Published May 2022

High-performance anticorrosion coatings are used to protect metal and concrete structures, tanks, pipes, and processing equipment from deterioration caused by exposure to corrosive environments, including acid rain. These coatings are used chiefly in chemical plants, oil refineries, public utility works, pulp and paper mills, and other facilities; in addition, anticorrosion coatings are used to protect ships, offshore oil drilling rigs and production platforms, and other structures used in marine environments.

The same types of coatings tend to be used in each market, and tend to be based mainly on epoxy, urethane,ethyl silicate, and to a lesser extent, acrylic, vinyl, and chlorinated rubber binders. Epoxies account for around 40‒60% of the global market; these coatings are noted for very good chemical and abrasion resistance and for excellent adhesion. The percentage is higher for marine coatings than for protective coatings. Urethanes, accounting for 10‒15% of consumption, display excellent color and gloss retention, good abrasion resistance, and flexibility.

Alkyds are still favored by many contractors because of their easy applicability, and are sometimes used on structures that have limited remaining service lives. Good growth is expected for coatings that are based on waterborne acrylics, especially in the industrialized regions, as environmental regulations become more stringent.

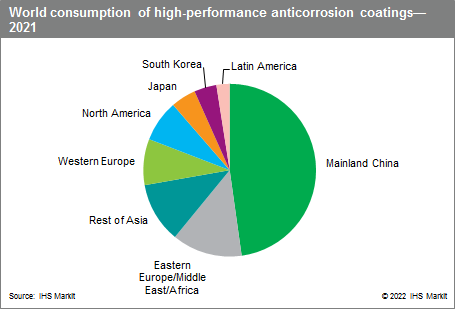

The following pie chart shows world consumption of high-performance anticorrosion coatings:

- Industrial maintenance or protective coatings applied to structures in the oil and gas, petrochemical, paper mill, and power generation industries, as well as to bridges and water and waste treatment plants.

- Marine coatings applied to commercial ships, including freight carriers, tows, cruise ships, yachts, and others.

Most of the current research effort in anticorrosion coatings is focused on the development of coatings that meet more stringent environmental standards dealing with emissions of volatile organic compounds (VOCs), especially in North America and Europe. Complying high-solids coatings, having at least 60% solids content, are already being used, primarily in the form of two-package epoxies and urethanes. The industry has been using additional quantities of solventless epoxies and urethanes. Complying waterbornes are also being developed, and interest in acrylic-based waterbornes has been growing rapidly. Both types of compliance coatings are more difficult to formulate and apply than conventional low-solids coatings. Other R&D projects are directed toward the following:

- Coatings for potable water supplies that must contain low levels of leachable toxic compounds.

- Ship bottom coatings for oceangoing vessels that limit the buildup of organisms on the hull but do not contain any biocide that presents potential hazards to the environment, and also decrease friction to improve fuel efficiency.

- Coatings that contain little or no toxic heavy metal pigment (lead- or chromate-based) or potentially hazardous organic solvent such as ethylene glycol–based ethers and esters, methyl ethyl ketone, methyl isobutyl ketone, toluene, xylenes, and chlorinated solvents.

- Coatings for concrete containment structures (such as those built around storage tanks) that resist migration of any spilled chemical into the concrete.

Most of the markets for industrial maintenance coatings should grow at moderate rates in the next five years in North America, Western Europe, and Japan. Some of the faster-growing segments in these regions will be the following:

- Water and wastewater treatment pipes and equipment.

- Intumescent coatings (thin-film decorative finishes that provide a degree of fire protection when exposed to high temperatures).

- Wind turbine coatings. Global wind farm capacity is forecast to grow strongly. Global offshore windmill capacity will grow even more strongly, which is driven primarily by new offshore wind projects in mainland China.

The global size of the anticorrosion coatings industry in 2021 represented a 10% share by value of the total 2021 coatings market. By volume, high-performance anticorrosion coatings represent a share of only 7%. The market is expected to grow at an average annual rate of 2.2%.

For more detailed information, see the table of contents, shown below.

S&P Global’s Specialty Chemicals Update Program –Coatings, High-Performance Anticorrosion is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program –Coatings, High-Performance Anticorrosion has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify the competitive environment and key players

- Assess key issues facing both suppliers and their end-use customers

- Understand industry integration strategies

- Keep abreast of industry structure changes, regulatory requirements, and other factors affecting profitability

- Identify new business opportunities and threats

- Follow important commercial developments