Published August 2024

Specialty paper chemicals play a vital role in enhancing papermaking efficiency by reducing water and energy usage, promoting wastepaper recycling and conserving raw materials, all while maintaining paper quality. This report focuses on the diverse specialty chemicals consumed in the manufacturing of pulp and manufacture of paper. It excludes commodity chemicals — such as sodium hydroxide, sulfuric acid, chlorine dioxide, hydrogen peroxide, calcium carbonate and starches — and water treatment chemicals used in the paper industry. Specialty paper chemicals can be classified into three groups according to their function and point of use in the paper production process: functional chemicals, processing aids and pulp and fiber treatment chemicals.

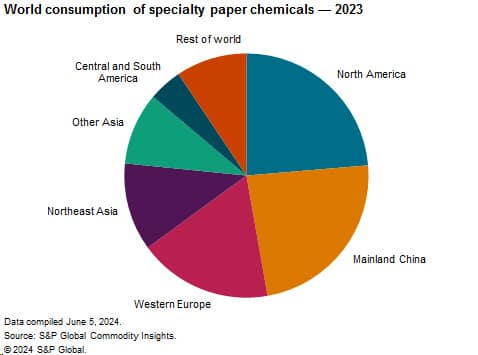

The following chart presents consumption of specialty paper chemicals by major region:

The consumption of specialty paper chemicals has remained relatively stable over the years, influenced by the shift from print to digital communication, which has reduced the demand for printing and writing papers. This shift has also led to the closure of smaller, less efficient paper mills. However, the demand for packaging and sanitary papers has grown, stabilizing the market. After a downturn in 2020 due to the COVID-19 pandemic, the market saw a recovery in the subsequent years, but faced a contraction in 2023, reverting to 2020 levels due to economic challenges such as high inflation and rising interest rates. The market is expected to grow modestly over the next five years, with packaging and tissue paper demand growing in line with GDP and population increases, while the demand for graphic paper continues to decline.

Regional consumption trends vary significantly, with mature markets like North America, Western Europe and Japan experiencing stagnation or decline, while emerging economies in South Asia and Southeast Asia are expected to see substantial growth. Despite its ongoing transition toward a slower growing economy, mainland China’s consumption is projected to exceed the average global growth rate.

For more detailed information, see the table of contents, shown below.

S&P Global’s Specialty Chemicals Update Program –Specialty Paper Chemicals is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program –Specialty Paper Chemicals has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade and economics.

This report can help you

- Identify the competitive environment and key players

- Assess key issues facing both suppliers and their end-use customers

- Understand industry integration strategies

- Keep abreast of industry structure changes, regulatory requirements and other factors affecting profitability

- Identify new business opportunities and threats

- Follow important commercial developments

- Recognize trends and driving forces influencing specialty chemical markets