Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 28, 2023

Have lenders and consumers taken on too much risk in the used vehicle portfolio?

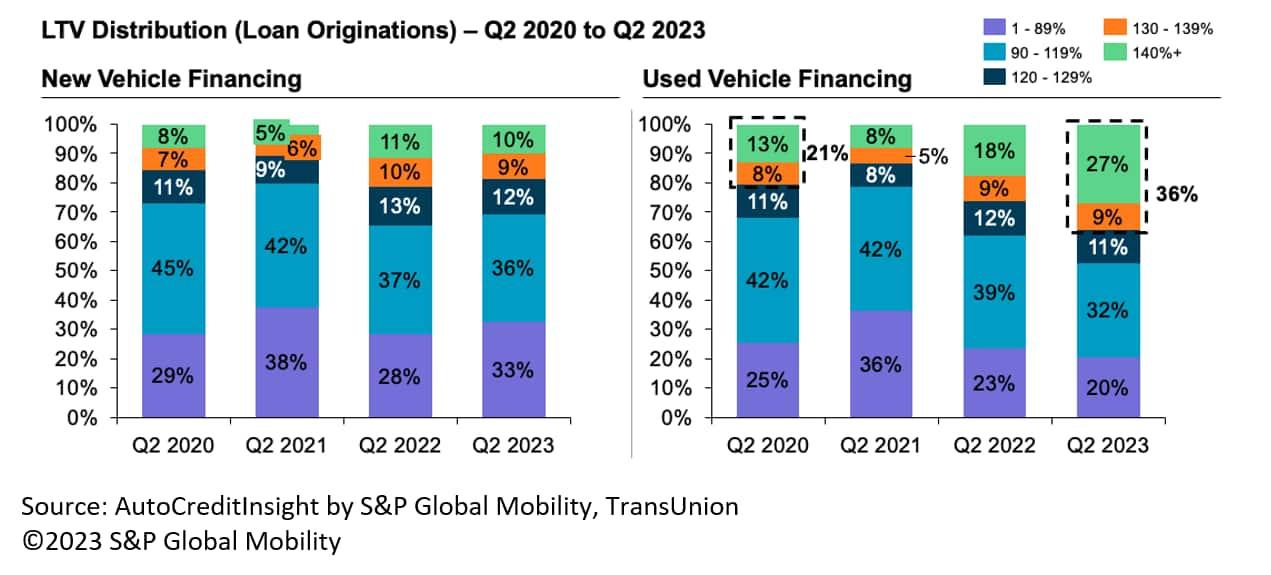

With more than one-third of used vehicle loans in 2023 carrying loan-to-value ratios above 130%, used vehicle LTVs are at historic highs. Have lenders (and consumers) taken on too much risk?

As the transaction prices of used vehicles steadily rose through the pandemic, the corresponding funding needs of consumers who purchase those vehicles also have increased. But so has the risk that lenders must consider when deciding to finance their customers' vehicle purchases, according to analysis of data from AutoCreditInsight by TransUnion and S&P Global Mobility.

The key metric in new- and used-car financing is the loan-to-value (LTV) ratio. LTV weighs the value of the vehicle as collateral for the loan and the amount of risk the lender is willing to take to originate the auto loan. And while used vehicle prices soared and mostly held firm, their underlying values as assets have not necessarily kept pace. What remains to be seen is how used vehicle values will decline or hold steady with new vehicle inventory, incentives, and demand.

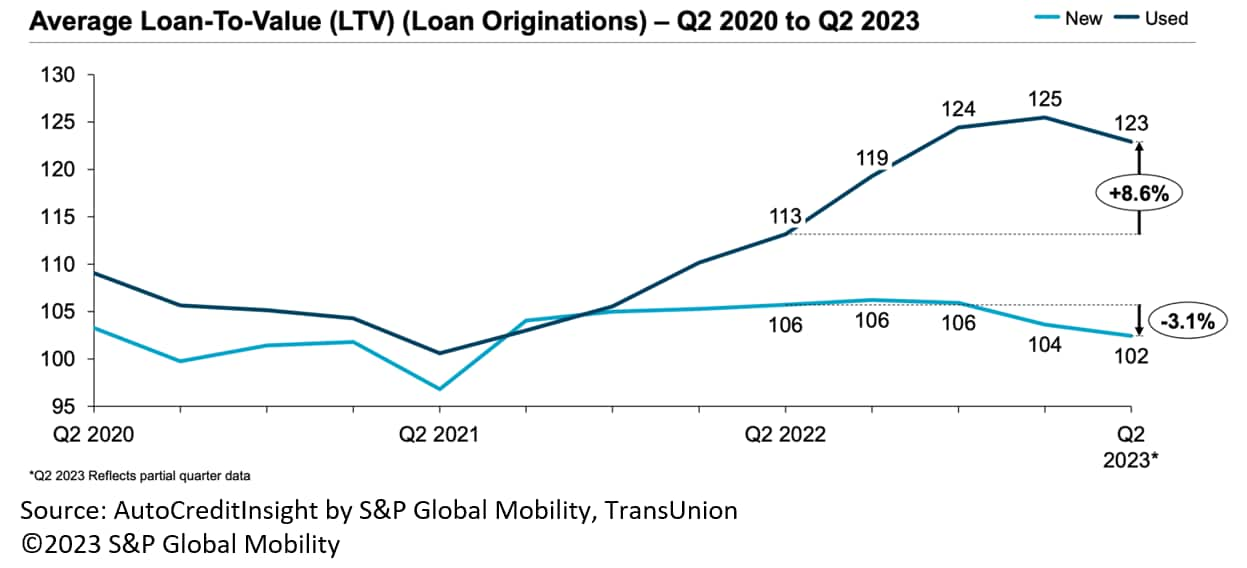

From the start of 2022 through Q1 2023, the average LTV on used vehicles climbed sharply to 125 percent, an increase of 15 percentage points, according to TransUnion and S&P Global Mobility AutoCreditInsight. In the second quarter of 2023, that percentage eased slightly, to 123%.

What's more, 40% of used vehicle loans in Q1 2023 originated with a starting LTV of 130% or higher, compared to only 22% hitting that level in Q1 2019. In Q2 2023, that percentage also eased slightly, to 36%, but those are still near historic highs.

In other words, lenders are loaning amounts of money far higher than the financed used vehicles are actually worth - at interest rates far higher than they were two years ago. Could this weigh down the whole portfolio, or is it just a blip?

Why is this number worth watching?

"While consumers are broadly still doing well due to low unemployment, recent trends of higher originating LTV's combined with higher vehicle prices and the possibility for quicker depreciation as vehicle values stabilize creates a pocket of elevated risk in some auto portfolios," said Satyan Merchant, senior vice president and automotive business leader for TransUnion.

"That said, with the exception of this recent pocket of higher LTV originations, the overall portfolio is well collateralized," Merchant added.

By contrast, new vehicle LTVs jumped slightly in 2021 and then held steady in 2022, before declining for the two latest quarters, almost back to pre-pandemic levels, according to AutoCreditInsight by TransUnion and S&P Global Mobility.

"Used vehicles' value skyrocketed during the pandemic due to the

inventory constraints of new vehicles from supply chain and

production issues," said Jill Louden, associate director for

AutoCreditInsight at S&P Global Mobility. "However, auction

indices we've seen are starting to level out following huge spikes

of year-over-year growth in used vehicle pricing."

Auctions and dealers want used vehicles because they know they can sell them for an elevated price based on demand and scarcity for these products, Louden added. A new twist: Recent-model used vehicles are going to be challenged again, as leasing cratered with the initial stage of the pandemic three years ago and as a result, fewer vehicles are coming off lease and available in the market."

"When consumers cannot buy new, due to lack of availability or pricing, then they are forced to buy used," Louden said. "But when there is a lack of availability of near-new used vehicles, the pricing pressure works its way through the entire resale chain."

Although there has been a lack of new-vehicle incentives from OEMs who have not needed to discount sticker prices, that is starting to turn, as new-vehicle inventories have been rising on many vehicles.

But effectively canceling any cash incentives - according to TransUnion - has been the Fed's attempt to tame inflation with a series of 11 rate hikes from March 2022 through August 2023.

Since the Fed began raising rates, average auto loan APRs have increased from Q4 2021 levels for new vehicles at 3.86% and used vehicles at 8.28%, up to Q2 2023 levels of 6.85% for new, and 11.87% for used, Merchant said.

These combined factors have pushed up vehicle payments, while carrying a LTV nearly 15 percentage points higher, and for a longer term. All of this adds risk - for lenders and consumers alike.

The monthly payment increase isn't as large for used vehicles during this period because used prices started to retreat from their peaks," Merchant said. "But despite the used price declines, monthly payment still went up due to rate increases. New vehicles had both price and APR increases to contend with."

Here's the math

According to S&P Global Mobility and TransUnion data, the average monthly loan payment for a used vehicle in Q1 2019 was approximately $390 with an LTV of 110% and an average monthly loan term of 63.6 months.

However, March 2020 marked the pandemic's start and ensuing havoc on regional and global economies.

By 1Q 2021, soaring used vehicle values meant the average monthly payment for a used vehicle surged to almost $414; but the LTV dropped to 104% — due to customers having higher down payments due to COVID-19 relief money and higher trade-in values due to used vehicle scarcity. Also, the average term jumped to 65.1 months.

In 1Q 2022, however, the full effect of the pandemic began to take shape with respect to the car-buying public. Used vehicle values continued to climb. As a result, used vehicles saw the average monthly payment jump by nearly $100 to $508, the LTV increase to 110% and the average term showing a modest increase to 67.2 months.

Then conditions became dramatic. Through 2Q 2023, TransUnion data show that the average monthly payment for a used car jumped to $533 while the LTV was 123%. These levels are stratospherically high, although the LTV has retreated slightly from 125% in 1Q 2023.

"An average monthly vehicle payment of more than $530 for used vehicles is a big chunk out of the household monthly income, and we see these challenges on monthly payments continuing for now," Louden noted.

"On the plus side, new vehicle inventories have returned on many vehicles, which will help dealers get back more traditional retail sales models and increase competition among OEMs - causing incentives to return to the new vehicle market and reducing pressure on the used vehicle side," Louden added.

"Things right now are leveling out on the new side, and used prices are slowly coming down," Louden said. "But compared to pre-pandemic, it's still not a consumer-friendly market."

CONSUMER LOYALTY TO FINANCE COMPANIES FELL SHARPLY DURING

PANDEMIC

AUTO-FINANCE DELINQUENCIES RISE PAST GREAT RECESSION PEAK, BUT…

SUBSCRIBE TO AUTOCREDITINSIGHT

LOWER-CREDIT BUYERS PUSHED OUT OF NEW VEHICLES

THE AUTO INDUSTRY SHARE WARS WILL RESUME IN '23

SEPTEMBER AUTO INDUSTRY TRENDS

SUBSCRIBE TO OUR TOP 10 INDUSTRY TRENDS NEWSLETTER

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fhave-lenders-and-consumers-taken-on-too-much-risk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fhave-lenders-and-consumers-taken-on-too-much-risk.html&text=Have+lenders+and+consumers+taken+on+too+much+risk+in+the+used+vehicle+portfolio%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fhave-lenders-and-consumers-taken-on-too-much-risk.html","enabled":true},{"name":"email","url":"?subject=Have lenders and consumers taken on too much risk in the used vehicle portfolio? | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fhave-lenders-and-consumers-taken-on-too-much-risk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Have+lenders+and+consumers+taken+on+too+much+risk+in+the+used+vehicle+portfolio%3f+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fhave-lenders-and-consumers-taken-on-too-much-risk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}