Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 20, 2024

Auto Lease Returns Projected to Drop in 2025: What OEMs, Dealers, and Lenders Need to Know

By Julie Knakal, Executive Director, Data and Content Management, and Alex Vinatrou, Senior Data Analyst, S&P Global Mobility

As we approach the first half of 2025 (H1 2025), a seismic shift is looming over the automotive market. We expect auto lease returns to plummet compared to the previous year, potentially wiping out a significant number of units from the industry.

The pressure is on for dealers and automotive lenders, but with the right strategies, there's a silver lining. Read on to discover what's driving these changes, why it matters and how your business can turn this challenge into an opportunity.

A Major Drop in Auto Lease Returns: What the Data Shows

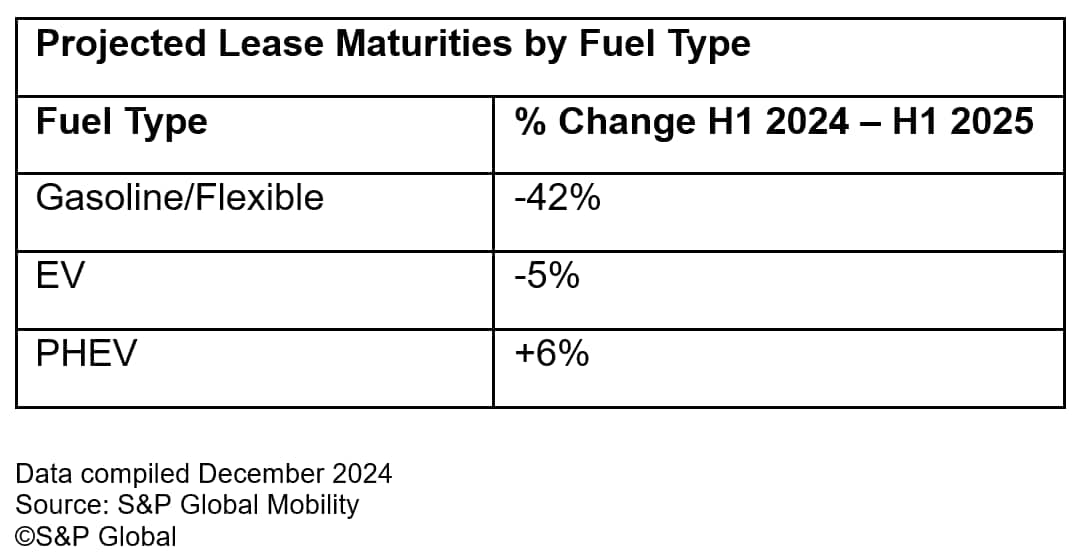

In H1 2025, we project lease maturities to fall by 41% compared to the same period in 2024. This significant decline could translate into a hit of nearly 1 million vehicles to the industry.

The premium market will take the hardest hit, with an expected 46% drop in lease returns. We expect mainstream segments to experience a decline of 39%. Most major vehicle brands will see decreases, but the range is wide—from a modest 11% drop to a staggering 81% reduction in lease returns for some major players.

What is Causing the Decline in Projected Auto Lease Returns?

The reasons behind this shift largely stem from a change in consumer behavior in response to the market conditions two to three years ago.

There are a few key factors that influenced those decisions:

- Inventory shortages and pricing: The primary lease term driving this decline is 36 months, so we need to consider what was happening in 2022. Low inventory in H1 2022 pushed OEMs and lenders to reduce their customer and dealer incentives, with the biggest impact on leases. This contributed to an average 10% rise in lease payments as a percentage of MSRP from 2019 to 2022. On the other hand, finance payments as a percentage of MSRP held steady. In part because of this differential, returning lessees in H1 2022 who opted to replace their outgoing leases often chose to finance their new vehicles instead.

- Longer loan terms: In H1 2022, the share of lessees who returned to the new vehicle market and leased a new vehicle was 64%—an eight percentage-point drop from H1 2020 and H1 2021. Thirty percent of lessees who returned to the market in H1 2022 financed their new vehicle—up from the typical 24% share. Of lessees who came out of a 36-month lease and chose to finance instead, many opted for longer loan terms: While 22.5% chose a 60-month loan, 45.2% opted for the longer terms of 72-months and 17.6% for 84-month terms.

Steps the Industry Can Take to Encourage Leasing inH1 2025

The challenge in H1 2025 remains: how do we get consumers to switch back to leasing? The good news is that the industry has levers to pull, and lease payments as a percentage of MSRP dropped in 2024.

- Adjust incentives: OEMs and lenders will need to get creative to encourage returning lessees to opt for leases again. Increasing incentives, particularly in the premium segment, will be key to making leases more appealing as the market shifts.

- Target specific states: More than 50% of projected lease maturities are concentrated in just five states, ranging from a 24% drop in returns in Michigan to a 49% drop in California. Tailoring strategies to these states could help dealers and lenders better manage the decline in lease maturities.

- Capture consumers who favor leasing: Many consumers prefer to lease because it allows them to drive a new vehicle every few years, ensuring they stay within warranty and enjoy the latest technology. Dealers and lenders should target these customers to ensure they remain loyal to leasing.

Looking Beyond 2025: A Path Toward Stability

Although the challenges of H1 2025 will be significant, there is light at the end of the tunnel. By H1 2026, the market should begin to stabilize, and we should see more meaningful improvement in H1 2027, with growth due to a 21% increase in 36-month lease volume in H1 2024.

That growth could increase to roughly 30 percent if recent trends in lease volume continue, as 24-month leases that go out the door in H1 2025 will begin returning in H1 2027. There is potential for additional upside in H1 2027 and H1 2028 if OEMs can successfully convert customers who have switched to financing back into leasing. Even so, we expect total lease maturities in future years to remain well below the higher levels seen from 2021 to 2024.

How Dealers and Lenders Can Prepare

- Promote lease return programs: To mitigate the impact of declining lease returns, dealers and lenders need to actively promote their lease return programs. This includes reaching out to consumers before their leases are up and providing them with clear incentives to lease again.

- Focus on customer education: Many consumers may not be fully aware of their equity position or the benefits of leasing. Dealers should focus on educating their customers about the value of leasing and how it aligns with their needs for lower payments, newer vehicles and warranty coverage.

- Leverage data to target potential lessees: Data analytics will be essential to identify lessees who are most likely to return to the leasing market. Dealers can use this data to target their outreach efforts and create tailored offers that appeal to these potential customers.

- Offer creative financing and leasing options: As vehicle prices remain high, offering flexible financing and leasing options could be crucial to convince consumers to stick with or return to leasing. Programs that make payments more manageable, like deferred payments or trade-in programs, will be essential.

Conclusion

The first half of 2025 presents not only a significant challenge for car dealers and automotive lenders but also an opportunity to adapt to changing consumer behavior. By understanding the factors driving the decline in lease returns and taking proactive steps to attract lessees back to the market, dealerships and lenders can position themselves for success as the market begins its recovery in the coming years.

AutoCreditInsight - offered in partnership with TransUnion - provides clients24/7 access to vehicle registrations and return-to-market volumes by month with depersonalized loan and credit information.

Learn More About AutoCreditInsight

Market Scan providesOEMs with fast, competitive payment analysis across vehicles, helping you to optimize your incentives and sales strategies to match your competition.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fauto-lease-returns-projected-to-drop-in-2025-what-oems-dealers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fauto-lease-returns-projected-to-drop-in-2025-what-oems-dealers.html&text=Auto+Lease+Returns+Projected+to+Drop+in+2025%3a+What+OEMs%2c+Dealers%2c+and+Lenders+Need+to+Know+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fauto-lease-returns-projected-to-drop-in-2025-what-oems-dealers.html","enabled":true},{"name":"email","url":"?subject=Auto Lease Returns Projected to Drop in 2025: What OEMs, Dealers, and Lenders Need to Know | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fauto-lease-returns-projected-to-drop-in-2025-what-oems-dealers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Auto+Lease+Returns+Projected+to+Drop+in+2025%3a+What+OEMs%2c+Dealers%2c+and+Lenders+Need+to+Know+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fauto-lease-returns-projected-to-drop-in-2025-what-oems-dealers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}