Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 27, 2020

Daily Global Market Summary - 27 May 2020

Most European and US equity markets and IG/HY credit indices closed higher on the day, while APAC equity markets closed mixed. The EU began discussions on a $2 trillion COVID-19 relief spending package, which will likely have some political hurdles to overcome before being approved.

Americas

- US equity markets closed higher and near the intraday highs, with the S&P 500 and Russell 2000 being in negative territory between 10:40-11:10am ET; Russell 2000 closed +3.1%, DJIA +2.2%, S&P 500 +1.5%, and Nasdaq +0.8%.

- 10yr US govt bonds closed -2bps/0.68% yield. Yields were as high as 0.73% at 8:00am ET, but steadily rallied 7bps by 11:10am ET, with a sell-off that followed in tandem with the rally in US equities.

- Another very strong close for both investment grade and high yield CDX indices; CDX-NAIG closed at -4bps/79bps and CDX-NAHY -22bps/560bps.

- Crude oil closed -4.5%/$32.81 per barrel.

- IHS Markit projects that onshore US shut-in volumes will reach 1.5-2.0 MMb/d over the next few months. While significant shut-ins are certain, there is little study of what can happen to a well after a shut-in period. IHS Markit's Energy Advisory Service published an analysis today that reviewed all wells in the top oil plays with at least two consecutive months of zero oil production and the data indicates that absolute production changes following shut-in are neutral to mildly positive in wells that are more than two years old when the shut-in starts. However, younger wells are more problematic, and are more likely to experience a negative production impact following shut-in. (IHS Markit Energy Advisory's Raoul LeBlanc and Imre Kugler)

- US chocolate and confectionery giant Hershey has posted an

update on its business trends during Covid-19 in a new SEC filing.

(IHS Markit Agribusiness' Sandra Boga)

- The company admitted that while it did experience a short-term increase in demand for some of its products at the onset of the pandemic, demand levels have since moderated. "We continue to see declines in our food service, owned retail and world travel retail businesses as well as certain parts of our International businesses as a result of known shelter-in-place and other restrictions," it said.

- Hershey said sales of gums and mints are down with fewer social gatherings across the globe.

- Some of the company's new on-the-go type snacks have also been hurt by the stay-at-home orders.

- The company has announced an expansion of its Cocoa For Good program, committing to 100% direct-sourced cocoa in high-risk areas by 2025, which will include all of its cocoa sourced by its suppliers from Ivory Coast and Ghana.

- Rental-car company Hertz filed for bankruptcy in the US state

of Delaware on 22 May, but the filing allows the company and its

subsidiaries to operate while it devises a plan to settle payments

for creditors. As a part of the filing, the company confirmed that

it has about USD25.8 billion in assets and USD24.4 billion of

debts, reports Bloomberg. As me mentioned in the 13 May edition of

the Daily, according to a Bloomberg report published earlier this

month, Hertz had already cancelled 90% of its orders for 2020 model

year vehicles per Hertz Global Holdings CEO Kathy Marinello

announcing the decision on a conference call on 12 May. (IHS Markit

Automotive Mobility's Surabhi Rajpal and AutoIntelligence's

Stephanie Brinley)

- The report noted that Hertz had as many as 567,600 vehicles in its US fleet and 204,000 in its international fleet, and that it keeps its US fleet for about 18 months and international vehicles for 12 months, citing a US Securities and Exchange Commission (SEC) filing.

- In addition, Bloomberg reports that in 2019, General Motors (GM) provided 21% of the company's fleet, Fiat Chrysler Automobiles (FCA) provided 18%, Ford 12%, Kia 10%, Toyota 9%, Nissan 7% and Hyundai 5%.

- The report does not detail specifics on the size of the order for 2020, nor which automakers these orders had been placed with.

- On 22 May, Argentina failed to make a USD503-million payment of

delayed interest on three bonds on the expiry of their grace

periods, entering a technical default. On 26 May, both Fitch and

S&P Global Ratings moved Argentina to restricted default

ratings. The government is restructuring USD66 billion of its

sovereign debt with private creditors. (IHS Markit Economists Carla

Selman, Alejandro Duran-Carrete, and Paula Diosquez-Rice)

- Technical default likely through June. Despite Argentina missing the payment, its Minister of Finance Martín Guzmán continues to negotiate with bondholders and has extended the deadline to reach an agreement until 2 June.

- President Alberto Fernández is likely to come out of the situation strengthened, but protests and strike risks will increase if future debt-service arrangements force the government to impose spending cuts. Reaching a settlement with bondholders is likely to further boost Fernández's popularity, which now stands at around 80%, according to some polls, after successful management of the COVID-19 virus outbreak.

- The country will not have external financing options even if it reaches a quick agreement with bondholders. The loss in NPV of the defaulted bonds will raise external financing costs; the grace period during an economic collapse implies that the debt-service "savings" will not be enough to cover current spending.

- The banking sector will be moderately affected because of low exposure to sovereign debt; a bank run is unlikely. Argentina's banking sector is only minimally exposed to the USD66-billion debt being restructured as these bonds only represent 0.08% of the banks' total assets.

- Mercedes-Benz has announced the resumption of production at its Gonzales Catan plant in Argentina, reports news agency Deutsche Presse-Agentur. The factory will have only one shift of employees working and will have all safety measures implemented amid the COVID-19 pandemic. (IHS Markit AutoIntelligence's Tarun Thakur)

- Hyundai has decided to extend the suspension of employment contracts of some employees at its Piracicaba plant and of employees in its offices in São Paulo in Brazil for another month until 25 June. Hyundai resumed production at the Piracicaba plant on 13 May, with only 700 employees working on one shift instead of the three regular shifts, and the extension of the employment contract suspension affects the remaining employees there. (IHS Markit AutoIntelligence's Tarun Thakur)

- US firm Anivive Lifesciences has submitted an application to the US FDA to repurpose its GC376 feline drug for COVID-19 in humans. Since 2018, Anivive has been developing its GC376 candidate to treat feline infectious peritonitis (FIP), which is the leading cause of death in kittens and young cats. FIP is caused by a coronavirus and contains a protease that is responsible for replication of the virus. GC376 is a small molecule protease inhibitor and has been found to block the replication process. Anivive has filed a pre-investigational new drug application with the FDA for the molecule's use in humans as a COVID-19 treatment. (IHS Markit Animal Pharm's Daniel Willis)

Europe/Middle East/ Africa

- European equity markets closed higher across the region except for Switzerland -1.2%; Spain +2.4%, France +1.8%, Germany/UK +1.3%, and Italy +0.3%.

- 10yr European govt bonds closer higher except for Germany +1bp; Italy -8bps, Spain -5bps, and France/UK -2bps.

- iTraxx-Europe closed -2bps/71bps and iTraxx-Xover -16bps/430bps.

- Brent crude closed -3.5%/$35.45 per barrel.

- The European Union set out a $2 trillion coronavirus response plan, including a massive pooling of national financial resources that, if approved, would deepen the bloc's economic union in a way that even the eurozone debt crisis failed to achieve. Wednesday's proposal, composed of a €750 billion ($824 billion) recovery plan and €1.1 trillion budget over the next seven years, aims to lift the region from its economic slump. (WSJ)

- Data released by the National Institute of Statistics and

Economic Studies (Institut national de la statistique et des études

économiques: INSEE) show the French business sentiment index

improving from 53 in April to 59 in May, while the consumer

confidence index has declined from 95 to 93, its lowest level since

early 2019. (IHS Markit Economist Diego Iscaro)

- Given the timing of the data's collection (from 28 April to 19 May in the case of the business sentiment survey and from 28 April to 16 May for the consumer confidence survey), May's figures provide only limited information as to how the economy has reacted following the easing of the COVID-19 virus-related containment measures on 11 May.

- Confidence in three of the four business sectors for which data were reported in May has improved. The exception is the wholesale trade sector, where the confidence index has fallen sharply to a level close to its 2009 all-time low.

- Confidence in the manufacturing sector has improved slightly in May, but remains extremely depressed. The index stands at 70, up from 68 in April. The index had averaged 105 during the first two months of 2020.

- Confidence in the services sector, which stood at an all-time low of 41 in April, has rebounded but remains at a very low 51 in May. Similar to manufacturing, the forward-looking elements of the survey have improved in May, but they remain low by historical standards.

- Meanwhile, the consumer confidence index has declined from 95 in April to 93, its lowest value since January 2019. Households remain very downbeat regarding the economic outlook (-71, unchanged from April), while their views on their personal financial situation during the coming year have improved only slightly from -21 to -20.

- The index measuring major purchasing intentions has also rebounded but remains well below average at -45 (-60 in April). At the same time, the index measuring savings intentions has risen to a 13-month high, hand in hand with an increase in the index measuring households' current saving capacity.

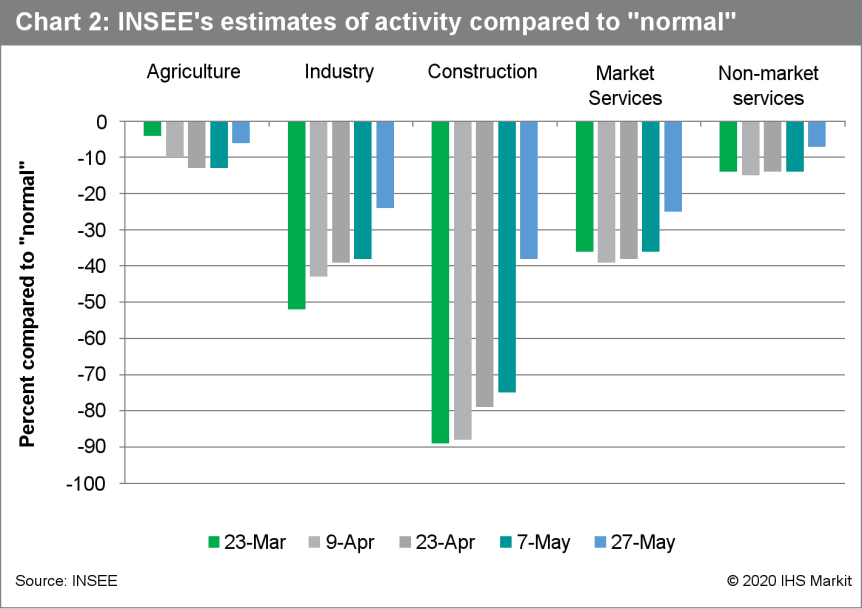

- The INSEE also published its latest "Point de Conjoncture"

report, in which it estimates that the economy is now working 21%

below "normal", up from -33% at the start of May. Given the latest

data, the INSEE estimates that French GDP is likely to contract by

around 20% quarter on quarter (q/q) during the second quarter of

2020, following a fall of 5.8% q/q during the first three months of

the year (chart below).

- France's President Emmanuel Macron has announced over

EUR8-billion-worth of measures designed to support the local

automotive sector in the wake of the disruption caused by the

COVID-19 virus pandemic. In a statement released on the Elysee

website, Macron said that the support plan is also aimed at making

the industry "greener and more competitive". (IHS Markit

AutoIntelligence's Ian Fletcher)

- Part of this funding will be used to stimulate new vehicle demand in a market where light-vehicle registrations have slumped in recent months.

- Part of this funding will be used to raise the bonus for private customers buying battery electric vehicles (BEVs) from EUR6,000 to EUR7,000, while businesses and local authorities will be eligible for EUR5,000 as long as the purchase price is under EUR45,000.

- It will also bring back incentives for customers to purchase plug-in hybrid electric vehicles (PHEVs) with the acquisition of such vehicles gaining a EUR2,000 benefit.

- Furthermore, the government has reassessed the "conversion premium" and will now offer households with a net tax income of less than EUR18,000 a EUR3,000 incentive to buy a new internal combustion engine vehicle, while EUR5,000 is available to those who switch to BEV.

- Macron also said that the second objective is to relocate value-added production back to France, something which OEMs are said to have already committed to in return for this. He added that there is a an objective for more than 1 million electrified vehicles - BEVs, PHEVs and hybrids - will be built in the country annually within five years.

- The funding will also be directed towards making the local automotive industry more competitive. Included within this is EUR200 million in subsidies being made available to support digitalization, robotization and industrial technologies, particularly for small businesses which cannot necessarily afford to make the same investment as larger companies.

- The Hungarian government on 26 May submitted a motion to revoke

a state of emergency introduced in response to the COVID-19 virus

pandemic and to repeal the "Enabling Act", which authorized the

government's unlimited rule by decree. The law will come into

effect in mid-June. However, this will not repeal several

legislative measures undertaken by the Fidesz-led government during

the state of emergency that further concentrated executive power,

decreased investors' legal certainty and weakened the political

opposition. (IHS Markit Country Risk's Blanka Kolenikova)

- Several measures enacted through ordinary procedures during the state of emergency are creating legal uncertainties for the private sector and weakening the political opposition by diverting funds away from the municipalities. These included the May draft bill (not yet finalised) empowering the government to declare investment projects exceeding HUF5 billion (EUR14 million) as "special economic zones".

- Foreign investors are likely to be targeted by a variety of revenue-raising measures, although domestic companies are less affected. The draft law on the special economic zones, once passed, will infringe on the legal security of investors, as agreements closed with municipalities would become obsolete (and move under the jurisdiction of County Councils).

- Certain points of the 'Enabling Act' will, however, remain and be used to weaken domestic criticism, rather than infringe on the operations of multinational companies. Most notable is the April amendment of Hungary's Criminal Code that introduced the crime of "fearmongering" (§ 337). According to the law, persons spreading allegedly "distorted facts" that may impede the crisis management of authorities can be imprisoned for up to five years.

- Poland's quarterly labor survey put the jobless rate at just

3.1% in the first quarter, considerably lower than the registered

unemployment rate (at 5.5% on average) due to differences in

methodology. (IHS Markit Economist Sharon Fisher)

- In April, the registered unemployment rate rose to a 13-month high of 5.8%, up from 5.4% in March.

- The number of registered unemployed reached 965,800 in April, from 909,400 the previous month. The number of job offers fell to 58,200, the lowest level since December 2014.

- Despite the recent easing of Poland's lockdown measures, concerns about further layoffs and a new wave of infections this autumn will make households cautious about spending. After plummeting in April, consumer unemployment fears improved only modestly in May.

- International ratings agency Moody's Investors Service has

changed Namibia's sovereign ratings outlook to Negative from

Stable. Both the issuer and senior unsecured ratings were left

unchanged at Ba2 (equivalent to 47.5/100 on the IHS Markit scale

and BB on the generic scale), in the Likely to Fulfil Obligations

category. (IHS Markit Economist Thea Fourie)

- Moody's expects Namibia's GDP to contract by 7% in 2020. Subdued global commodity prices and COVID-19 lockdown measures are expected to curtail mining production and exports during 2020, while tourism proceeds, contributing around 12% of GDP, are also expected to trail down as a result of the cessation of international travel.

- The weak growth combined with health-related spending on the COVID-19 virus outbreak are expected to widen the fiscal deficit to an estimated 10% of GDP in 2020, moderating only slowly to 8.5% of GDP in 2021.

- Public-sector debt is expected to reach 68.5% of GDP by end-2020, from 53.3% of GDP at end-2019, Moody's estimates show. Public-sector debt is expected to rise further and reach 72.3% of GDP by end-2021.

- A sharp decline in foreign-reserves holdings could also place pressure on the rating.

Asia-Pacific

- APAC equity markets closed mixed; India +3.3%, Japan +0.7%, South Korea +0.1%, Australia -0.1%, China -0.3%, and Hong Kong -0.4%.

- US secretary of state Mike Pompeo has said Hong Kong is no longer autonomous from China, taking a potential first step towards removing the special trade status that has helped sustain Hong Kong as Asia's financial capital. (FT)

- Chinese yuan closed ¥7.17/USD today and is coming close to revisiting last summer's 12-year low of ¥7.18/USD.

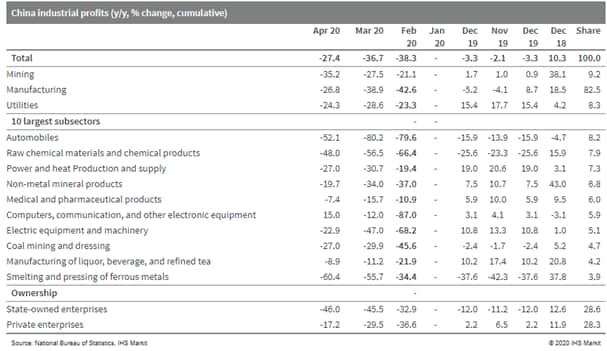

- Chinese industrial profit declined 4.3% year on year (y/y) in

March, narrowing by 30.6 percentage points from the contraction in

March, according to the release by the National Bureau of

Statistics (NBS). The profits in the first four months fell 27.4%

y/y. (IHS Markit Economist Yating Xu)

- The sequentially improvement came as industrial production and operating revenue of industrial firms both recovered to expansion in April.

- Meanwhile, a sharp increase in investment revenue and a low base in the same period last year contributed to the headline improvement.

- The sequential improvement in industrial profits is expected to continue into May. Under the stimulus package released by the 2020 government work report, China's economy is expected to return to expansion in the second quarter.

- Measures including tax and fees reduction, interest rate cut, and especially support for employment and small firms will continue to lead to cost reduction and demand recovery.

- However, weaker-than-expected domestic demand recovery and

deeper-than-expected global economic recession will continue to be

headwinds for the industrial profits.

- Japan has tightened foreign investment controls and the

reclassifications are likely to widen regulation and discourage

FDI. A November 2019 amendment to Japan's Foreign Exchange and

Foreign Trade Act (FEFTA) started implementation on 22 May, with

full application scheduled for 7 June. It requires foreign

investors to obtain prior government approval before share

acquisitions amounting to 1% or more in designated Japanese firms,

a reduction from the previous 10% threshold. (IHS Markit Country

Risk's Hannah Cotillon)

- The amendment also requires government clearance before foreign investors take an "activist" role in a designated investee company - including becoming a board member, disposing of certain business activities, or accessing information about the company's technology.

- The designated sectors are classified into two groups. The first group includes 12 sectors designated as "core" to Japan's national security, while the second group includes over a dozen sectors designated as "non-core". Certain foreign investors in the latter group are exempt from the requirement to obtain approval for share acquisitions exceeding 1% on condition that they do not take on an activist role.

- Renault-Nissan-Mitsubishi Alliance today (27 May) unveiled

several initiatives aimed at improving the competitiveness and

profitability of all three member companies. The initiatives are

part of a new co-operation business model agreed by the automakers.

The initiatives are over and above the existing benefits that the

Alliance enjoys in terms of joint purchasing, leveraging their

respective leadership positions. The principle governing the new

co-operation model is being called the "leader-follower" scheme,

which is currently being deployed in the Alliance's light

commercial vehicle (LCV) unit. The scheme is expected to deliver

savings of up to 40% in model investments, for vehicles that fully

fall under it. Key initiatives include: (IHS Markit

AutoIntelligence's Tarik Arora)

- Further standardization within the Alliance, from platforms to vehicle upper bodies.

- For each product segment, the focus will be on one leader car and sister vehicles will be engineered by the leading company, with support from follower teams.

- Each brand will have leader and follower vehicles, which will be produced using the most competitive set-up. This could include grouping production as well, wherever appropriate.

- For the LCV segment, the Alliance will continue to build on product sharing.

- Reference regions: Each company within the Alliance will focus on its core regions, with the aim of being among the most competitive and to serve as a reference for others.

- Leader-follower for vehicle: The product portfolios of each automaker will also follow this scheme, and leader and follower vehicles will be produced using the most competitive set-up. Under this plan, Nissan will lead the revival in the C-SUV (sport utility vehicle) segment after 2025, while the revival in the B-SUV segment will be led by Renault in Europe.

- Leader-follower for technology: The scheme will be extended from platforms and powertrains to all key technologies. Nissan will assume leadership in autonomous driving, while connected car technologies will be led by Renault for Android-based platforms and by Nissan in China.

- The South Korean government aims for alternative-powertrain vehicles to account for at least 90% of the vehicles owned by governmental bodies by 2030, reports the Yonhap News Agency. In 2019, public organizations owned 118,314 vehicles, with electric, fuel-cell, and hybrid models accounting for 14,981 units. They also purchased some 15,000 vehicles last year, with alternative-powertrain models accounting for nearly 28% of these. To achieve its aim, the government has told public organizations that alternative-powertrain vehicles must make up at least 80% of their new vehicle purchases from 2021. (IHS Markit AutoIntelligence's Jamal Amir)

- Hyundai Mobis plans to invest KRW1 trillion (USD810.2 million) on research and development (R&D) projects this year, reports the Yonhap News Agency. In its 2020 sustainability report, Hyundai Mobis said it will invest in 2,000 R&D projects involving next-generation vehicles and will expand its R&D workforce to over 5,000, up from 4,987 in 2019. The R&D spending for this year is slightly higher than the KRW965 billion the company spent in 2019. It has planned KRW1.5 trillion in overall capital expenditure for 2020, up from KRW1.3 trillion a year earlier. (IHS Markit AutoIntelligence's Jamal Amir)

- LG Chem has announced plans to carry out safety checks at its 38 sites worldwide. The company says it will also implement comprehensive upgrades and repairs—or even closure of sites—if required, to make safety its top priority. The examination of sites—15 in South Korea and 23 overseas—will last until June. The decision to perform the inspections follows recent accidents at manufacturing plants operated by LG Chem in India and South Korea. The incident in India on 7 May killed at least 12 people and made more than 1,000 ill.

- Uzbek GDP grew by 4.1% y/y in the first quarter of 2020

according to data from the Uzbek Committee on Statistics. The

negative impact of the global spread of the COVID-19 virus

contributed to significantly slower expansion than the economy had

enjoyed in the first quarter of 2019, when GDP had increased by

5.7% y/y. The primary impetus for growth in the first quarter of

2020 was sustained, strong construction activity, with total value

added growing by 6.5% y/y. Total industrial value added increased

by 4.0% y/y, agricultural value added grew by 3.9% y/y, and the

services sector improved by 3.8% y/y. Moreover, unlike many other

countries in the world, Uzbekistan has two mitigating factors that

might limit its downturn: (IHS Markit Economist Andrew Birch)

- First, the country's long history of isolation from global economic markets may serve to buffer the loss of foreign trade activity, as domestic production can be ramped up to meet a loss of import supply. As part of its reform efforts since 2017, the country has pushed to become more engaged in globalization, but significant progress is still needed for it to become a fully functioning part of the global economy.

- Second, Uzbekistan is the ninth largest producer of gold in the world, providing the country access to hard currency that many other emerging economies do not have. As demand for gold remains strong because of the turmoil in global capital markets, export earnings for Uzbekistan may not drop off as sharply as they may for many other economies.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-may-2020.html&text=Daily+Global+Market+Summary+-+27+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 27 May 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+27+May+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-27-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}