Published December 2021

Mining has been identified as one of the global megatrends that the industry is focusing on, since a growing world population and increasing wealth can be expected to result in an increasing need for raw materials to produce consumer goods, and to build infrastructure for housing and transportation. Mining chemical use can be expected to provide even stronger growth, since the industry is faced with lower grade ores that require larger amounts of chemical products in their processing. Increasing requirements for environmental and health protection in the industry also require increasing use of chemicals, i.e., in dust control, and the more efficient use of in many cases scarce water resources.

This report uses a functional classification of the major chemicals used in mineral processing operations that includes flotation reagents (e.g., frothers and collectors), flocculants, solvent extractants, rheology modifiers, and wet- and dry-grinding aids. These categories represent the largest and most important specialty chemicals used in mineral processing. Other specialty products are used, such as defoamers, corrosion inhibitors, antiscalants, biocides, dust suppressants, and others; however, their markets are relatively small in the mining industry, and are only briefly discussed. Commodity chemicals that are also used in large volumes in the mining industry (i.e., sodium cyanide and hydrogen peroxide, as well as explosives) are discussed in separate reports.

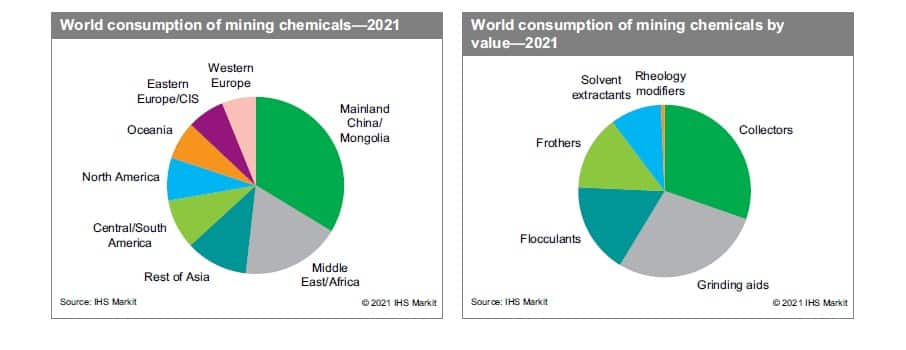

The following pie charts show world consumption of mining chemicals by region and by type:

The mining segment provides an interesting area for the chemical industry through acquisitions of chemical companies that are active in the area, but also through development of new products that help to improve the industry’s efficiency. The specialty mining chemical industry represents a significant volume and value. The dynamics of the industry may also play in disfavor of its players, that is, the cyclic nature of the world mining markets and prices, and the tendency to commoditization of specialty mining chemicals with increasing volumes. In addition, the mining chemical industry is undergoing a similar change to that of the oil field chemicals segment away from a focus on the sale of chemical product to the mine operator toward the sale of a service, including technical know-how, transportation, storage, and handling of the chemicals. Players need to closely follow these developments and to remain innovative in order to be successful in this market segment.

The mining chemicals industry has developed slowly over the past three years, with

- A slow increase in production volumes of essentially all minerals and mined raw materials

- Development that has differed substantially by world region

- Consumption of mining chemicals that has grown at higher rates than mining production on average

Lower-quality and more complex ore bodies are harder to process and require more complex processes which usually consume more mining chemicals per ore weight.

Mining chemicals are supplied by large global companies such as BASF, Solvay, Arkema, and Clariant, by more specialized globally active producers and distributors of mining chemicals such as SNF Flomin, Nasaco, and ArrMaz, and by regional and local producers and distributors. Distributors have increased their share in the large-volume mining chemicals market as a result of decreasing prices in this more-commoditized product segment, with product that is often imported from mainland China. Large global companies and specialized regional companies tend to withdraw from this market sector and focus on higher-cost product lines with more advanced chemistries.

Overall, the consumption of metals and other construction materials will continue to grow, in particular in developing world areas, and will result in increasing mining output and consumption of mining chemicals accordingly. Growth in mainland China, which was the main contributor to overall global growth for more than a decade, has slowed more recently, and despite increasing raw material consumption in other growth regions, such as India, Africa, and Central and South America, overall continuing slow growth is expected in the 2021– 26 forecast period.

The mining industry will continue to develop and invest in more sophisticated beneficiation solutions. The use of inappropriate and outdated technology destroys the inherent value of mining operations and reduces profitability. In the past few years, commodity prices have trended lower, and investment was directed toward more-efficient process technology and profitability of existing mines, rather than exploration of new mines. The need to meet increasingly stringent environmental criteria is another reason to expect investment in beneficiation technology—and mining chemicals accordingly—in the forecast period. Investment in more sophisticated and more expensive mining chemical solutions will not be straightforward, as the mining industry has become used to the opposite trend of commoditization and cheaper chemical prices.

For global companies able to offer a broad product line but subject to increasing global competition, success factors include the ability to offer dependable technical service, abandon unprofitable product lines on a timely basis, and contemplate joint venture, licensing, or reselling arrangements with low-cost suppliers, especially in less-developed countries. For companies specializing in a limited product line, success factors include the ability to customize products, emphasize performance rather than cost, and maintain unexcelled technical service. For regional suppliers, particularly in less-developed countries, success factors include the ability to gain access to technology at reasonable cost, and to exercise entrepreneurial skills with appropriate government support.

For more detailed information, see the table of contents, shown below

S&P Global’s Specialty Chemicals Update Program – Mining Chemicals is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program – Mining Chemicals has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify the competitive environment and key players

- Assess key issues facing both suppliers and their end-use customers

- Understand industry integration strategies

- Keep abreast of industry structure changes, regulatory requirements, and other factors affecting profitability

- Identify new business opportunities and threats

- Follow important commercial developments

- Recognize trends and driving forces influencing specialty chemical markets