Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 01, 2017

Global manufacturing sees strong start to Q3, though output growth slows

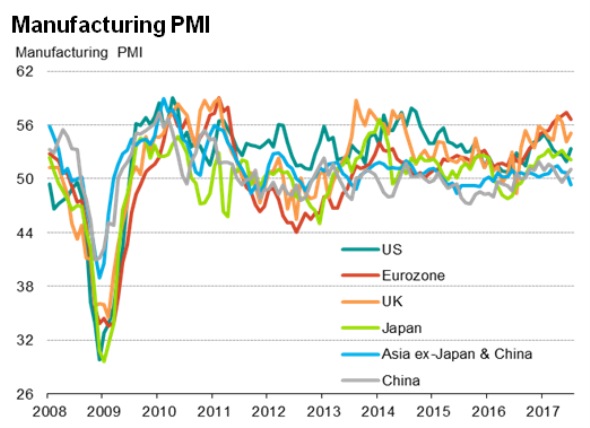

The global manufacturing economy reported a sustained improvement in business conditions in July, with growth once again led by European countries as Asia struggled.

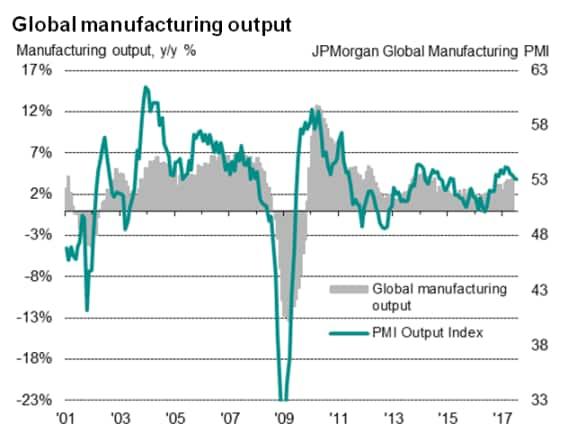

The headline JPMorgan Global Manufacturing PMI, compiled by IHS Markit, was largely unchanged at 52.7 in July compared to 52.6 in June. The latest reading indicates that the overall health of the manufacturing economy continued to improve at the start of the third quarter at a similar rate to those seen in both the first and second quarters.

The global output index fell slightly for a fourth successive month, indicating that production growth has cooled further across the world's factories to reach a ten-month low. However, the rate of increase of new orders perked up from June's seven-month low, to suggest that production growth could revive again in August.

Employment continued to rise at a steady rate, with hiring promoted by a further build-up of uncompleted orders. Rates of increase of both were largely unchanged on prior months, underscoring the picture of ongoing steady expansion.

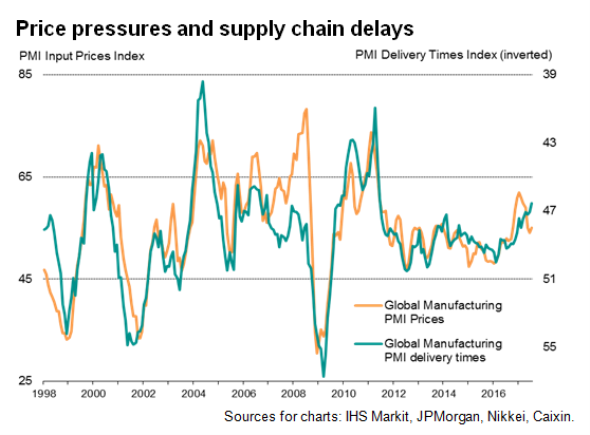

Supply chain delays push up prices

A consequence of the sustained steady expansion so far this year has been the stretching of supplier lead times. Delays in the delivery of goods to manufacturers in July were the most widespread for over six years as demand increasingly outstripped supply. Prices often rose as a result, pushing the overall global rate of input cost inflation higher for the first time in six months, although remaining well below January's peak.

Average selling price inflation meanwhile picked up marginally for a second month running, albeit likewise remaining below the peaks seen at the turn of the year.

The rise in capacity constraints signalled by the higher incidence of supplier delays nevertheless suggests that upward price pressures could intensify in coming months.

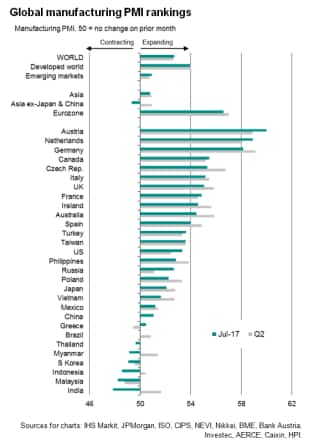

Europe leads, thanks to stronger exports

European countries, clustered around Germany, continued to dominate the manufacturing PMI rankings in July. The fastest growth was seen in Austria, followed by the Netherlands and then Germany. Six of the top ten performing manufacturing economies were in fact found in the eurozone, helping sustain the region's strongest growth spell for six years.

Canada was the strongest growing non-euro country, followed by the Czech Republic.

Much of the recent success of the fastest expanding countries can be linked to an outperformance in terms of exports, a surge in orders for which also helped propel the UK to seventh place in the global PMI rankings. Germany saw the fastest export order growth of all countries surveyed, closely followed by the UK.

The US sat in fourteenth place in the headline PMI rankings, stymied by lacklustre exports. US goods exports in fact slipped back into modest decline in July, one of only seven countries to see exports fall at the start of the third quarter.

Only six of the 29 countries saw manufacturing business conditions decline, all of which were found in Asia. India and Malaysia saw the sharpest declines, the former hit by the country's new sales tax. Brighter news came out of China, where the Caixin PMI signalled the strongest expansion since March. Japan's upturn slowed, but its expansion at least contrasted with the downturn seen across Asia ex-Japan and China as a whole, which suffered the first decline in activity for nearly one-and-a-half years.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01082017-Economics-Global-manufacturing-sees-strong-start-to-Q3-though-output-growth-slows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01082017-Economics-Global-manufacturing-sees-strong-start-to-Q3-though-output-growth-slows.html&text=Global+manufacturing+sees+strong+start+to+Q3%2c+though+output+growth+slows","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01082017-Economics-Global-manufacturing-sees-strong-start-to-Q3-though-output-growth-slows.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing sees strong start to Q3, though output growth slows&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01082017-Economics-Global-manufacturing-sees-strong-start-to-Q3-though-output-growth-slows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+sees+strong+start+to+Q3%2c+though+output+growth+slows http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01082017-Economics-Global-manufacturing-sees-strong-start-to-Q3-though-output-growth-slows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}