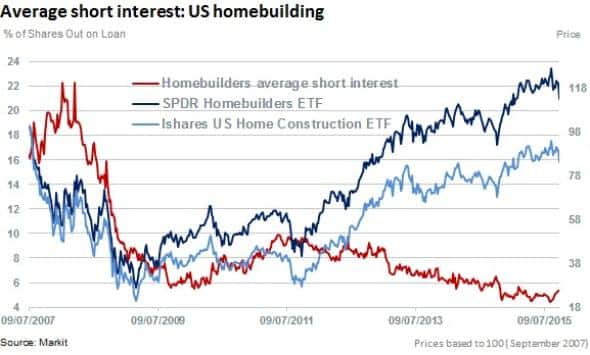

Using the SPDR Homebuilders and iShares US Home Construction ETFs as proxies for the sector shows that short sellers managed to time the 2008/09 crisis well. Short interest for the segment peaked before prices slumped in 2009, followed by covering by short sellers.

Shorts looked to have returned to the sector in 2012 but success looks to have been company specific, with average short interest across US homebuilders continuing to decline since then, to an over eight year low currently.

Shorts narrow focus

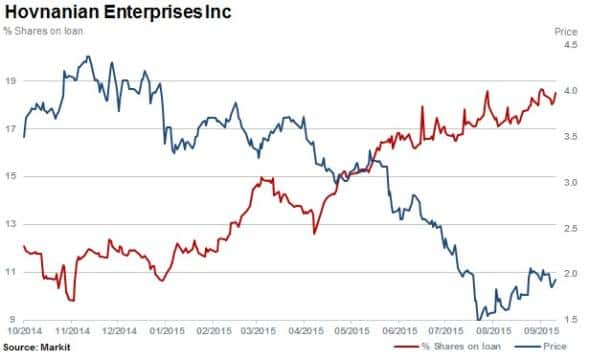

Shares in Hovnanian Homes have fallen 41% in the last 12 months and the company is still the most shorted homebuilder currently. Short sellers have continued to build positions during the decline, with shares outstanding on loan reaching a 12 month high of 18%.

Hovnanian shares initially came under increased pressure in June 2015 after the company missed earnings expectations for the second quarter of 2015.

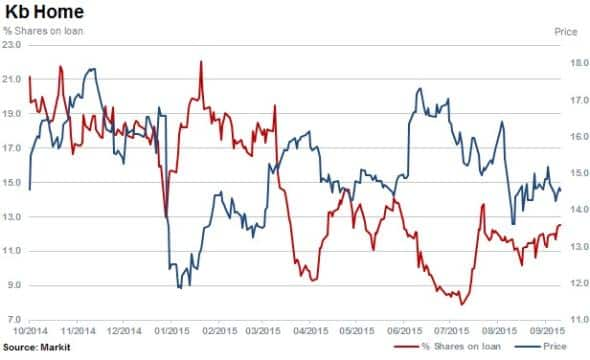

Hovnanian joins KB Home who frequently ranks amongst the most shorted companies ahead of earnings with 12.5% of shares outstanding on loan currently. KB Home's share price has however recovered from an earlier fall during the year, with shares are 3% up over the past 12 months.

In early 2015 KB Home announced it was expecting a significant drop in margins which sent shares falling. However less than six months later, the company topped market expectations when announcing strong second quarter earnings.

Largest attractions in US homebuilding

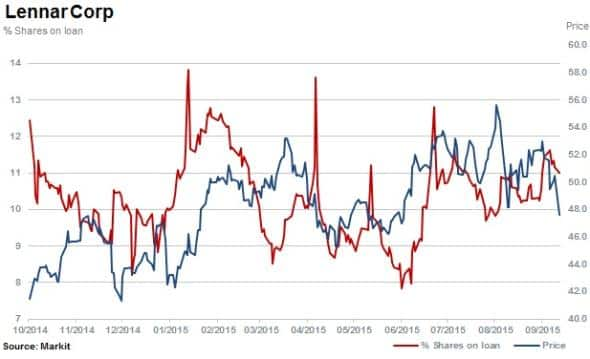

Lennar, the second largest to D.R. Horton by market value ($8.2bn) and houses constructed, has maintained its attraction to short sellers with 11% of shares outstanding on loan. The company's strong set of results echoed the sustained recovery in the US housing market.

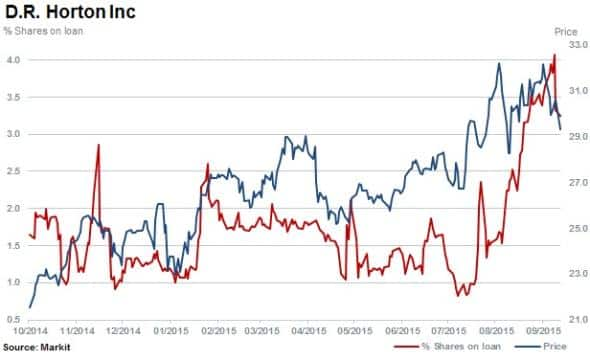

Despite the industry's recent show of exuberance, short sellers have also been attracted to the largest name in US home building, D.R. Horton.

The company has seen a twofold increased in short interest in the past three months with shares outstanding on loan rising to 3.2% but does not make the top ten most shorted homebuilder in the US.

D.R. Horton and Lennar are the top two holdings of the IShares US Home Construction ETF representing 22% of holdings in total.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092015-Equities-US-home-builders-flying-higher.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092015-Equities-US-home-builders-flying-higher.html&text=US+home+builders+flying+higher","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092015-Equities-US-home-builders-flying-higher.html","enabled":true},{"name":"email","url":"?subject=US home builders flying higher&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092015-Equities-US-home-builders-flying-higher.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+home+builders+flying+higher http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29092015-Equities-US-home-builders-flying-higher.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}