Published December 2023

The electronics industry uses a broad range of highly sophisticated specialty chemicals in many processing steps in the manufacture of electronic components and products, including silicon wafers and integrated circuits, for packaging and printed circuit boards (PCBs), in the manufacture of compound semiconductors and optoelectronics, and in the production of flat panel display products. This report covers the major specialty chemicals consumed in the production of integrated circuits or silicon chips, including silicon wafers, atmospheric and specialty gases, photoresists, ancillary chemicals, wet-processing chemicals, CMP slurries, thin film metals, copper plating chemicals, and new chemicals and precursor materials for low-k and high-k dielectrics.

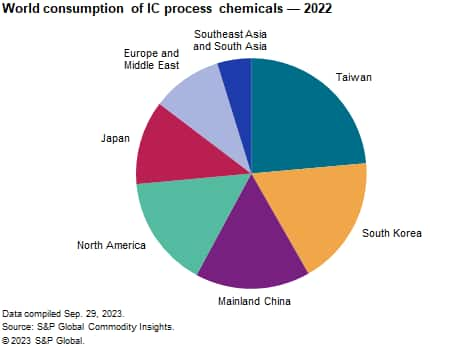

In 2022, consumption of silicon wafers accounted for the largest share of total electronic chemicals consumption, followed by atmospheric and specialty gases, wet-processing chemicals, CMP slurries and pads, photoresist ancillary chemicals, photoresists, thin film metals and others. In 2022, the largest IC process chemical–consuming region was Taiwan, followed by South Korea, mainland China, the United States, Japan, Europe, the Middle East, and Southeast Asia and South Asia.

The following pie chart shows world consumption of IC process chemicals:

In 2000, about three-quarters of the world market for electronic chemicals was concentrated in the United States, Western Europe and Japan. This dominance rapidly eroded as other Asian nations emerged as producing regions, claiming a share of about 61% of world consumption of IC process chemicals in 2022. This trend was fueled by the growing global consumer electronics market, the growing consumer electronics production industry in Asia, and a strategy change of US, European and Japanese integrated device manufacturers that turned to asset-light or fabless strategies and outsourced production to foundries in Taiwan, South Korea, mainland China and Singapore.

Global consumption of IC process chemicals follows directly the growth of the semiconductor industry. Demand for semiconductors will be powered by the following technology trends:

- Digitalization of industry and services

- Rapid development of artificial intelligence (AI) will drive consumption of most advanced logic and memory chips

- 5th-generation (5G) mobile network. This global standard for high-speed wireless connectivity enables faster communication between computers, smartphones, automobiles, industrial machines and home appliances, known as Internet of Things (IoT).

- Automotive industry consumes more and more semiconductor devices: for assistance and entertainment systems, to improve engine efficiency and to improve performance of electric vehicles (longer range, faster charging, etc.).

In addition to the above technology drivers, consumption growth of IC processing chemicals will be directly driven by the construction of numerous new semiconductor fabs all over the world. Because modern chip fabs require huge investments, they are often supported by government policies such as the US CHIPS and Science Act, and the European Chips Act. This governmental support has gained importance since the major global semiconductors supply shortage in 2021 and 2022.

For more detailed information, please see the table of contents listed below.

S&P Global’s Specialty Chemicals Update Program –Electronic Chemicals—Semiconductors, Silicon, and IC Process Chemicals is the comprehensive and trusted guide for anyone seeking information into this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program –Electronic Chemicals—Semiconductors, Silicon, and IC Process Chemicals has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you:

- Identify the competitive environment and key players

- Assess key issues facing both suppliers and their end-use customers

- Understand industry integration strategies

- Keep abreast of industry structure changes, regulatory requirements, and other factors affecting profitability

- Identify new business opportunities and threats

- Follow important commercial developments

- Recognize trends and driving forces influencing specialty chemical markets