Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 26, 2020

Daily Global Market Summary - 26 May 2020

iTraxx-Europe (investment grade) and iTraxx-Xover (high yield) European credit indices closed at their tightest level since 6 March and equities closed higher across most of the globe today, as the restarting of the global economies continues to improve market and consumer sentiment. US housing reports came in relatively strong in April, all things considered, and consumer and business sentiment reports continue to show more optimism as the world speeds up the pace of the reopening.

Americas

- US equity markets closed higher on the day, but a late day sell-off that began at approximately 3:32pm ET resulted in most indices closing on the lower end of the day's range; Russell 2000 +2.8%, DJIA +2.2%, S&P 500 +1.2%, and Nasdaq +0.2%.

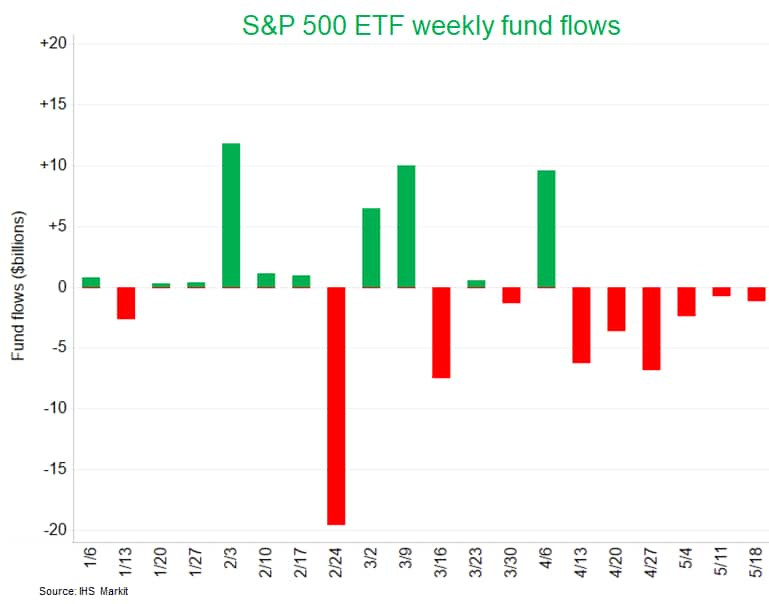

- According to IHS Markit's Exchange Traded Products (ETP) data,

ETFs benchmarked to the S&P 500 have reported weekly outflows

every week since the week of April 13. Prior to that week, there

had been no consecutive weeks of outflows this year:

- 10yr US govt bonds closed +3bps/0.69% yield.

- CDX indices closed higher today; CDX-NAIG -4bps/83bps and CDX-NAHY -42bps/581bps

- Crude oil closed +3.3%/$35.35 per barrel.

- The swift rally in oil, coupled with more supply chain breathing room, is starting to weaken the drivers and enforcers of this correction, namely prices below marginal costs to produce and logistical/demand constraints. This sets up an environment wherein the price signal is starting to bring supply back to the market, which will soon set up a race with a tentative demand recovery. NYMEX WTI at $35/bbl does not necessarily undermine the recovery just yet, and should not derail the sharp pullback in capex and US production that will ultimately define the upcycle, but sustained momentum closer to $40/bbl could swiftly unwind the 2.0+ MMb/d of temporary shut-ins even as US refiners continue to contend with a product glut. If demand recovers quickly back to pre-COVID levels, the running of the bulls can and will be vindicated. But in the more likely scenario of a measured and choppy demand return, the rapid return of sidelined supply will undermine the price recovery. (IHS Markit Energy Advisory's Roger Diwan)

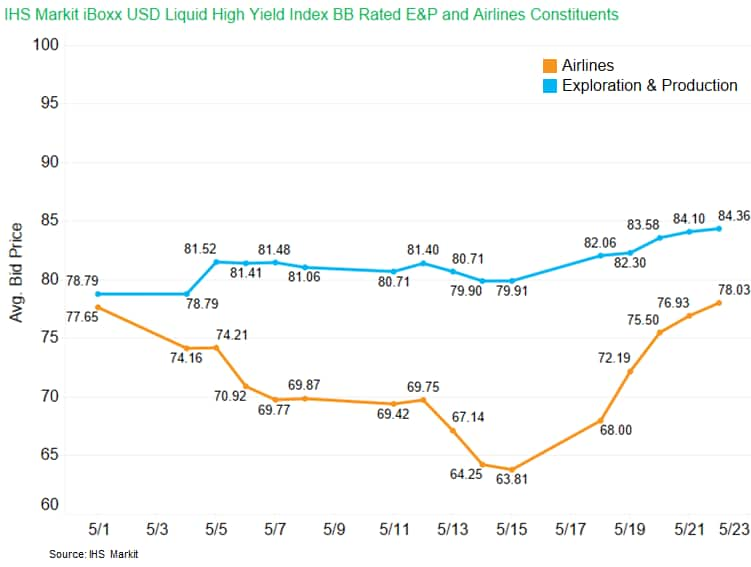

- Prices for the BB rated oil exploration & production

constituents in the IHS Markit iBoxx Liquid High Yield index are

+7.1% this month, while comparably rated airline issues where

-17.8% as of 15 May before rallying to close +0.5% on the month as

of 22 May.

- The US Conference Board Consumer Confidence Index increased 0.9

point (1.1%) to 86.6 in May. This stabilization followed an

enormous 33.1-point decline in April to a downwardly revised 85.7

reading, and it is consistent with our expectation that the second

quarter will represent a low point for consumer spending. The

survey's cutoff date was 14 May. Many US states began lifting

business restrictions in late April and reopenings have continued

through May. (IHS Markit Economists David Deull and James Bohnaker)

- The expectations index was responsible for the headline increase, rising 2.6 points to 96.9. The present situation index, in contrast, fell a further 1.9 points to 71.1. Prior to April, July 2014 was the last time the expectations index exceeded the index of views on the present situation.

- The labor index (the percentage of respondents viewing jobs as plentiful minus the percentage viewing jobs as hard to get) improved somewhat, increasing 5.3 points to 10.4.

- The net percent of respondents expecting business conditions to improve in six months rose 7.2 points to 21.9%, the highest since 1984, likely encouraged by steady growth in equity indices that continued during May. A net 19.1% expected employment conditions to improve. However, the net share of respondents expecting higher incomes remained below water at 1.0%.

- Purchasing plans mostly saw modest improvement in May. The share of respondents planning to buy autos in the next six months recovered 3.1 points to 11.2%. The share planning to buy major appliances increased 1.1 points to 46.9%. The share planning to purchase homes slipped 0.3 point to 5.0%, but this was not far from its range over the last several years.

- Vacation plans are reported every second month. Some 31.8% of respondents in April intended to travel for vacation within six months, down from 54.9% in February and the fewest since 1968. However, the share planning to travel via airplane, at 19.0%, exceeded the 13.4% of October 2010.

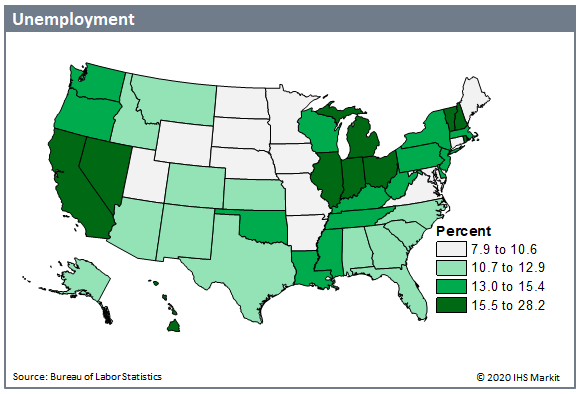

- Total nonfarm payroll employment decreased in all states and

the District of Columbia in April 2020, losing a net 20.1 million

jobs from the previous month on a seasonally adjusted basis,

according to the most recent report from the US Bureau of Labor

Statistics (BLS). (IHS Markit Economist Steven Frable)

- California lost 2.3 million jobs in April, followed by New York, which had losses of up to 1.8 million to payrolls.

- The Mid-Atlantic region, which is made up of New York, Pennsylvania, and New Jersey, had a combined 3.6 million in lost payroll jobs, as the region took the national lead in total confirmed cases.

- The Midwestern states of Michigan, Ohio, and Illinois struggled

as well, as a drop in national demand for nonessential goods and

supply-chain disruptions forced manufacturers to shut plants down

and furlough workers.

- New US home sales inched up 0.6% (±14.9%, statistically

significant) from their March level to a seasonally adjusted annual

rate of 623,000 in April. (IHS Markit Economist Patrick Newport)

- Sales for the prior three months were revised down a cumulative 35,000.

- The number of units for sale fell by 6,000 to 325,000; completed homes for sale came in at 78,000, up 2,000.

- The months' supply of unsold homes inched down 0.1 month to 6.3 months.

- The median price fell to $309,900, down 8.6% from a year earlier; the average price was down 5.4% year on year (y/y) at $364,500. The declines suggest that builders sweetened deals by discounting prices.

- US house prices rose 1.7% in the first quarter, increasing for

the 35th straight time. Prices were 5.7% higher than the same

period a year earlier. (IHS Markit Economist Rebecca Mitchell)

- House prices rose in 48 states as well as the District of Columbia, with Virginia and Alaska declining by 2.1% and 0.1%, respectively, in the first quarter. Meanwhile, home prices in all of the top 100 metropolitan areas rose between the first quarter of 2019 and that of 2020.

- House prices also increased in all nine census divisions, month over month (m/m), quarter over quarter (q/q), and year over year (y/y).

- The seasonally adjusted monthly index edged up by 0.1% in March from February and 5.7% from a year earlier, marking the 51st straight month of increases for the index.

- The first-quarter data is unlikely to reflect the economic impact of COVID-19, according to the Federal Housing Finance Agency (FHFA).

- Home prices are not expected to take as dramatic a hit as sales and starts, since, entering March, inventories of homes for sale were as tight as they have been in decades. We expect home prices, as gauged by the FHFA house price purchase index, to slow to below 2% in 2021, before slowly edging up over the years to just below 3%.

- S&P CoreLogic Case-Shiller US home price composites

accelerate again in March despite initial COVID-19 impacts. (IHS

Markit Economist Troy Walters)

- Data in March was limited to only 19 cities as opposed to the 20 under normal circumstances. Data for Wayne County, Michigan was unavailable and as a result, there is no data for Detroit in this release.

- The 10-city composite index was up 0.4% month over month (m/m) in March while the 20-city index was up 0.5%.

- Home prices rose m/m in all 19 cities reported. Increases ranged from 1.3% in Tampa to just 0.1% in Dallas.

- On an annual basis, home price growth accelerated again in March. The 10-city composite index was up 3.4% year over year (y/y) and the 20-city index increased 3.9%.

- Prices in March were higher than one year ago in all 19 cities for which data was reported. Phoenix remained the growth leader at 8.2% y/y. Seattle retained the number two spot at 6.9% y/y. The slowest pace of appreciation was in Chicago at 1.5% y/y.

- Growth in the national index accelerated to 4.3% y/y, the fastest pace since December 2018.

- Philipp Schiemer, president of Mercedes-Benz of Brazil, has said that the automaker expects that Brazil's truck market to shrink at least 30% in 2020 due to a fall in demand amid the coronavirus disease 2019 (COVID-19) virus pandemic, reports the Wall Street Journal. According to the report, Schiemer said, "The truck market hasn't stopped as much as passenger cars or buses. Some truck segments are at full speed, such as agriculture, chemical, the food sector, and with a good perspective, but in industry, retail, private consumption demand is suffering a lot." He said that the market might shrink 30% to 40% in 2020 if businesses begin to reopen in June or July; however, if the reopening is pushed back past July, then demand could fall even more. Mercedes has implemented new policies to safeguard its workers from the pandemic. (IHS Markit AutoIntelligence's Tarun Thakur)

- Volkswagen (VW) reopened its São Paulo (SP) factories on 26 May, reports Automotive Business. The return, as previously stated by the automaker, was scheduled for 25 May, but was postponed due to the state holiday of 9 July being brought forward to 25 May as a measure to reduce the circulation of people during the coronavirus disease 2019 (COVID-19) virus pandemic. (IHS Markit AutoIntelligence's Tarun Thakur)

- Five Iranian-flagged tankers carrying Iranian fuel reached port in Venezuela on 24 May in an effort to circumvent US sanctions on Venezuela's oil sector. According to the US Department of State, Venezuela paid Iran for the shipments with gold. The Venezuela navy escorted the Iranian tankers within Venezuelan territorial waters in a sign of celebration. The US is likely to increase pressure to force Maduro to step down and for an interim government to be formed to organise free and fair elections, in exchange for the lifting of sanctions. Pressure is likely to take the form of the US imposing secondary sanctions on Venezuela and/or designating it as a state sponsor of terrorism. Secondary sanctions would apply to non-US companies that do business with Venezuela and would therefore render them unable to trade with US companies or conduct transactions within the US financial system. (IHS Markit Country Risk's Diego Moya-Ocampos, John Raines, and Jack Kennedy)

Europe/Middle East/ Africa

- European equity markets closed higher across the region; Spain +2.2%, France/Italy +1.5%, UK +1.2%, and Germany +1.0%.

- 10yr European govt bonds closed lower except for Italy -4bps; Germany +7bps, France +5bps, UK +4bps, and Spain +1bp.

- Brent crude closed +1.7%/$36.74 per barrel.

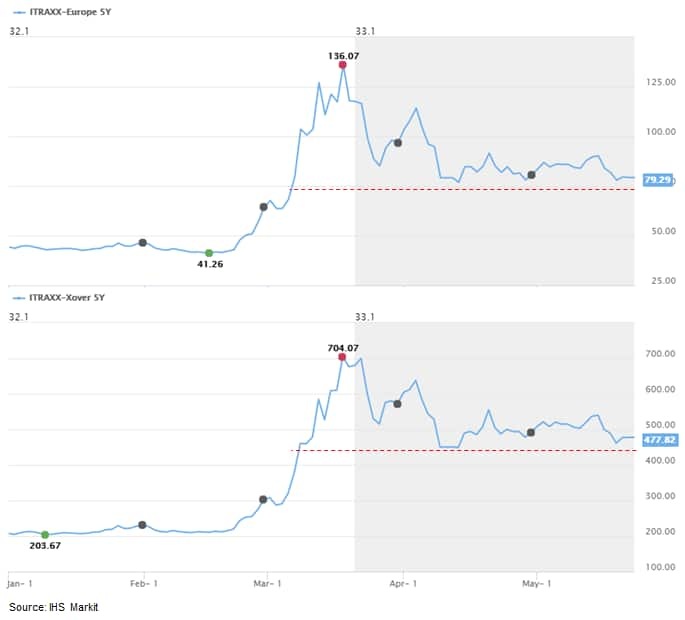

- iTraxx-Europe closed -6bps/74bps and iTraxx-Xover closed

-31bps/447bps - both indices reported their tightest closing level

since the significant sell-off that took place on 6 March (charts

are as of 25 May, but red dotted line indicates today's

close).

- Yesterday (25 May), the European Banking Authority published a

preliminary estimate of the impact of the coronavirus disease 2019

(COVID-19) virus on the EU banking sector. Based on 2018

stress-test data, it suggests that credit risk losses could reach

2.3-3.8% of risk-weighted assets. (IHS Markit Economist Brian

Lawson)

- The European Banking Authority (EBA) forecasts "growing NPL [non-performing loan] volumes" and "rising cost of risk" to reflect sharp economic shrinkage, with "high volatility on financial markets" creating further damage to capital buffers. The analysis does not adjust for the beneficial effects of loan moratoria for badly affected firms or state guarantees and also does not incorporate the potential impact on sectoral revenues or from market risks on securities holdings.

- It reports that funding conditions for banks have "significantly deteriorated", with sharply wider spreads and reduced issuance, while 30% of bank liabilities need refinancing during 2020 (20% within six months).

- The assessment suggests that although banks face heavy asset quality damage, the improvement of their CET1 capital ratios from 9% in 2009 to nearly 15% by end-2019 gives most banks adequate capital to resist the impact of the pandemic while preserving more than the minimum required capital buffers.

- Liquidity strains are likely to remain limited. The European Central Bank (ECB)'s supervisory statistics indicate that deposits account for around 70% of total liabilities in significant institutions and we assess that the risk of widespread deposit runs remains very low.

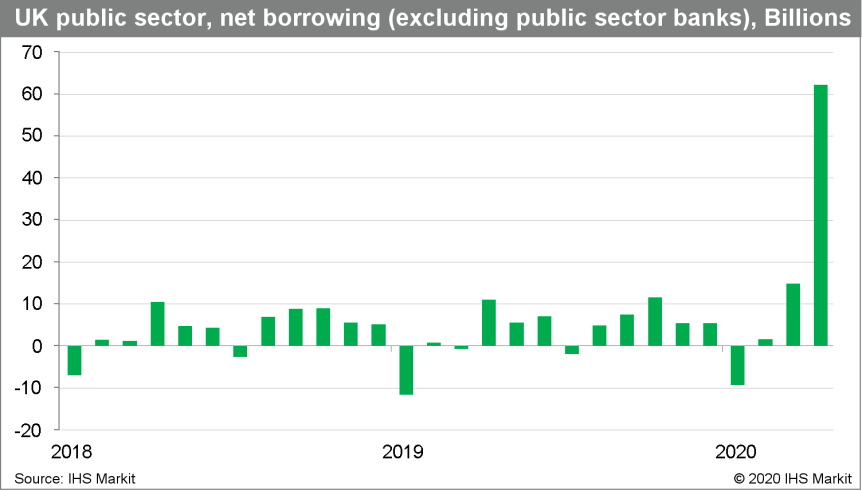

- According to the Office for National Statistics (ONS), UK

government borrowing (public-sector net borrowing excluding

public-sector banks; PSNB ex) stood at GBP62.1 billion (USD75.6

billion) last month, which was GBP51.1 billion higher than in April

2019. This was the highest borrowing in any month since records

began in January 1993. (IHS Markit Economist Raj Badiani)

- Central government receipts collected by HM Revenue & Customs fell for a second successive month in April, declining by 26.5% year on year (y/y), pulled down by shrinking economic activity, job losses, and companies deferring tax payments. Specifically, income and capital gains and corporation tax receipts dropped by 36% y/y and 14.1% y/y, respectively. Meanwhile, value-added tax (VAT) receipts were negative in April, implying that the government collected less than was handed back in repayments.

- Central government expenditure climbed by 52% y/y in April, partly due to the cost of the coronavirus job retention scheme (CJRS or furlough scheme), higher grants to local authorities, and increased funds for frontline public services.

- In addition, the net debt position increased by 17.4 percentage

points over the year to stand at 97.7% of GDP in April, which was a

sharper rise than occurred at any point during the 2007-08

financial crisis.

- Italian financial institution Intensa Sanpaolo is set to give preliminary approval of a loan to Fiat Chrysler Automobiles (FCA) that will be guaranteed by the Italian government. Approval of the loan is expected to take place at a board meeting of the bank today (26 May), reports Reuters, citing a source close to the matter. The preliminary approval by Intensa Sanpaolo would bring FCA a step closer to obtaining a loan of up to EUR6.3 billion (USD6.8 billion) guaranteed by the Italian state to support the automaker's domestic operations in the wake of the coronavirus disease 2019 (COVID-19) virus pandemic. (IHS Markit AutoIntelligence's Ian Fletcher)

- A senior Spanish politician has warned Nissan that it will cost more to close its Barcelona (Spain) facility than invest in it, reports Reuters. The country's secretary general for Industry and Small and Medium Enterprises (SME) Raül Blanco Díaz was quoted on a call with journalists as saying that while it has received no official confirmation of Nissan's plans, "it is much cheaper to invest than to leave." He went on to say that it would cost the company more than EUR1 billion to settle labor and contractual issues to complete its closure. (IHS Markit AutoIntelligence's Ian Fletcher)

- Germany's headline Ifo index, which reflects business

confidence in industry, services, trade, and construction combined,

has recovered from April's series low of 74.2 to 79.5 in May,

considering data since January 2005 when the service sector was

first incorporated into the headline measure. This compares with a

long-term average of 97.3 and a series high of 104.9 (January

2018). (IHS Markit Economist Timo Klein)

- The manufacturing series that has a history going back to 1960, which just managed to stay clear of its all-time (post-Lehman) low of March 2009 in April, has recovered by eight points, owing to the sub-index for expectations in the sector rebounding by 22 points to a level now just above its previous low point in December 2008.

- The expectations component rebounded from their record low of 69.4 to 80.1, broadly returning to their level in March. It should be noted that 80.1 is only slightly above the previous series low of 79.2 recorded in December 2008 after the Lehman collapse.

- The current condition index edged down slightly further from 79.4 to 78.9, maintaining a level that modestly exceeds those in March-July 2009 during the recession triggered by the global financial market crisis.

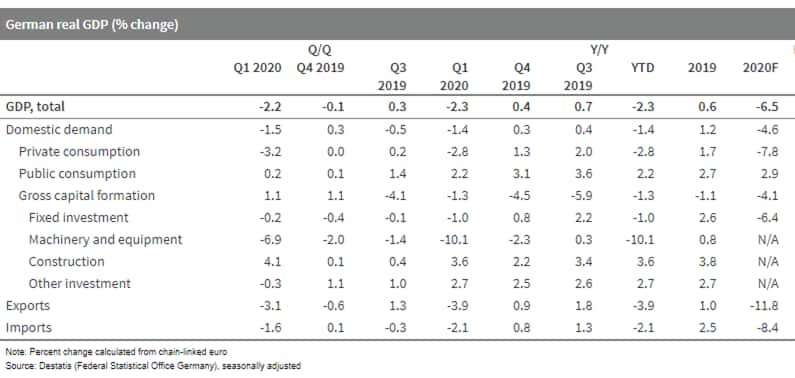

- German GDP declined by 2.2% quarter on quarter (q/q) in the

first quarter of 2020, as published by flash data on 15 May. The

detailed breakdown that is now available reveals that the largest

burden came from private consumption, followed by net exports and

investment in equipment. Exports dropped by almost twice as much as

imports, resulting in net exports being responsible for about a

third of the first-quarter GDP decline. IHS Markit currently

expects GDP to decline by 6.5% in 2020, followed by a partial

recovery by 3.3% in 2021. This assumes only a gradual resumption of

activity in the coming months and a full recovery at best from

mid-2021 onwards based on the expectation that a vaccine has become

widely available by then. (IHS Markit Economist Timo Klein)

- The German government confirmed on 20 May that it was close to

concluding around two months of negotiations and reaching a

compromise agreement with Europe's second-largest carrier,

Lufthansa, which mitigates the severe economic impact of the

coronavirus disease 2019 (COVID-19) virus outbreak. Lufthansa

grounded around 95% of its fleet in response to the recent

unprecedented restrictions on movement and travel plus EU and wider

global border closures in March. (IHS Markit Country Risk's Blanka

Kolenikova, Laurence Allan, Dijedon Imeri, Jan Gerhard, Petya

Barzilska, and Bibianna Norek)

- Following Italy's decision to renationalize Alitalia in March, the Lufthansa bailout plan is one of multiple national government initiatives to support Europe's aviation sector with further public funding likely to be introduced in the coming months. The German government plans to take a 20% stake in Lufthansa and take two seats on the company's advisory board.

- The ongoing public health crisis will fundamentally change the European aviation industry and is likely eventually to shape a more co-ordinated formal approach by the European Union. This is likely to require long-term amendments to the EU's state aid rules, which were temporarily relaxed in mid-March to accommodate national-level emergency funding of about EUR1.9 trillion.

- Decisions on public emergency funding are likely to be increasingly influenced by civil society initiatives, organised lobbying, trade unions, and political parties. For instance, the French and Dutch governments have been criticised for failing to request Air France-KLM to adhere to stricter environmental laws in exchange for financial support of roughly EUR10 billion in loans and guarantees.

- EU and member-state national government attempts to provide equitable treatment to the worst-affected sectors likely benefit businesses in the hospitality, automotive, and other sectors.

- Bayer shares jumped 8.8% in Frankfurt on Monday on reports that the company was nearing an agreed settlement of US litigation claiming that the company's glyphosate-based herbicide Roundup causes cancer. The move added €4.91 billion ($5.35 billion) to the company's market valuation. Bayer confirmed it had made progress toward a deal after Bloomberg reported that verbal agreements had been made on a $10-billion package covering between 50,000 and 85,000 actual and potential lawsuits, which would include $2 billion for any future cases that are brought after the settlement. Bloomberg reported that people familiar with the negotiations said the deals had not yet been signed but that Bayer was likely to announce the settlements in June.

- At the end of week-20, coal stocks at the Richards Bay Coal

Terminal (RBCT) are calculated at 5.3-5.4mt marginally lower versus

previous week levels. (IHS Markit Maritime & Trade's Rahul

Kapoor and Pranay Shukla)

- TFR railings during the reported period firmed up to 1.2-1.3mt levels from 1.0-1.1mt a week before.

- Congestion at the RBCT terminal is building up and due to this the railings are improving.

- As per IHS Markit's Commodities at Sea, during the week 20, RBCT coal shipments are calculated at 1,250kt (5.4mt on 30-day basis) vs 961kt (4.1mt on 30-day basis). The shipments to India have although restarted but still way below average weekly levels.

- During the reported week, MV TOMINI DESTINY (63,590 dwt) sailed from RBCT on 18 May 2020 for destination Iskenderun, Turkey. The panamax vessel is scheduled to reach Turkish port by 17 June 2020. In the last couple of weeks in absence of strong buying from India, RBCT shippers are sending cargoes to South East Asia, Far East, Europe and now lately to Mediterranean market.

Asia-Pacific

- Most APAC equity markets closed higher across the region except for India -0.2%; Australia +2.9%, Japan +2.6%, Hong Kong +1.9%, South Korea +1.8%, and China +1.0%.

- The Singapore Ministry of Trade and Industry (MTI) has sharply

revised down its GDP forecast for calendar year 2020 to a

contraction in the range of 4.0-7.0%, compared with the earlier

forecast of 1.0-4.0% contraction. The MTI also released its latest

GDP statistics for first-quarter 2020 GDP, showing that GDP

contracted by 0.7% year on year (y/y). (IHS Markit Economist Rajiv

Biswas)

- Construction sector output was down 4.0% y/y while services sector output fell by 2.4% y/y.

- The contraction in construction and services was mitigated by a 6.6% increase in manufacturing output, which was helped by expansion in output from the biomedical manufacturing, precision engineering, and transport engineering clusters.

- Output in the wholesale and retail trade sector fell by 5.8% y/y, while output in the accommodation and food services sector fell by 23.8% y/y.

- The retail sales index showed a contraction of 9.7% y/y for first-quarter 2020.

- Tesla is seeking permission from the Chinese authorities to use lithium iron phosphate (LFP) batteries in its Model 3 electric vehicle (EV) being built in China, reports Automotive News China, citing a document on the website of the Ministry of Industry and Information Technology. However, the document does not reveal the name of the battery-maker that would supply the batteries. In February, Reuters reported that Tesla was in talks with Chinese battery-maker Contemporary Amperex Technology Ltd (CATL) about the supply of cobalt-free batteries, specifically regarding sourcing some of the company's batteries produced in Shanghai. The batteries would use LFP rather than the typical nickel-cobalt-aluminum cells. Reuters reported that the move was driven by efforts to lower production costs as EV sales in China struggle. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The Hong Kong Economic Journal reported yesterday (25 May) that

the China Banking and Insurance Regulatory Commission (CBIRC) has

mandated a 5% credit growth rate for the manufacturing sector in

2020, with a 1-percentage-point increase in longer term tenor

loans. The target is set up for large banks. (IHS Markit Banking

Risk's Angus Lam)

- According to the 2019 annual reports of the country's four largest banks, the Industrial and Commercial Bank of China (ICBC), Bank of China, China Construction Bank (CCB), and Agriculture Bank of China, manufacturing-sector credit growth was 4.3%, -0.9%, -1.1%, and 2.9%, respectively, year on year. Manufacturing remained one of the largest proportions of total lending outstanding, at between around 7% (CCB) of the total loan book to 17% (ICBC) in 2019.

- IHS Markit's main concern is that because of the push to lend more to the manufacturing sector, the potential global demand shortfall, and a lack of good quality borrowers; the amount of loans that become non-performing will increase. This will affect the overall non-performing loan (NPL) ratio for these banks because of the proportion of manufacturing loans to loans outstanding.

- China's State-owned Asset Supervision and Administration Commission (SASAC), the top state-owned asset watchdog, required 40 coal plants in five western provincial-level regions to be integrated into the leading power generator in each province, Caixin reports, citing an official release on 22 May. By 30 June, 38 of the plants will be merged, with the remaining 2 joining in the next year. Upon completion of the plan, each province will have one central government-controlled power generator, with the five major power generators - China Huaneng, China Datang, China Huadian, State Power Investment and China Energy Investment - operating the majority of the fossil fuel plants in Gansu, Shaanxi, Xinjiang, Qinghai and Ningxia respectively. The move of coal power plant integration is in line with the plan issued by the SASAC in 2019, aiming to reduce losses and overcapacity from the five major state-owned power companies by reallocating resources. It calls to reduce the capacity of coal power generation by at least a quarter and reduce losses by half as of the end of 2021. (IHS Markit Economist Yating Xu)

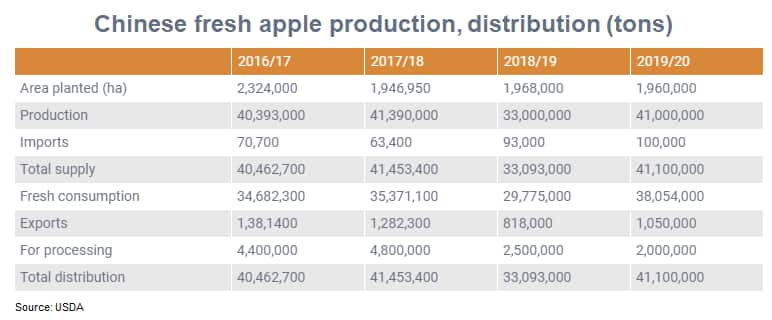

- It appears that a late frost in April has damaged the apple

crop in three of China's apple-producing provinces. The extent of

the damage is unknown, but the fruit setting is reported to have

been badly affected. In the growing areas in Jinzhong, Changwu,

Binzhou, Xunyi, Luochuan, Fuxian, Yichuan, Qingyang, and Lingwu and

other major production areas, losses are reported to be as high as

60%. The remaining apples are prone to frost ring disease. One IEG

Vu source has warned of a severely reduced harvest. A second

concurred but added that a clear picture will not be available

until well into June. China's apple harvest was about 43 million

tons last year, a recovery from the 32 million tons recorded in

2018. IEG Vu doubts that the frost damage is as bad as it was in

that year and thinks that 35-40 million tons is quite possible.

(IHS Markit Agribusiness' Neil Murray)

- Toyota Kirloskar announced in a statement that that it has restarted production operations at its Bidadi facility in Bangalore today (26 May). Production operations will resume in a gradual manner in accordance with the directives laid out by the state and central governments. (IHS Markit AutoIntelligence's Isha Sharma)

- Suzuki has reported a 24.9% year-on-year (y/y) decline in consolidated net income to JPY134.2 billion during the full financial year (FY) 2019/20, which ended 31 March 2020. Operating income declined by 33.7% y/y to JPY215.1 billion during the period on net sales of JPY3.48 trillion, down by 9.9% y/y. Of this total, the automotive division accounted for net sales of JPY3.15 trillion, down by 10.6% y/y, while operating income was down by 35.1% y/y to JPY197.1 billion. The decline was primarily the result of a decrease in sales in India and Pakistan and the negative impact of appreciation of the yen. (IHS Markit AutoIntelligence's Tarik Arora)

- Japanese truck manufacturer Isuzu posted a 28% year-on-year (y/y) decline in its consolidated net profit to JPY81.2 billion during the full financial year (FY) 2019/20 ended 31 March 2020. Operating income declined 20% y/y to JPY140.6 billion on sales revenue of JPY2.079 trillion, down 3% y/y. Isuzu's global sales totalled 600,000 units, a 7% y/y decline. Sales of light commercial vehicles (LCVs) totalled 311,000 units, down 9% y/y. Sales of commercial vehicles (CVs) totalled 289,000 units, a 5% y/y decline. CV sales in Japan, Isuzu's biggest market, totalled 81,000 units to decline 2% y/y. (IHS Markit AutoIntelligence's Tarik Arora)

- Emperor Energy and APA Group have agreed to commence pre-FEED work on the Judith gas field off eastern Victoria, Australia. The pre-FEED study will include early design for a gas processing plant to be located adjacent to the existing Orbost plant owned by APA and currently processing gas from Cooper Energy's Sole field. The pre-FEED work will also involve concept design for a 40-km subsea pipeline from Judith to shore and a design for an export pipeline from the gas plant to the Eastern Gas Pipeline in Sydney. The pre-FEED study is expected to begin in July and take 4 months to complete. The design basis for the plant is production of 80 MMscfpd of sales gas for a project life of 25 years. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-may-2020.html&text=Daily+Global+Market+Summary+-+26+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 26 May 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+26+May+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-26-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}