Published August 2021

The rubber-processing, plastics, food and feed, and the fuel and lubricants industries are major consumers of antioxidants. Antioxidants are part of a company’s broader portfolio of additive products designed to serve specific end-use industries. Therefore, antioxidants do not really represent an industry but characterize one component of the larger chemical additives industry.

The principal chemical classes of antioxidants are amines, hindered phenols, phosphites, thioesters, and various natural or natural-based compounds. These chemicals are used primarily to inhibit the oxidative degradation of unsaturated organic materials, such as elastomers, plastics, petroleum-based fuels, and food or animal feed.

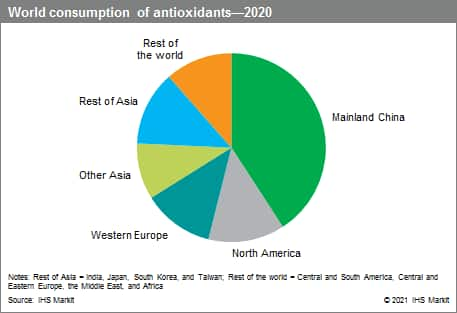

The following pie chart shows world consumption of antioxidants:

Antioxidant producers have been facing a significant shift of their customer base to Asia Pacific, particularly to mainland China. Meanwhile, market competition from mainland China is growing rapidly. To serve the growing global customer base, major antioxidant producers have been partnering with local companies to expand local production bases. Asia Pacific accounts for about 50–60% of the global production of antioxidants, mostly in mainland China, but also in India, Taiwan, and South Korea, as well as Japan.

In 2020, the global economy endured a deep recession as a result of the COVID-19 pandemic. Global real GDP fell an estimated 3.5% in 2020. The most severe downturns have occurred in India, Western Europe, Central and South America, and the Middle East. In response, the major economies have been deploying major fiscal and monetary stimuli. Recovery from the recession began in mid-2020 and global real GDP is projected to increase 6.0% in 2021. As vaccination rates increase and pandemic-related restrictions are lifted, consumer spending will surge and economies are predicted to return or continue to slowly return to historical growth patterns. On the other hand, COVID-19 virus flare-ups remain a risk to the economic outlook in regions where vaccination rates are lagging. Each region’s economic conditions are reflected in the consumption forecasts for that region. These forecasts reflect the authors’ chosen, cautious approach. Additional factors in this report’s forecasts include the migration of manufacturing from developed to developing economies and the uncertainty in energy prices. Each region’s economic conditions are reflected in the consumption forecasts for that region.

In 2020, rubber, latex, and elastomer applications accounted for 58% of total antioxidant consumption in the major regions, followed by plastics (34%), food and feed (4%), and petroleum fuels (2%) on a volume basis. Substantial differences in end-use distribution are apparent in the major regions, and end-use data are presented in the various regional sections of this report.

The five-year global consumption growth rate through 2025 is projected to be 3.5% per year. India is expected to grow the fastest, followed by Africa, Middle East, Central and Eastern Europe, and Other Asia. The remaining regions are expected to grow at a slower rate over the same period.

For more detailed information, see the table of contents, shown below.

S&P Global’s Specialty Chemicals Update Program –Antioxidants is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program –Antioxidants has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you:

- Identify the competitive environment and key players

- Assess key issues facing both suppliers and their end-use customers

- Understand industry integration strategies

- Keep abreast of industry structure changes, regulatory requirements, and other factors affecting profitability

- Identify new business opportunities and threats

- Follow important commercial developments

- Recognize trends and driving forces influencing specialty chemical markets