Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 15, 2024

Facing Overcapacity, China’s Truck Makers Turn to International Markets

Exports seen as potential solution to overcapacity issues in Chinese plants.

Over the past decade, mainland China's medium- and heavy-commercial-vehicle (MHCV) production has experienced remarkable growth, soaring from 1.3 million units in 2013 to a peak of 2.1 million units in 2020.

Despite this impressive expansion, production factories are not operating at full capacity, and average plant utilization has struggled to exceed 50%. As of the end of 2023, mainland China's MHCV production volume was at 1.11 million units — just 24% of total production capacity, which is estimated to have reached 4.7 million units, per S&P Global Mobility's MHCV Production Capacity Module.

Government Guidelines and Industry Consolidation

To tackle the overcapacity issue, Chinese policymakers have introduced a series of guidelines aimed at consolidating the automotive industry. These measures include setting annual production floors for individual automakers. Companies that fail to meet these production targets will be blacklisted and prohibited from declaring new models.

As a result, approximately 10 manufacturers, including BAW, Lifan Sojen Auto, and Youngman, have exited the MHCV sector since 2013, leading to a reduction in the number of plants from 98 to 85. In the meantime, production activities have become increasingly concentrated among leading manufacturers, with the market share of top-five players having risen from 66% in 2013 to 76% in 2023.

Shifting Focus to Global Expansion

The slow advancement in industry consolidation, coupled with mounting challenges to domestic demand — including a moderating economy, diminishing stimulus effects, oversupplied trucking, and driver shortages — has pushed mainland Chinese MHCV manufacturers to turn their focus towards global expansion.

Leveraging a matured supply chain, the Belt and Road initiatives, and favorable geopolitical opportunities, these manufacturers have successfully doubled their exports of above 5-ton trucks and buses from the 2021 level of 192,000 to 378,000 units in 2023, according to the General Administration of Customs of the People's Republic of China.

The Road Ahead: Global Expansion and Growth Potential

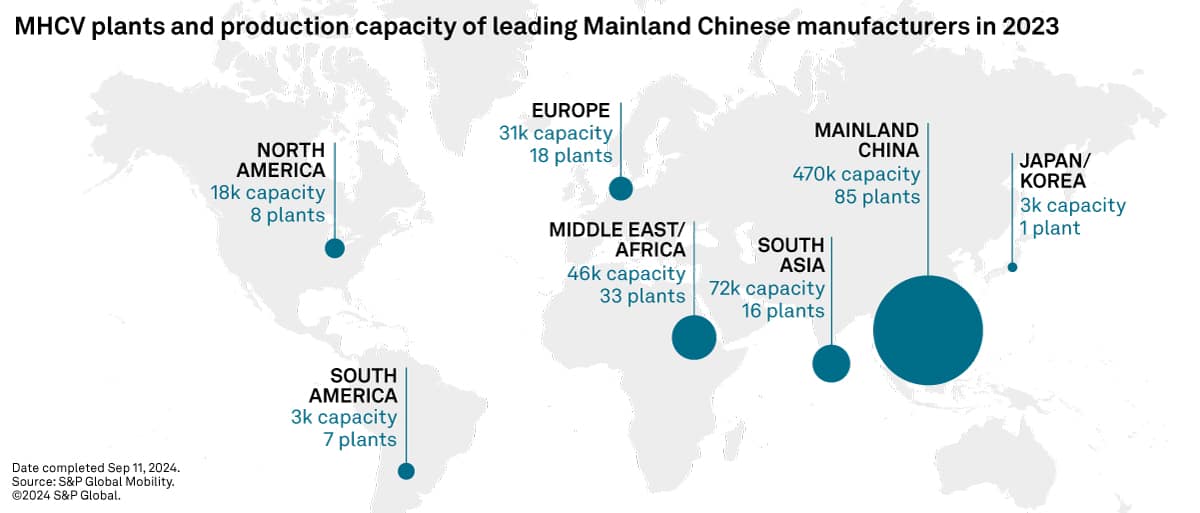

Furthermore, leading players have established over 80 overseas assembly plants (with around 50 included in our forecast geography), boasting a combined capacity of more than 170,000 units per year. This strategy not only saves costs but also alleviates domestic capacity utilization, as kits used for assembly in overseas plants are sourced from facilities in mainland China.

While exports now account for over 30% of production, there is still a long way to go for mainland Chinese MHCV manufacturers to leverage the global market as a means to digest the surplus in production capacity. Factors such as underdeveloped sales channels, inadequate aftermarket services, limited brand recognition, insufficient advanced technology, and fierce competition from global players remain hurdles.

Still, a low base and the ongoing increases in product quality of Chinese MHCV products suggest substantial potential for future growth. In the November release of S&P Global Mobility's MHCV Model Production Forecast and Export Module, we anticipate Chinese MHCV brands to produce 1.5 million units globally (combined domestic and abroad) in 2027, with maximum capacity utilization rate improving from 24% in 2023 to 30% that year.

Download a free MHCV plant capacity data sample

Learn more: MHCV Production Capacity Forecast

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fchina-commercial-vehicles-production-capacity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fchina-commercial-vehicles-production-capacity.html&text=Facing+Overcapacity%2c+China%e2%80%99s+Truck+Makers+Turn+to+International+Markets++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fchina-commercial-vehicles-production-capacity.html","enabled":true},{"name":"email","url":"?subject=Facing Overcapacity, China’s Truck Makers Turn to International Markets | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fchina-commercial-vehicles-production-capacity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Facing+Overcapacity%2c+China%e2%80%99s+Truck+Makers+Turn+to+International+Markets++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fchina-commercial-vehicles-production-capacity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}