Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 28, 2020

Daily Global Market Summary - 28 May 2020

European and most APAC equity markets closed higher today, while the US markets had a late day sell-off after President Trump announced a press conference on China tomorrow and closed in negative territory. European credit indices had another strong day, while US credit closed higher but near the lows of the day. On a positive note, US continuing claims for unemployment insurance declined for the first time in 11 weeks.

Americas

- US equity markets were higher most of the day until President Trump's unexpected early afternoon announcement of a press conference being scheduled for tomorrow regarding China triggered all major indices to close lower on the day; Russell 2000 -2.5%, DJIA -0.6%, Nasdaq -0.5%, and S&P -0.2%. S&P 500 declined 1.5% between the intraday high at 1:54pm and the low at 3:50pm ET.

- 10yr US govt bonds closed +1bp/0.70% yield.

- Crude oil closed +2.7%/$33.71 per barrel. Crude oil began rallying about an hour after today's 10:30am ET EIA inventory report, despite it showing an unexpected 7.9 million barrel build.

- The CDX indices closed higher on the day, but at the widest end

of the day's trading range; CDX-NAIG -1bp/78bps and CDX-NAHY

-7bps/553bps:

- Seasonally adjusted US initial claims for unemployment

insurance, at 2,123,000 in the week ended 23 May, remained at

historically high levels, although well below the all-time high of

6,867,000 in the week ended 28 March. This was the 10th straight

week with claims in seven figures and a total of 37.2 million

initial claims (non-seasonally adjusted) have been filed over this

period. This is 22.9% of the labor force as of February. (IHS

Markit Economist Akshat Goel)

- There were 1,192,616 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 23 May. The number of initial claims for PUA in the week ended 16 May was revised down to 1,246,871 from 2,226,921. A total of 5,299,883 initial claims for PUA have been filed so far.

- The seasonally adjusted number of continuing claims, which lag initial claims by a week, fell by 3,860,000 to 21,052,000 in the week ended 16 May. The level of continuing claims declined for the first time in 11 weeks and the all-time high of 24,912,000 in the week ended 9 May could be an inflection point in the series. The insured unemployment rate in the week ended 16 May stood at 14.5%.

- US manufacturers' orders for durable goods declined 17.2% in

April, while shipments fell 17.7% and inventories rose slightly

(0.2%). (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- The declines in orders and shipments were largely accounted for by transportation and especially motor vehicles and parts. Excluding transportation equipment, orders declined 7.4% and shipments declined 6.3%.

- US automakers have restarted production, and sales are beginning to recover, implying orders and shipments of motor vehicles and parts are likely to turn up in May.

- The slight increase in inventories of durable goods was about as we expected and was consistent with our latest forecast of a $24 billion decline in inventory investment in the second quarter (to -$91 billion).

- The US Pending Home Sales Index (PHSI) plunged 21.8% in April

to 69.0, an all-time low (data start in 2001). (IHS Markit

Economist Patrick Newport)

- For the second straight month, all four regions saw double-digit month-on-month and year-on-year declines. The Northeast and West plummeted to record lows.

- The National Association of Realtors' (NAR) chief economist, Lawrence Yun, sees April as the low point for this index and May as the low point for existing home sales. Based on recent data, the NAR raised its 2020 forecast for change in existing home sales from -15% to -11%. The NAR also expects the median price to grow 4% this year, up from zero percent last month.

- The Mortgage Bankers Association (MBA) reported yesterday that applications to buy homes, after increasing 9% last week and 54% since early April, were back at normal levels.

- US real GDP fell at a 5.0% annual rate in the first quarter, according to the Bureau of Economic Analysis's (BEA's) "second estimate." This was revised down 0.2 percentage point from the "advance estimate" and was 0.5 percentage point below our tracking estimate. Relative to IHS Markit's tracking estimates, final sales to domestic purchasers matched our expectations. However, a larger-than-anticipated decline in inventory investment brought first-quarter GDP growth below our estimate, suggesting less of a decline in inventory investment in the second quarter. (IHS Markit Economists Ken Matheny, Michael Konidaris, and Lawrence Nelson)

- Ford engineers have developed a new heating software that uses heat from the engine and climate control system in Ford Explorer police vehicle to kill the COVID-19 virus in the vehicle's cabin. The method, which has been developed and researched with Ohio State University uses the study showing that exposing the virus to temperatures of 133 degrees Fahrenheit for 15 minutes would reduce the viral concentration by 99%. (IHS Markit AutoIntelligence's Tarun Thakur)

- Ford has temporarily shut down a plant after an employee tested positive for COVID-19 for the third time in a week, reports the Detroit Bureau, this time at its Chicago stamping plant. Ford performed a deep clean in the part of the facility where the COVID-19-positive employee had been. (IHS Markit AutoIntelligence's Tarun Thakur)

- San Diego-based Ascus Biosciences has closed a $46 million series B round to fuel sales growth of its endomicrobial animal feed. Ascus' funding round was led by Singapore-based investment company Temasek. It also featured participation from Anterra Capital, Formation 8, Cavallo Ventures (the venture capital arm of US agricultural firm Wilbur-Ellis) and various angel investors. The round snared investors that have a history in backing animal health companies. Anterra supported InVetx this year, while Cavallo has previously invested in SomaDetect and Performance Livestock Analytics. Formation 8 has funded Algal Scientific. Ascus uses proprietary technology "to resolve the complexities in the native microbial communities living in highly productive and healthy animals". The company selects and isolates efficacious native microorganisms from animal samples. These isolates are then developed into microbe products. (IHS Markit Animal Pharm's Joseph Harvey)

- Canada's current-account deficit expanded to $11.1 billion in

the first quarter as the trade net loss in goods and services

increased once again after the temporary improvement at the end of

2019. (IHS Economist Arlene Kish)

- The goods account deficit increased by $1.0 billion to $9.8 billion, partly due to the strong deficit increase in energy, aircraft, and other transportation equipment and parts, and metals ores and non-metallic mineral products.

- The services account deficit increased by $0.3 billion to $5.9 billion, as the travel deficit balance worsened, and the commercial surplus balance narrowed.

- The primary income deficit narrowed to $0.1 billion while the secondary income deficit widened to $1.2 billion.

Europe/Middle East/ Africa

- European equity markets closed higher across the region; Italy +2.5%, Switzerland +2.2%, France +1.8%, UK +1.2%, Germany +1.1%, and Spain +0.7%.

- 10yr European govt bonds closed mixed; Spain -6bps, France/Italy -5bps, Germany -1bp, and UK +2bps.

- Brent crude closed +1.6%/$36.03 per barrel.

- iTraxx-Europe closed -2bps/69bps and iTraxx-Xover -18bps/413bps.

- Germany's Federal Statistical Office (FSO) has reported

preliminary data, based on information from various regional

states, that suggest the country's national consumer price index

(CPI) declined by 0.1% month on month (m/m) in May, much softer

than the 0.3-0.4% monthly increase in May in recent years. The

inflation rate has dropped anew from 0.9% to 0.6%, the magnitude of

the decline being curtailed by an offsetting base effect. The

EU-harmonized CPI measure stagnated m/m in May, dampening its

year-on-year (y/y) rate from 0.8% to 0.5%. (IHS Markit Economist

Timo Klein)

- Energy prices in NRW declined by another 1.4% m/m, their y/y rate thus falling from -6.0% to -8.6%. Noteworthy declines apart from energy were seen for furniture and household goods (-0.9% m/m, thus the y/y rate is down from 1.3% to 0.3%) and interestingly also healthcare (-0.1% m/m, with y/y rate softening from 1.7% to 1.4%).

- Categories showing accelerating inflation included alcohol/tobacco (0.8% m/m, y/y rate from 2.4% to 3.3%) and clothing/shoes (0.5% m/m, y/y rate up from -0.6% to 0.5%). Meanwhile, food prices steadied at 0.1% m/m and 3.9% y/y (April: 4.0%).

- Overall service-sector inflation in NRW weakened just slightly from 1.3% to 1.2% y/y, whereas goods inflation declined from 0.1% to -0.4% and thus deflation territory due to energy.

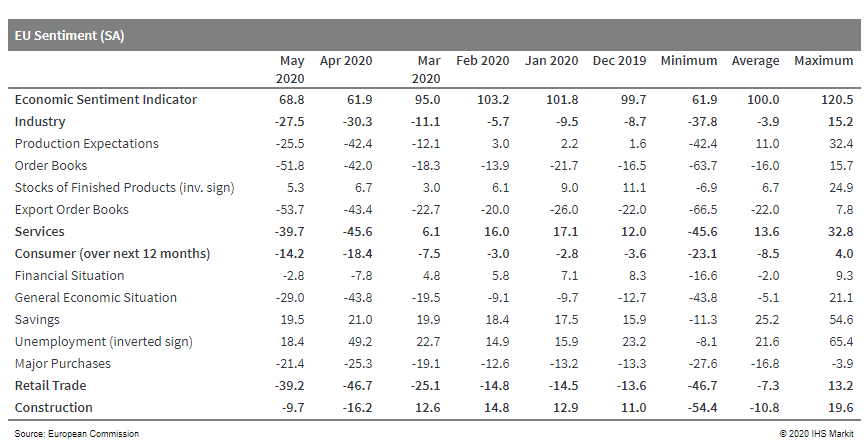

- The European Commission's economic sentiment index for Austria

has partially recovered from April's all-time low of 61.9, rising

to 68.8 in May. The latest level is still only modestly higher than

the lows observed in early 2009 in the wake of the global financial

market crisis, and it compares with an all-time high of 120.5 in

December 2017 and a long-run average of 100.0. Finally, Austrian

sentiment in May was marginally better than in the average of the

eurozone (67.5). (IHS Markit Economist Timo Klein)

- The Austrian breakdown (see table for details) reveals that the largest rebounds were observed (in this order) in retail trade, construction, and services. Consumer and industrial confidence also improved but to a somewhat lesser extent. Sentiment in the service sector will probably improve in an above-average manner during the imminent summer season due to the benefits of the reopening trend to tourism and hotels/restaurants.

- Consumer confidence had suffered far less than the other areas in April due to supermarkets and healthcare services not having been closed during the lockdown and as short-time work schemes have buffered the impact on the labour market to some extent.

- The sub-indicators regarding unemployment expectations or the readiness to make major purchases during the coming 12 months have broadly returned to March levels already. This echoes the message from the separately calculated Employment Expectations Indicator (EEI), which regained almost half its April losses in May.

- Industrial confidence only improved modestly because production

expectations improved significantly, presumably as supply chain

disruptions eased. Stocks of finished products, which enters

calculations with an inverted sign, contributed only slightly to

the recovery, while order books actually worsened considerably

further.

- Fitch switched its outlook on Iceland's rating to Negative

because of impact of COVID-19 virus pandemic. (IHS Markit Economist

Diego Iscaro)

- Fitch notes that Iceland has entered the crisis in a relatively strong position owing to past improvements in its public finances and elevated external reserves. However, the small size and openness of its economy, as well as the large relative importance of tourism and commodity exports make it particularly exposed to the current economic shock.

- Fitch expects Iceland's GDP to contract by 8.9% in 2021, while the fiscal balance is projected to experience a deficit of 9.0% of GDP this year (following a deficit of just 1.0% of GDP in 2019).

- Lower tourism revenues and exports of maritime goods and aluminum (which account for 35% of total exports) will lead to a deterioration of the current-account balance from a surplus of 5.8% of GDP in 2019 to a deficit of 2.3%, according to Fitch.

Asia-Pacific

- APAC equity markets closed mixed; Japan +2.3%, India +1.9%, Australia +1.3%, China +0.3%, South Korea -0.1%, and Hong Kong -0.7%.

- Gilead Sciences (US) has written to the Indian Prime Minister's Office, and several government departments, to raise concerns over BDR Pharmaceuticals (India)'s plans to manufacture remdesivir in India without a voluntary licensing agreement. According to the Indian newspaper The Economic Times, BDR Pharmaceuticals has submitted an application to the Drug Controller General of India (DCGI) to manufacture remdesivir, which earlier this month received emergency use authorization (EUA) from the US FDA for the treatment of COVID-19. Gilead's patents protecting remdesivir in India allow the company to exclusively manufacture and commercialize the drug until 2035. (IHS Markit Life Science's Sacha Baggili)

- South Korea's central bank, the Bank of Korea (BOK), cut its

policy rate by 25 basis points at its Monetary Policy Board meeting

today. The Base Rate was lowered from 0.75% to 0.5%. (IHS Markit

Economist Rajiv Biswas)

- The Bank of Korea also lowered its GDP growth forecast for 2020 from its earlier 2.1% year-on-year (y/y) forecast made in February to a contraction of 0.2% y/y. GDP in first half 2020 is estimated to contract by 0.5% y/y, improving in second half 2020 to marginal positive growth of 0.1% y/y.

- Private consumption is estimated to contract by 3.4% y/y in first half 2020, impacted heavily by the escalation of new COVID-19 cases in first quarter 2020. However, with the pandemic having been rapidly been brought under control in South Korea during April and May, a moderate positive expansion of private consumption by 0.6% y/y is forecast for second half 2020.

- The BOK forecasts that the South Korean economy will rebound in 2021, expanding at a pace of 3.1% y/y.

- Key downside risks to the 2020 growth outlook include a prolonged spread of the pandemic, as well as potential risks from escalating US-China trade tensions and any significant delay in the semiconductor industry's recovery.

- Hyundai Motor Group has selected LG Chem as one of the battery suppliers for its upcoming new electric vehicles (EVs) due to be launched in 2022, reports Maeil Business Newspaper. Details of the supply contract including the EV model and the full amount of the deal are confidential. LG Chem joins another South Korean battery manufacturer, SK Innovation, to become the battery supplier for Hyundai Motor Group's upcoming electric models based on its in-house-developed EV-dedicated electric-global modular platform (E-GMP). The platform is expected to allow EVs to have a spacious interior with the batteries placed under the vehicle's floor. (IHS Markit AutoIntelligence's Jamal Amir)

- South Korea's Hyundai Cosmo Petrochemical Co (HPC). is targeting to restart its smaller paraxylene unit this week after a six-week debottlenecking which has increased the capacity from 380,000/mt to 580,000 mt/year, a company source said Wednesday. HPC is a joint venture between South Korea's Hyundai Oilbank and Japan's Cosmo Oil. The PX-MX spread has crashed to a new low of $65/mt on Wednesday, IHS Markit Chemical data showed. This is half what PX producers using MX as feedstock needed to break even. Asian MX price has strengthened due to strong gasoline blending demand from China as its economy rebounded from the coronavirus disease (COVID-19) which is still keeping most parts of the world under lockdown.

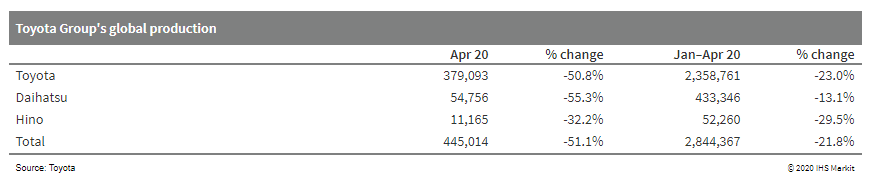

- Toyota Group has announced its global production figures for

April 2020. It reported a 51.1% year-on-year (y/y) decrease in

overall output to 445,014 units. The figure includes output at its

subsidiaries Daihatsu Motor and Hino Motors. (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- Toyota Group's worldwide production fell again last month, the seventh consecutive month of decline.

- Domestic production also declined for the seventh consecutive month, while overseas production experienced 11 consecutive months of de-growth.

- Toyota Group witnessed absolutely no production in North America and Latin America during April as the company had to suspend production operations at its plants owing to weak demand and to keep its employees safe amid the COVID-19 virus outbreak.

- Only 577 units were produced at its plant in France, while operations in the United Kingdom, Turkey, and other parts of Europe remained suspended.

- Production in other Asian countries was low because of weak

demand and the suspension of production at many of its plants.

- Nissan reported a net loss of JPY671.2 billion during FY

2019/20, down from a JPY319.1 billion profit during FY 2018/19.

(IHS Markit AutoIntelligence's Tarik Arora)

- The operating-income loss during FY 2019/20 stood at JPY40.5 billion on net sales of JPY9.87 trillion, down by 14.6% y/y.

- Nissan's global sales volumes declined 10.6% y/y to 4.93 million units during the full FY 2019/20.

- Sales declined by 10.3% y/y to 534,000 units in Japan and 14.6% y/y to 1.62 million units in North America, including a 14.3% y/y decrease to 1.23 million units in the United States and 19.1% y/y to 521,000 units in Europe. Its sales in mainland China fell by 1.1% y/y to 1.54 million units.

- Nissan has also unveiled a four-year plan to achieve profitability by the end of FY 2023, and aims to achieve a 5% operating profit margin and a global market share of 6% by that time.

- Toray Industries reported a 29.7% drop in net income for its

full fiscal year ended 31 March, to ¥55.7 billion ($517.3 million).

Operating income dropped 7.3% to ¥131.1 billion. Revenue was ¥2.2

trillion, a decrease of 7.3%.

- Sales by Toray's fibers and textiles segment were ¥883.1 billion, a decline of 9.4%. Operating income decreased 16.7% to ¥60.7 billion. In Japan, shipments of products for apparel and industrial applications remained weak. Overseas demand for apparel applications, including garments and textiles, as well as automotive applications, the mainstay of the industrial applications business, remained sluggish.

- Sales by Toray's performance chemicals business decreased 11.3% to ¥770.8 billion and operating income was ¥58.7 billion, down 13.2%.

- The chemicals business was squeezed by a decline in the basic chemicals market. In the films business, sales of battery separator films for lithium-ion secondary batteries increased reflecting demand growth, and polyester films were hurt by an inventory adjustment for optical as well as electronic parts applications.

- The electronic and information materials business saw a strong performance by organic light-emitting diode (OLED)-related materials and electronic circuit materials.

- The carbon fiber composite materials segment achieved a sales increase of 9.7%, to ¥236.9 billion; operating income jumped 81.6% to ¥21 billion. Demand for aircraft applications as well as the performance of industrial applications in the environment and energy-related fields, such as compressed natural gas tanks and wind turbine blades, remained strong.

- The BMW Group and IHS Markit have released their data on global

and European electrified vehicle market share. The data, which is

commissioned from IHS Markit, is an interesting measure of the

relative performance of OEMs in terms of the rate and success of

their efforts to electrify their model ranges. <span/>(IHS Markit AutoIntelligence's Tim

Urquhart)

- The global market share index sees Tesla take a 24% share of the combined global battery electric vehicle (BEV) and plug-in hybrid market for the first three months of 2020, according to IHS Markit's sales data.

- The BMW Group and the Volkswagen (VW) Group were equal second with 7% of the market each, largely thanks to their extensive plug-in hybrid electric vehicle (PHEV) offerings, while Tesla's 24% is of course made up of pure battery electric vehicles (BEVs).

- Renault held fourth place with a 5% share, and Volvo, Hyundai, Kia, Audi and Peugeot all take a 4% share.

- BYD, Nissan and Mercedes had a 3% share, with mixture of smaller volume brands, many of which operate in the Chinese market, taking a 28% share of the market.

- The Indian holding ITC has signed an agreement to acquire the spice processor Sunrise, a leader in the state of West Bengal, for an undisclosed sum. ITC will integrate Sunrise within Aarshirvaad, a company specializing in high-quality spices in the states of Telangana and Andhra Pradesh, both in Central India. ITC is listed on the Mumbai exchange and it has subsidiaries in the hostelry, paper, FMCG and agricultural industries. This acquisition leads to ITC expansion in domestic consumption and agribusiness sectors. Its revenue totaled INR5.203 billion (USD6.9 bln) in 2018-19 (April-March). (IHS Markit Agribusiness' Jose Gutierrez)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-may-2020.html&text=Daily+Global+Market+Summary+-+28+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-may-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 28 May 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+28+May+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-28-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}