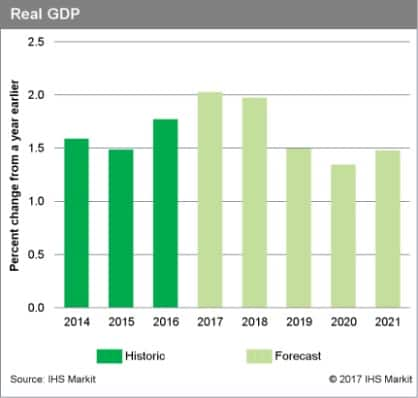

Initial growth then a leveling off.

Germany’s real GDP growth has averaged 0.4% quarter-on-quarter (q/q) since mid-2013, driven mainly by domestic demand. With key leading indicators at near-six-year highs in March-April 2017, Germany’s economic growth should reach 0.7% q/q in the first quarter, due in part to a weather-related construction sector boost, while full-year, work-day-adjusted growth should increase from 1.8% in 2016 to 1.9% in 2017.

S&P Global expects domestic demand to continue to fuel Germany’s real GDP growth, resting mainly on private and public consumption and on residential construction. By contrast, we believe investment in equipment will recover only moderately as high global levels of uncertainty cause firms to be cautious. Net exports will likely remain a modest burden on GDP growth as import growth accelerates faster than export growth. Industrial production growth should strengthen from 1.0% in 2016 to roughly 3.0% in 2017, as indicated by three-year highs of the output component of the manufacturing Purchasing Managers Index (PMI) survey during February–April. S&P Global forecasts that Germany’s real GDP growth will peak to 2.0% in 2017-2018, then decline to 1.3% by 2020.

Visit Advanced Country Analysis & Forecast Service to learn more