Published December 2023

Displays have become an essential part of both the professional and private lives of human beings all over the world. They are present in TVs, computers, mobile phones, automobiles and many other devices. In the last three decades, huge technological transformations have taken place. Flat-panel displays (FPD) have completely replaced cathode-ray tubes that had dominated the market during half a century.

This report covers the specialty chemicals and materials consumed in the production of flat panel displays. These include substrates, optical and functional films, liquid crystals, OLED materials, color filter resists, electrode materials and processing chemicals. The latter category includes photoresists, gases and wet-processing chemicals.

In 2022, consumption of optical and functional films accounted for the largest share of display materials market value, followed by substrates, processing chemicals, electrode materials, color filter resists, OLED materials and liquid crystals.

FPD technologies undergo fast transformations, driven by very dynamic consumer electronic markets, which are characterized by short product lifecycles. The rapid development of smartphones in the 2010s and the rapid progresses in high-resolution TV panels have boosted consumer demand growth for flat-panel displays. This strong demand growth and technological transformations have required many investments in production capacities for LCD and OLED panels. Virtually all these capacities were built in Northeast Asia, mainly in South Korea, Taiwan and mainland China.

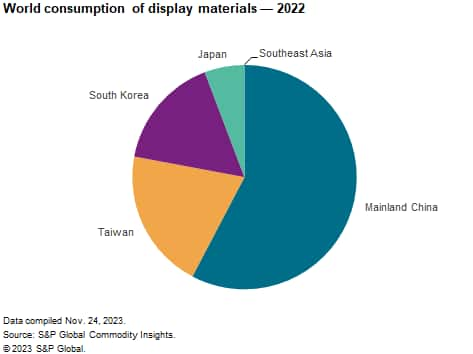

The following pie chart shows world consumption of display materials:

Innovations in materials technologies have enabled the development of more energy-efficient LCD and OLED display panels with higher contrast, resolution and brightness. Displays have also become thinner and larger in the past 20 years. Those breakthroughs were made possible by the development of better-performing liquid crystals, OLED materials, optical films, color filter resists and substrates at many display materials manufacturers. Many chemical producers are still carrying out research and development on materials for future flat-panel displays will offer lower power consumption and better image quality, as well as for new applications such as transparent or flexible displays.

Because of their lower power consumption and better image, OLED displays have gained significant market share in the last decade. In the last five years, display chemicals producers have focused their R&D efforts and investments on products for OLED displays, especially on more efficient emitting materials. Therefore, consumption of display materials for OLED displays has been growing at a higher rate than for LCDs, and this trend will continue in the future.

For more detailed information, see the table of contents, shown below.

S&P Global’s Specialty Chemicals Update Program –Electronic Chemicals — Display Materials is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program –Electronic Chemicals — Display Materials has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade and economics.

This report can help you:

- Identify the competitive environment and key players

- Assess key issues facing both suppliers and their end-use customers

- Understand industry integration strategies

- Keep abreast of industry structure changes, regulatory requirements, and other factors affecting profitability

- Identify new business opportunities and threats

- Follow important commercial developments

- Recognize trends and driving forces influencing specialty chemical markets