Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 18, 2024

Surprising Trends in the US Electric Vehicle Market

Excluding Tesla, the US retail electric vehicle market is performing higher than reported.

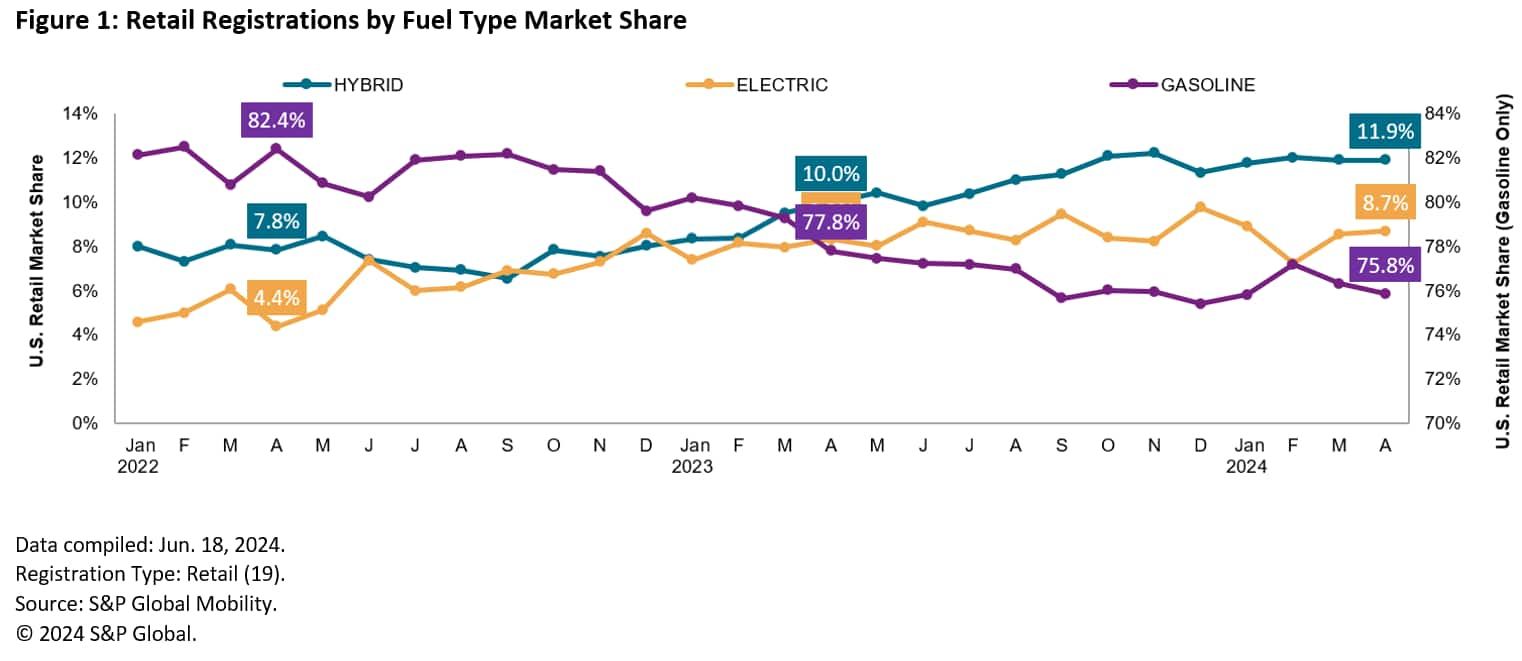

Starting in early- to mid-2023, the growth in US retail market share for electric vehicles has slowed. The April 2024 retail share of 8.7% was up just 0.4 percentage points from a year ago, while hybrid share rose almost 2 points over the same time period.

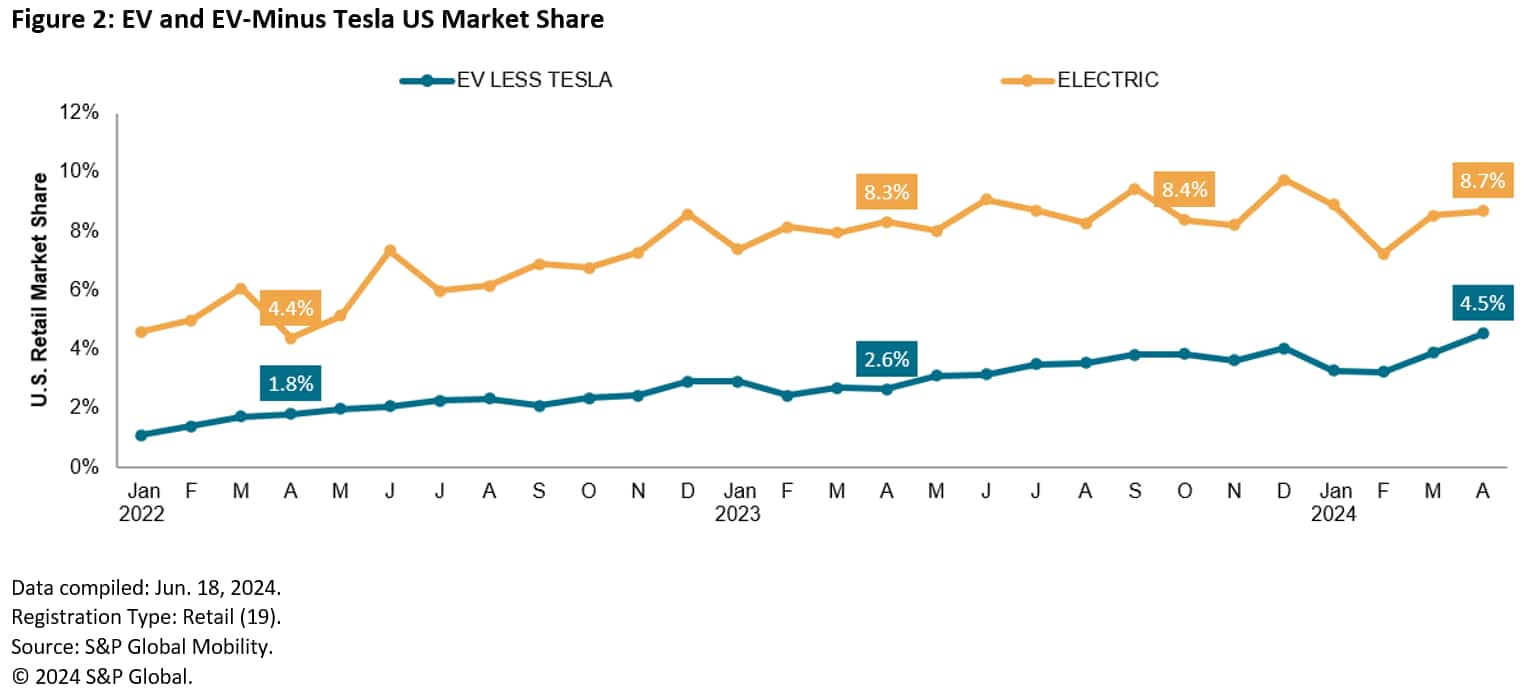

But the electric vehicle (EV) story is not that simple. If Tesla's results are removed, then the EV market has performed at a higher level than most realize. As Figure 2 suggests, even though the EV-minus-Tesla market did have a slight dip in the January/February time period, it came back in March and reached an all-time high of 4.5% in April. Not only is this April share up 1.3 percentage points from just two months ago, but it is up almost 2 full percentage points from April 2023.

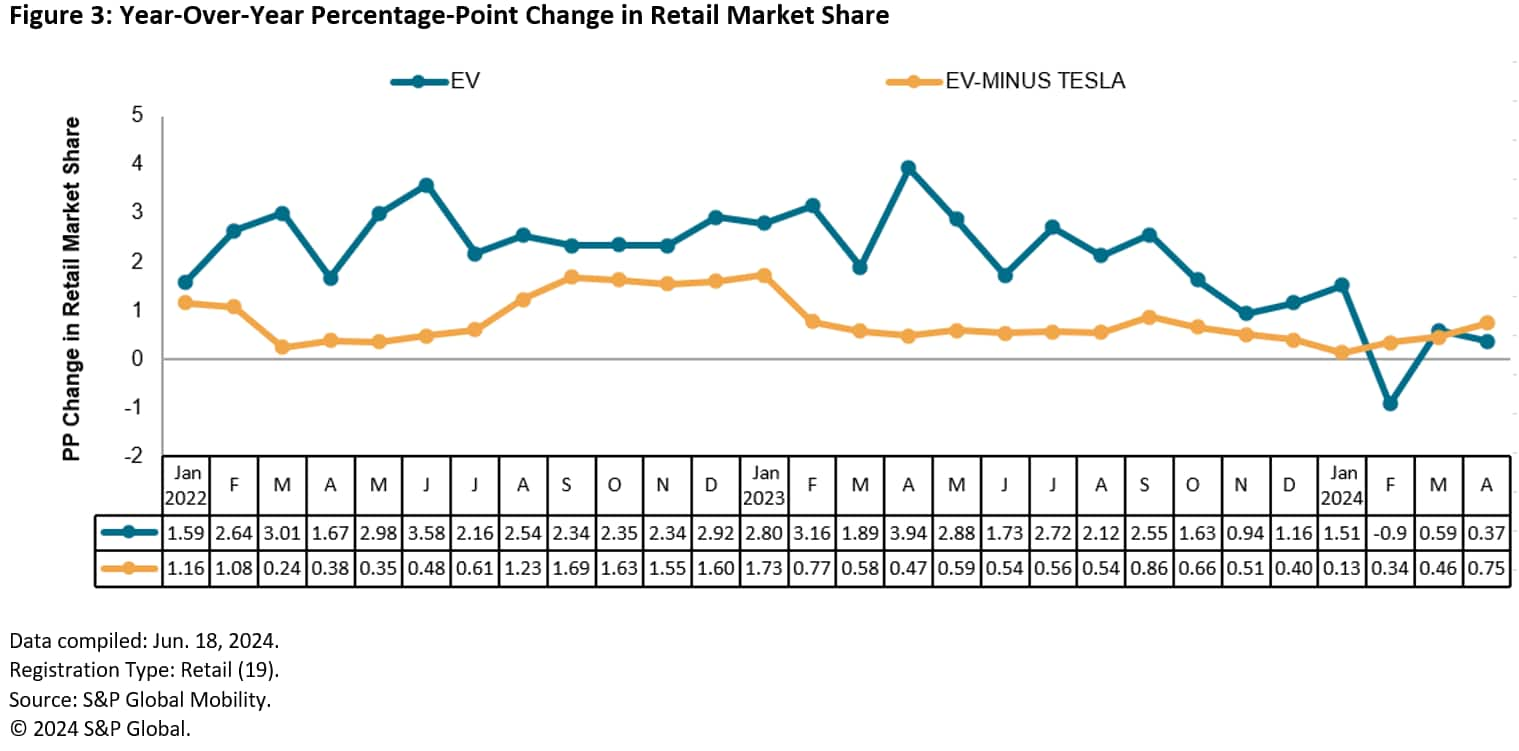

A review of the year-over-year changes in market share for both the total EV and EV-minus-Tesla markets reinforces the conclusion that the second is out-performing the first (see Figure 3). The overall EV market was down almost a full percentage point in February, and its gains in March and April were both less than 1 percentage point. Yet, without Tesla, the category has enjoyed consistent year-over-year market share improvements dating back to at least the start of 2022.

April results at the brand level further illustrate the negative market impact of Tesla. The overall EV market climbed 12% year-over-year in April, but if Tesla is removed, EV deliveries jumped an impressive 75%. Eighteen brands enjoyed year-over-year increases in April, while only nine experienced declines. Four additional brands had EV registrations this past April but none a year ago.

Among the 18 brands with year-over-year gains, EV deliveries doubled (at least) for eight of them in April, and registration volumes for three of them surpassed 6,000 units, including Ford (6,409), Hyundai (6,049) and Toyota (4,509).

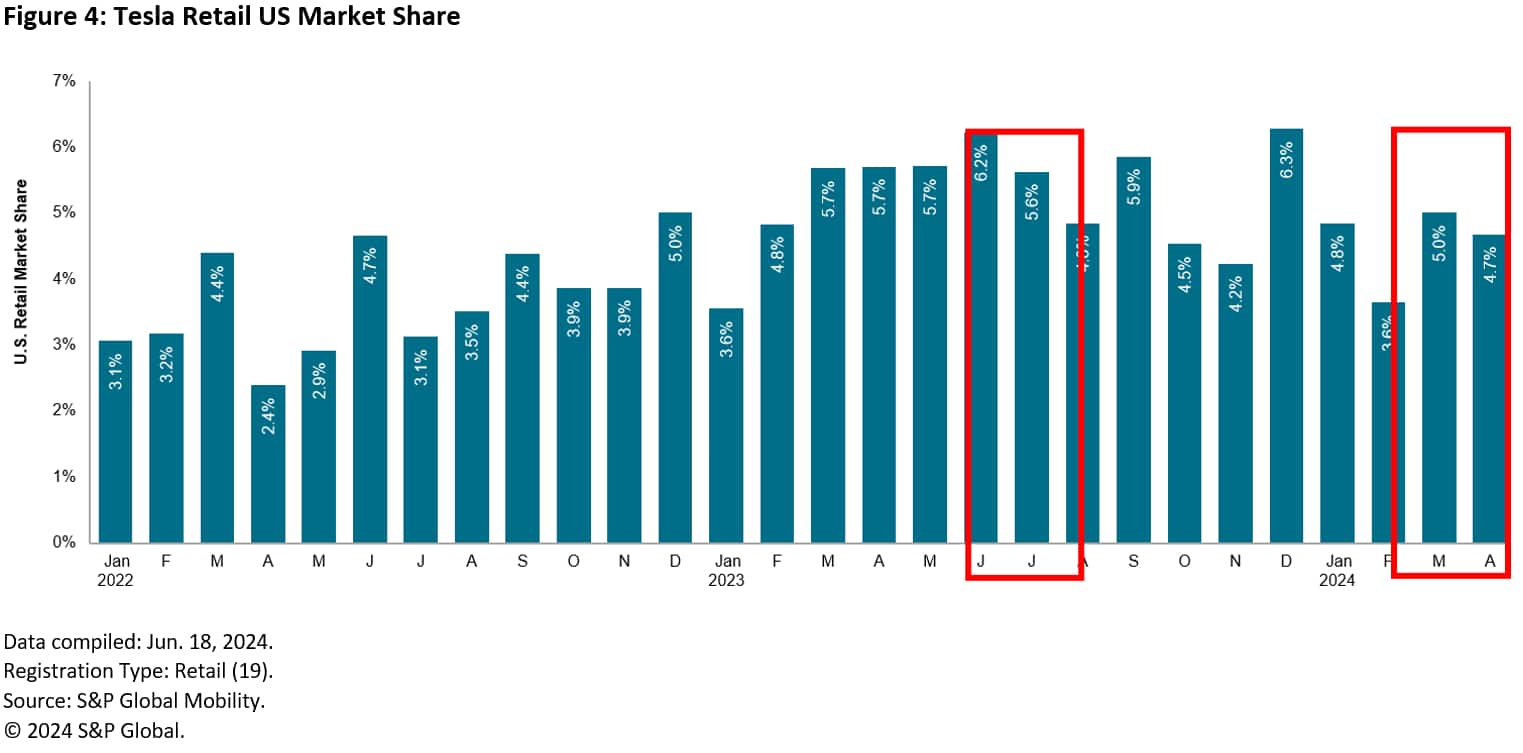

Predictably, Tesla's share of the US market declined in each of the three most recent months (versus a year ago), never exceeding 5% during this time period while exceeding that threshold in two of the three corresponding months a year ago.

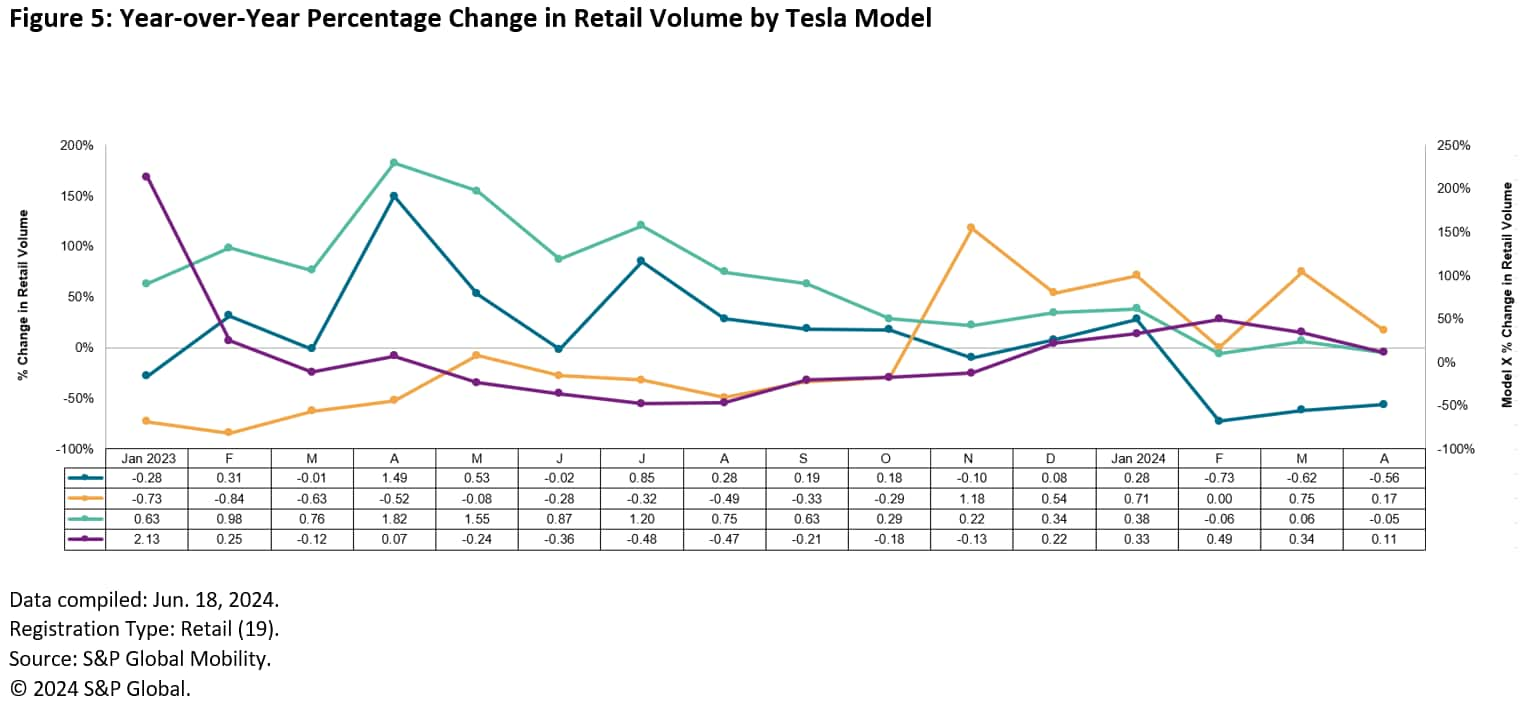

At the model level, sales of the Model 3 plummeted by more than half in each of the three most recent months, while the other three Tesla models had year-over-year gains or stayed even. Both the changeover to a new version and reduced IRA (Inflation Reduction Act) credits for the 2024 version have negatively impacted the Model 3's performance. With no registrations a year ago, the Cybertruck is not included in this analysis.

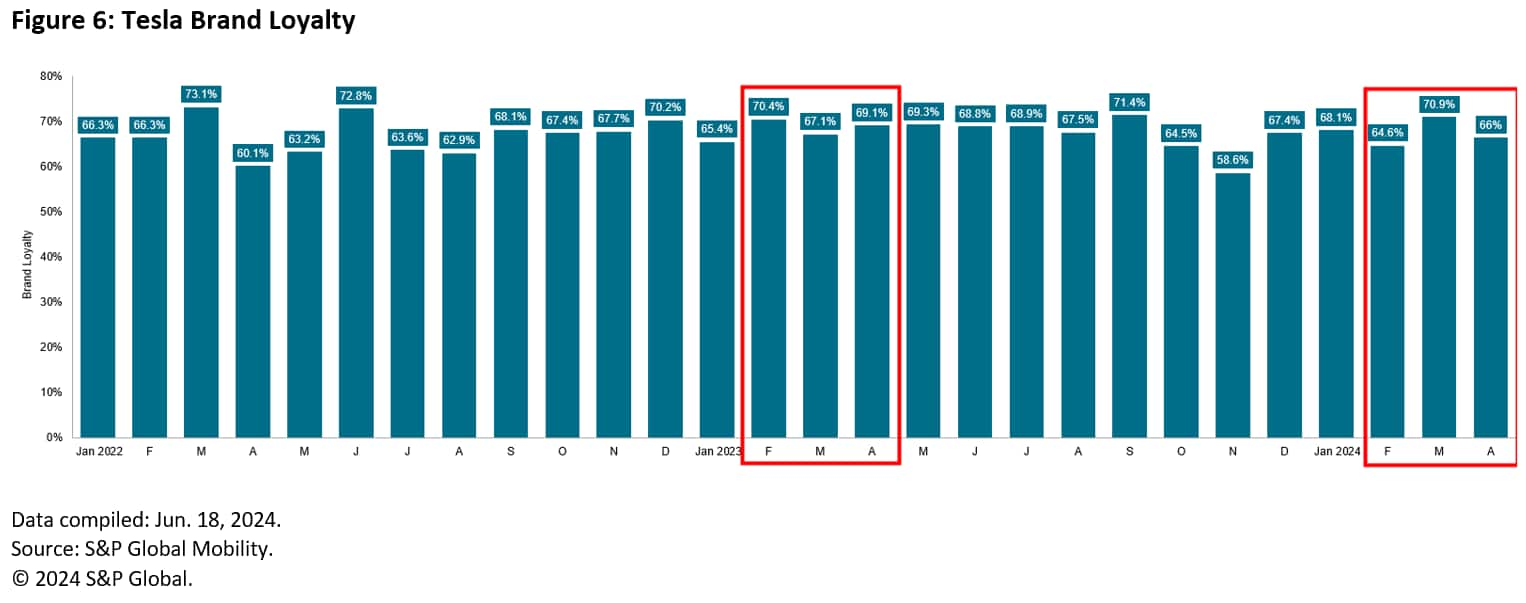

Tesla Brand Loyalty Remains Steady

Given Tesla's poor showing in each of the three most recent months, a decline in brand loyalty would make sense. But, as shown in Figure 6, Tesla's brand loyalty has only declined marginally since February.

Tesla brand loyalty remained relatively steady because return-to-market (RTM) Model 3 households, unable to get another one due to model changeover, migrated to the Model Y and thereby remained brand loyal. Given that the Y is a utility and the 3 a sedan, that migration pattern makes sense. This past February, more than 50% of RTM Model 3 households opted for a Model Y, the highest result for this pattern migration dating back to at least the beginning of 2022.

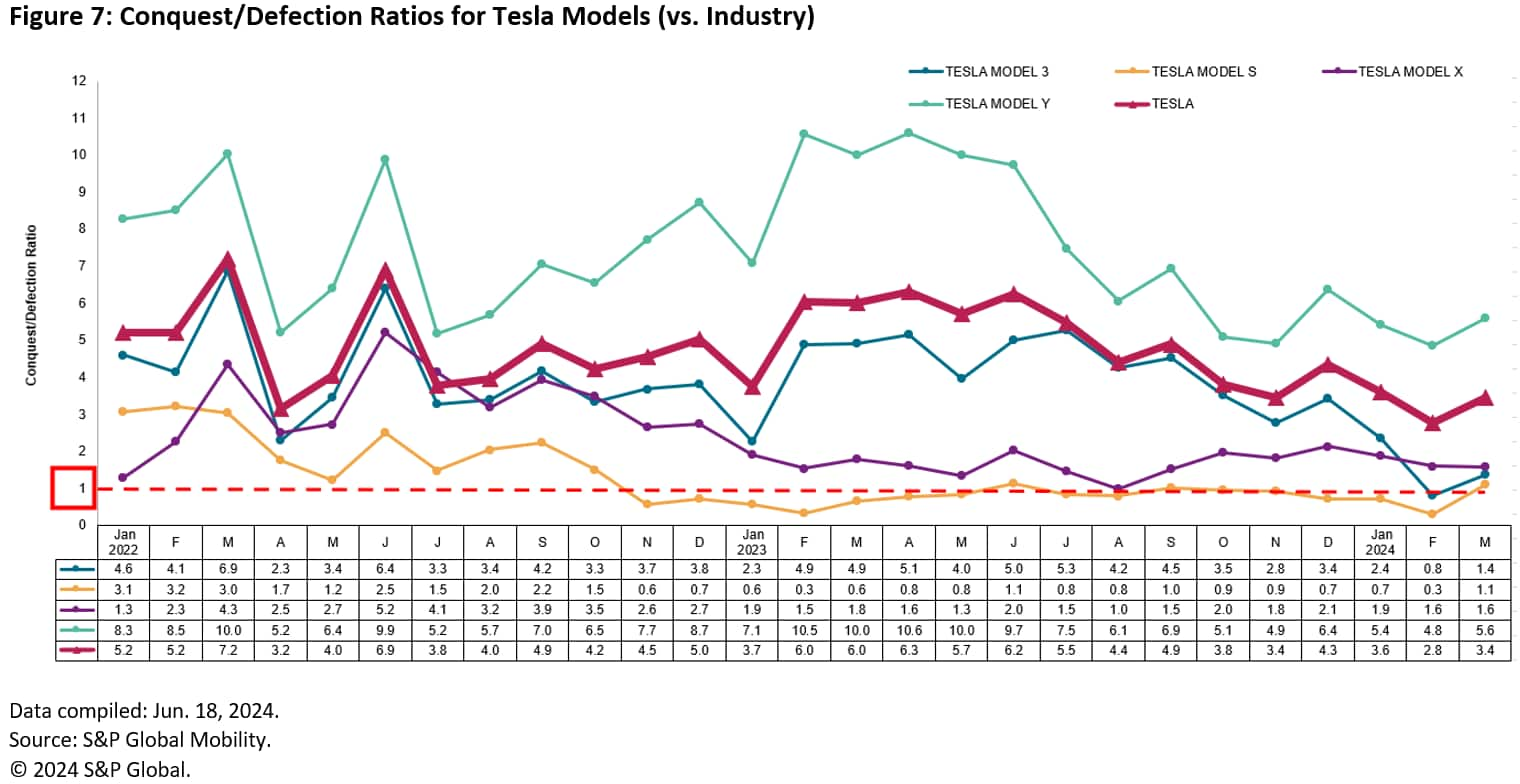

Model 3's reduced availability in the past several months not only caused owners to migrate to the Model Y, it also reduced the Model 3's ability to conquest competitive brand owners. Model 3's conquest/defection ratio with the rest of the industry plummeted at the start of this year when measured versus a year ago. This year's ratios of 2.4, .8 and 1.4 in January, February, and March, respectively, all are down significantly from 2.3, 4.9 and 4.9 a year ago.

Three takeaways from this review are:

- Loyalty, conquest, defection, and general migration patterns

frequently diverge from predictable ones during a build-out of one

model and launch of another.

- Tesla's continued influence on the entire US EV market is

illustrated by the fact that one Tesla model's atypical market

performance can influence not just Tesla but the entire US electric

vehicle market.

- By monitoring model and brand migration patterns on a weekly basis, a brand can quickly see changes in the marketplace and adjust marketing programs to mitigate unwanted results.

Try a demo of our loyalty analytics tool and access EV buyer audiences for your marketing campaigns.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fsurprising-trends-us-electric-vehicle-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fsurprising-trends-us-electric-vehicle-market.html&text=Surprising+Trends+in+the+US+Electric+Vehicle+Market+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fsurprising-trends-us-electric-vehicle-market.html","enabled":true},{"name":"email","url":"?subject=Surprising Trends in the US Electric Vehicle Market | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fsurprising-trends-us-electric-vehicle-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Surprising+Trends+in+the+US+Electric+Vehicle+Market+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fsurprising-trends-us-electric-vehicle-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}