Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 08, 2018

Brexit chaos damages UK credit

When market makers start sending runs based on nation states rather than sectors it may be a harbinger of fundamental change in how European credit is traded.

That is precisely what we are seeing as the Brexit process descended into chaos. A number of UK cabinet members have resigned in protest at Theresa May's draft EU withdrawal agreement, quashing hopes that it would bring certainty and stability to markets. Instead, dealers are now distributing 'Brexit' runs and sending quote messages classified by country, not sector. Perhaps this signals the start of a decoupling of the UK from other EU members.

British credits have underperformed the broader European market that was already looking fragile over the last week. There are 29 UK names in the Markit iTraxx Europe - 23% of the total. At the close on November 14 - prior to the key resignations - the average spreads of the UK names was 78bps, more or less in line with the other constituents. This state of parity is no longer the case. In a new stage of uncertainty, it is inevitable that UK credits will now trade with a significant risk premium.

The prospect of a hard Brexit - leaving with no deal and reverting to WTO terms - holds many risks for UK business and is the worst case scenario. Unfortunately, it is now more likely given the instability of the government. Credit deterioration was felt by some sectors more than others, in particular financials, industrials and consumer services. UK bank HoldCos, unsurprisingly, were significantly wider, with senior five-year CDS spreads on Barclays, Lloyds and RBS gapping out by 17bps. The equivalence regulatory arrangement under the proposed deal was far from perfect but they face much stiffer obstacles to European market access under a hard Brexit.

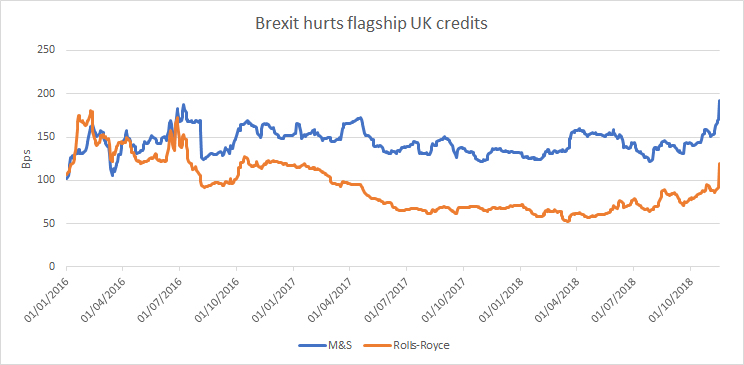

If that wasn't enough, then crashing out of the EU would surely have a serious impact on the real economy. Bad debts would rise and impact bank profitability and capital. High street retailers - already under severe presssure due to structural changes in the industry - widened ahead of a likely retrenchment in consumer spending and higher costs imposed by sterling depreciation. Marks and Spencer hit 192bps, 20bps wider and its worst level for over five -years. Next also felt the pain, widening by 13bps to trade at 117bps.

The worst performing investment grade name, however, was the jewel in the crown of the UK's industrial sector. Rolls Royce CDS widened 28bps to 120bps and and its bonds also suffered a sell-off. Credit investors are clearly not buying into the hard Brexit vision of UK exporters flourishing outside the customs union and single market. Similarly a no deal outcome is unlikely to favour Thomas Cook. The travel company was among the laggards in the Markit iTraxx Crossover, though UK supermarkets Tesco and Sainsbury were the worst performers in percentage terms. German steelmaker Thyssenkrupp also widened significantly, a reminder that European names with UK exposure are not immune to Brexit.

Perhaps a combination of market pressure and strong arming from whips will persuade Conservative MPs to back the withdrawal deal in parliament next month. But at the time of writing we don't even know if Theresa May will still be in office. This uncertainy will feed into spreads and could lead to further credit deterioration, with UK names bearing the brunt. Political risk has never felt so acute.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-chaos-damages-uk-credit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-chaos-damages-uk-credit.html&text=Brexit+chaos+damages+UK+credit+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-chaos-damages-uk-credit.html","enabled":true},{"name":"email","url":"?subject=Brexit chaos damages UK credit | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-chaos-damages-uk-credit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brexit+chaos+damages+UK+credit+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-chaos-damages-uk-credit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}