Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 19, 2024

BriefCASE: From cradle to grave: OEMs' long quest for additional revenue

The ability of original equipment manufacturers to extract revenue from a vehicle once it has left the dealer's lot is the holy grail for the motor industry. It's by no means a new quest, either. The industry has long recognized the imbalance between the revenue that accrues to OEMs at the point of sale and the financial riches harvested during a vehicle's life. Jac Nasser, ex-president and CEO of Ford, even made cradle-to-grave services a cornerstone of Ford's strategy in the late 1990s. More recently, many OEMs would rather be seen as mobility companies than plain old automakers, a nod to the spectrum of services in which they see growth opportunities for their brands.

The opportunities for OEMs are more diverse now than ever in the car's 120-year-plus history. The "connected" component of the connected, autonomous, sharing and electrification (CASE) megatrend, and, more latterly, the software-defined vehicle (SDV) — or the now increasingly modish AI-defined vehicle — emphasize this ability to extract more dollars from consumers, be it for subscription or one-off payment services. That's the theory, in any case. The reality, as BMW discovered with its notorious heated-seat experiment, can be different.

To better assess demand and consumers' willingness to pay for connected car features, S&P Global Mobility conducts a global survey of 8,000 vehicle owners annually. Here are some insights from the survey:

Connected services brands and perceptions

Most respondents had a favorable opinion of their existing or most recent connected services brand, and 83% would likely recommend it to a friend. Positive opinions were higher for regional/local automaker brands.

Compared with last year's survey, the top three connected services brands per country remained almost the same across the board. However, the US and Brazilian markets saw a change in preferences. In the US, OnStar retained its top spot, but FordPass and Honda Connect were new entrants to second and third. In Brazil, Volkswagen We Connect, Toyota's T-Connect and Honda Connect were all newcomers in the top three.

There was a slight decline in the likelihood of recommending connected services brands: a warning to automakers. In this year's survey, 43% of respondents were "very likely" to recommend their chosen brand's services, compared with 47% in the prior year. The countries where respondents were most likely to recommend connected services were Brazil, with 94%, and mainland China and India, with 91%.

Satisfaction and willingness to pay

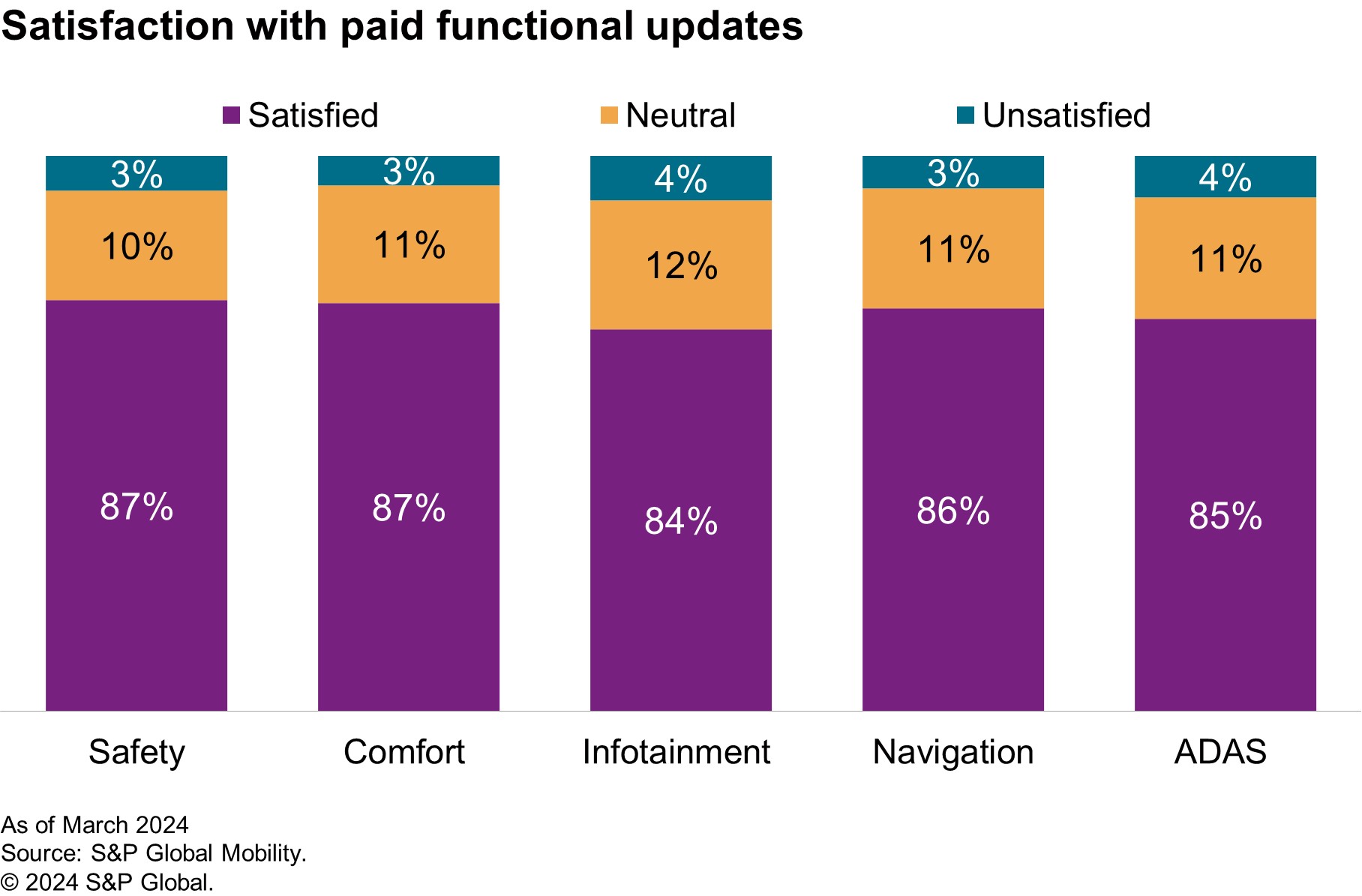

S&P Global Mobility's survey indicated declining satisfaction levels across all connected services categories compared with the previous year. The highest satisfaction was reported for navigation, personalization and infotainment, while the lowest was for safety and security. Paid functional updates showed high satisfaction in safety, comfort, infotainment, navigation and advanced driver-assistance systems (ADAS). Willingness to pay was highest for safety and electric vehicle services and lowest for navigation and infotainment.

Consumers expressed a strong desire for navigation and safety and security services in their next vehicle, while productivity services were the least desired. The desirability of EV services and personalization are on the rise. For paid functional updates, enhanced navigation, smartphone integration and basic ADAS functionality were highly desirable. About 39% of respondents preferred an annual subscription for these updates.

Data privacy concerns

As in the previous survey, data privacy remains a significant concern, with 73% of respondents willing to share vehicle data in exchange for free connected services. The main reported concerns revolved around security, data misuse/trust and understanding the value of data sharing.

Finally, even though trust in sharing information has increased overall, respondents still feel more comfortable sharing it with automakers than with technology companies.

The survey demonstrates that the search for incremental revenue will be far from the walk in the park that some leading proponents of the SDV paradigm suggest. As ever, consumer loyalty and trust are hard-won. The industry is on the very first steps of that journey with paid updates and subscriptions. Any false step now could prove very costly for automakers as they work to diversify their sources of revenue. The holy grail of paid updates and subscription services could be another empty vessel from which the industry drinks.

The survey included nearly 8,000 adult respondents from eight territories, reflecting a diverse range of regional specifics. The online survey was conducted in local languages, and quotas were based on demographics such as gender, age, household income and region. Key criteria for participation included owning a vehicle from the model year 2019 or newer, ensuring the sample targeted were potential end users of the technologies under consideration.

Get daily insights and intelligence by subscribing to AutoTechInsight.

Subscribe to the BriefCASE email newsletter.

Author: Vivek Beriwal, Senior Research Analyst II, S&P Global Mobility

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbriefcase-connected-cars-consumer-preferences.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbriefcase-connected-cars-consumer-preferences.html&text=BriefCASE%3a+From+cradle+to+grave%3a+OEMs%27+long+quest+for+additional+revenue+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbriefcase-connected-cars-consumer-preferences.html","enabled":true},{"name":"email","url":"?subject=BriefCASE: From cradle to grave: OEMs' long quest for additional revenue | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbriefcase-connected-cars-consumer-preferences.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=BriefCASE%3a+From+cradle+to+grave%3a+OEMs%27+long+quest+for+additional+revenue+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbriefcase-connected-cars-consumer-preferences.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}