Published July 2022

This report focuses on the business of manufacturing and marketing chemicals that are used as ingredients in cosmetics and toiletry products. It excludes natural soaps (i.e., sodium or potassium tallowate or coconoate) as well as fillers and binders used in soaps. Ethanol (a large-volume solvent), fragrances, propellants, and dental polishing agents are also excluded.

The driving forces in the worldwide cosmetics industry include

- The growing consumer preference for natural, mild, and non-animal-based products

- Corporate and consumer interest in environmentally friendly, sustainably produced ingredients

- Strong interest in antiaging products, particularly in the developed world

- Growing demand for beauty products that are tailored to the needs of specific ethnic groups

- The increased use of personal care products by men

- The growing role of individual consumers and advocacy groups in discussions of ingredient safety

These issues have accounted for much of the recent new product development work and are likely to determine many of the future changes in the cosmetic chemical industry.

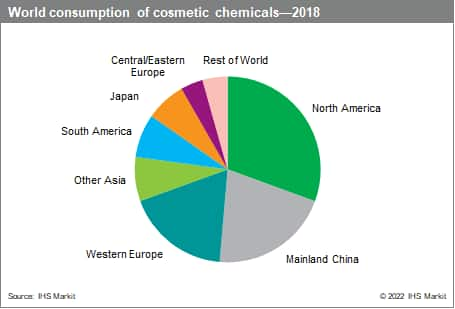

The following pie charts show consumption of cosmetic chemicals by region and type, based on value. July 2022 Cosmetic Chemicals Specialty Chemicals Update Prog

At present, North America consumes the largest volume of cosmetic ingredients. By 2023, however, China is expected to become the world’s largest cosmetic chemicals market. Growth rates for North America, Western Europe, and Japan are expected to range from 1% to 2%, while the market in China is expected to grow at an average annual rate of almost 8% during 2018–23.

Approximately 1,000–1,500 chemical entities are recognized as cosmetic chemicals worldwide. This report groups these compounds into the major categories shown above. Products within each functional category often compete with one another, regardless of chemical similarities. The single-use additives category includes antidandruff agents, antiperspirants and deodorants, hair conditioning polymers and silicone fluids, hair setting resins, and sunscreens.

The cosmetic chemicals industry is fragmented; hundreds of producers/suppliers provide the broad array of organic and inorganic chemicals that are the essential ingredients of cosmetics and toiletries. However, 20 or so major multinational companies control a substantial share of the cosmetic chemicals business. In most segments, between two and four companies dominate the market in a given geographical region. In North America and Western Europe, most cosmetic chemicals are sold directly to the cosmetics industry; a much smaller share is sold to distributors and small specialty formulators. In Japan, distributors and specialty formulators play a much larger role. In China, basic cosmetic chemical materials are sold directly from domestic chemical producers to cosmetic manufacturers, while the high-value-added materials are almost all imported from BASF, DSM, and others. The imported materials are all traded by distributors. In the past, cosmetic formulations had been developed by cosmetic owner companies. In recent years, ODM (original design manufacturing) cosmetic formulators have become a booming business in China, providing formulation design and cosmetic manufacturing services for cosmetic owner companies.

The growing need for higher-performance, higher-purity products and data documenting their safety and efficacy has improved the competitive position of the large multinational cosmetic chemical producers. These companies have greater resources available for R&D, technical service, and expensive, time-consuming health and safety tests. They can also use these resources to supply the large multinational cosmetic companies on a worldwide basis, further increasing their position as the leading suppliers to cosmetic companies.

Five major trends will shape the markets of the future:

- Population growth, resulting in more consumers

- Higher disposable income in the developing countries, resulting in more money to spend

- Increasing consumer awareness regarding wellness and health, resulting in more “actives”; more “mild” / “renewable” ingredients will be demanded

- Further market segregation: ethnic products, male grooming, silver agers, adolescents, resulting in new market opportunities

- Tightening of legislation concerning the safety of cosmetic chemicals, resulting in rising development costs for formulations as substances under scrutiny need to be replaced

Producers of cosmetic chemicals have already adapted to these trends with increased investment in developing countries, many of which also offer rich sources of natural products that can be used in cosmetics. This trend is bound to continue as local formulators in these growing markets need both cosmetic chemicals that are easily available and assistance in advanced formulation technologies.

Based on per capita spending, it is obvious that volume growth is to be expected in Asia and South America as well as in the Middle East and Africa. In the more mature markets, the volume (units sold) will stagnate, while the price per unit is bound to increase as more functionality is demanded by the consumer. This can be achieved only by the development of more sophisticated cosmetic chemicals and more complex formulations (at a higher price).