Published April 2022

Textile chemical products range from highly specialized chemicals (biocides, flame retardants, water repellents, and warp sizes, for example) to relatively simple commodity chemicals (such as bleaches) or mixtures thereof (such as emulsified oils and greases, starch, sulfonated oils, waxes, and some surfactants). Several thousand textile chemical specialties are sold; many of them are quite similar and differ from one supplier to another merely in trade names and prices. Because of the nature of the chemicals involved, assessment of market sizes is very difficult and, at best, gives estimates based on published statistics on fibers and textile production and typical application levels required for specific process steps.

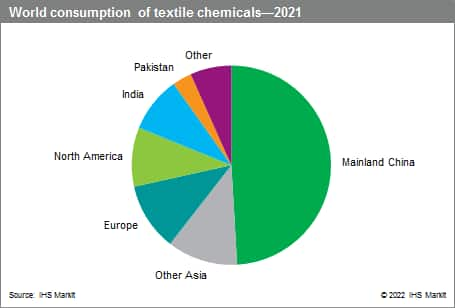

The following chart shows world consumption of textile chemicals on a value basis:

Mainland China was the largest consumer of textile chemicals, accounting for close to half of the global value in 2021. Although mainland China continues to be one of the fastest growing markets for textiles and chemicals in the world, the pace of growth is slowing. Mainland China became a leader in world apparel and home textile (towel and sheets) production because of its low-cost labor compared with other countries. However, rising labor costs are becoming a concern. In addition to escalating production costs, government regulations are impacting the volumes and types of chemicals that can be used in mainland China’s textile industry.

Textile production and chemical consumption have shifted to Asia and away from the traditional production centers of the United States, Western Europe, and Japan. These regions have suffered from the loss of their traditional export markets and major increases in imports, mainly from Asian countries. The only textile segments in the United States, Western Europe, and Japan that have remained unaffected by this geographic shift are the production of carpets, tire cord, technical textiles, and nonwoven fabrics.

India is trying hard to pursue mainland China, but its success will depend on how well marketing in export markets and production with low-cost labor can be linked. In the case of the developed regions, the keys to survival for the US, European, and Japanese textile industries are high-fashion apparel and interiors, carpet, and technical fibers.

In terms of product types, surfactants are the largest chemical category consumed in textile processing. Surfactants are used in many different functional textile formulations and operations as scouring agents, dyebath additives, and softeners. In 2021, surfactants accounted for close to 30% of the total global value of chemicals, followed by coatings and warp sizes.

For more detailed information, see the table of contents, shown below.

S&P Global’s Specialty Chemicals Update Program –Textile Chemicals is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program –Textile Chemicals has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you:

- Identify the competitive environment and key players

- Assess key issues facing both suppliers and their end-use customers

- Understand industry integration strategies

- Keep abreast of industry structure changes, regulatory requirements, and other factors affecting profitability

- Identify new business opportunities and threats

- Follow important commercial developments

- Recognize trends and driving forces influencing specialty chemical markets