Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsAutomotive Inventory

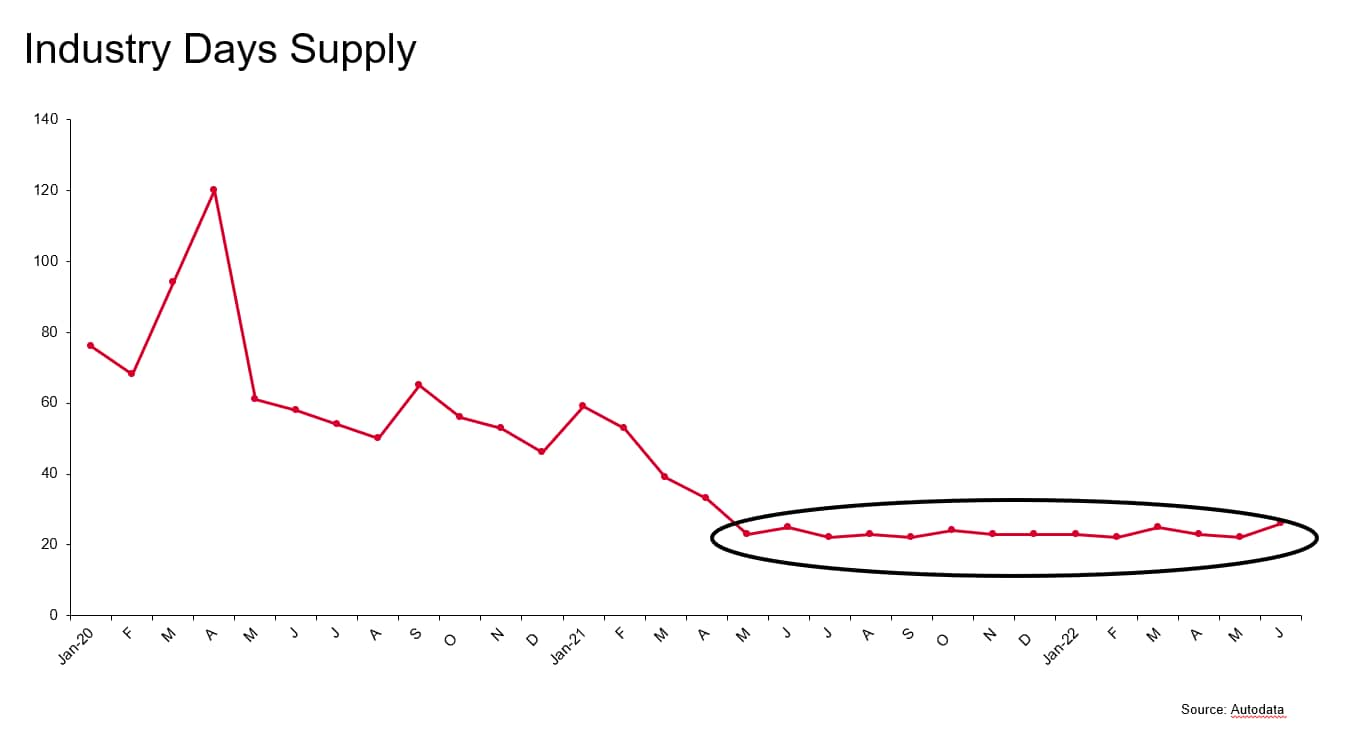

With June 2022 industry 'number of days supply' coming in at 26 days, the automotive industry now has experienced an unprecedented 14 consecutive months of inventories below a 30-day supply. "Normal" inventories are usually in the 55-65 days range, so a drop below 30 days for just one month would be extraordinary. For such a shortage to continue for over a year is unheard of.

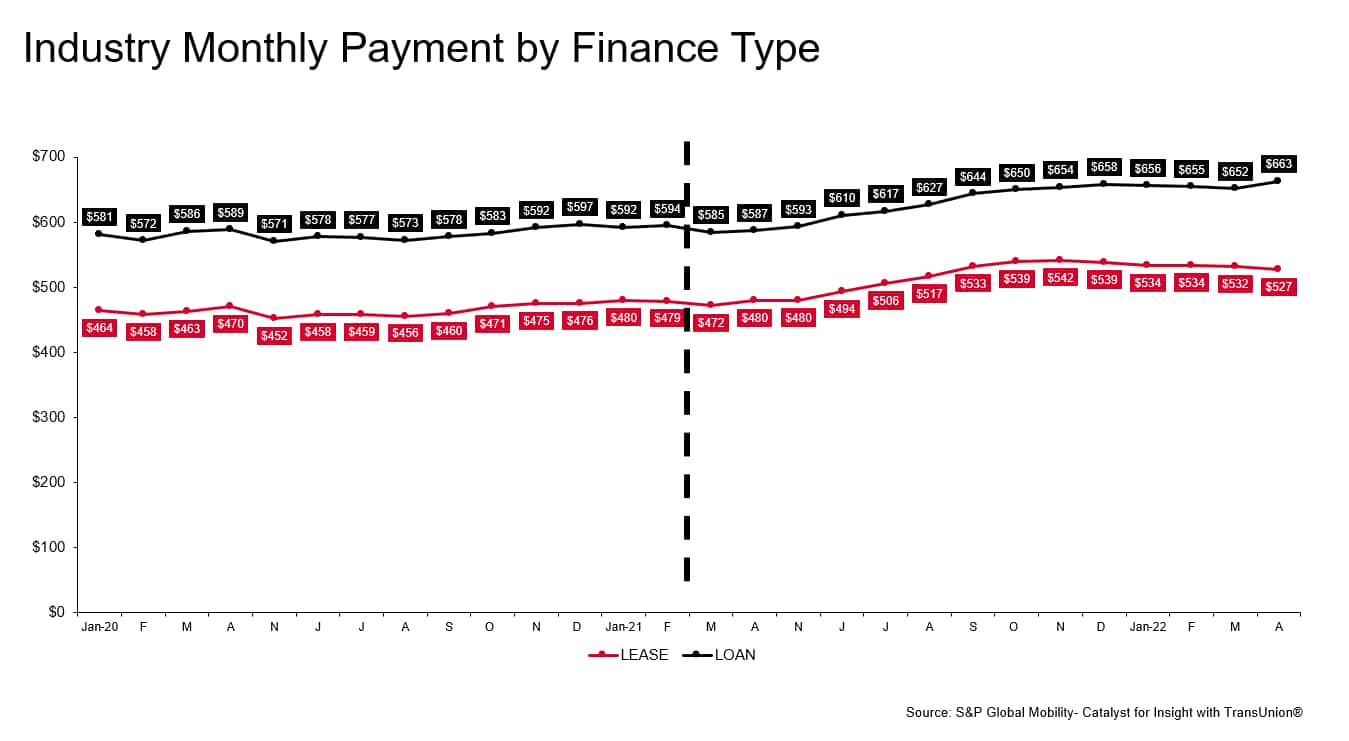

Predictably, as the automotive inventory began to shrink, leverage shifted towards the sellers, including brands and dealers. Both these constituencies have taken advantage of the suppy and demand for vehicles imbalance to raise prices for both financed and leased vehicles. Resulting monthly vehicle loan payment on average have surged 8.5% in the last 14 months when compared to those in the previous 14 months, while vehicle lease payments have climbed 11% over the same time. The average April 2022 new vehicle monthly loan payment of $663 is the highest of any month dating back to (at least) the start of January 2020. While the April monthly vehicle lease payments of $527 is down from its November 2021 peak of $542, the 14-month average, as mentioned, remains elevated.

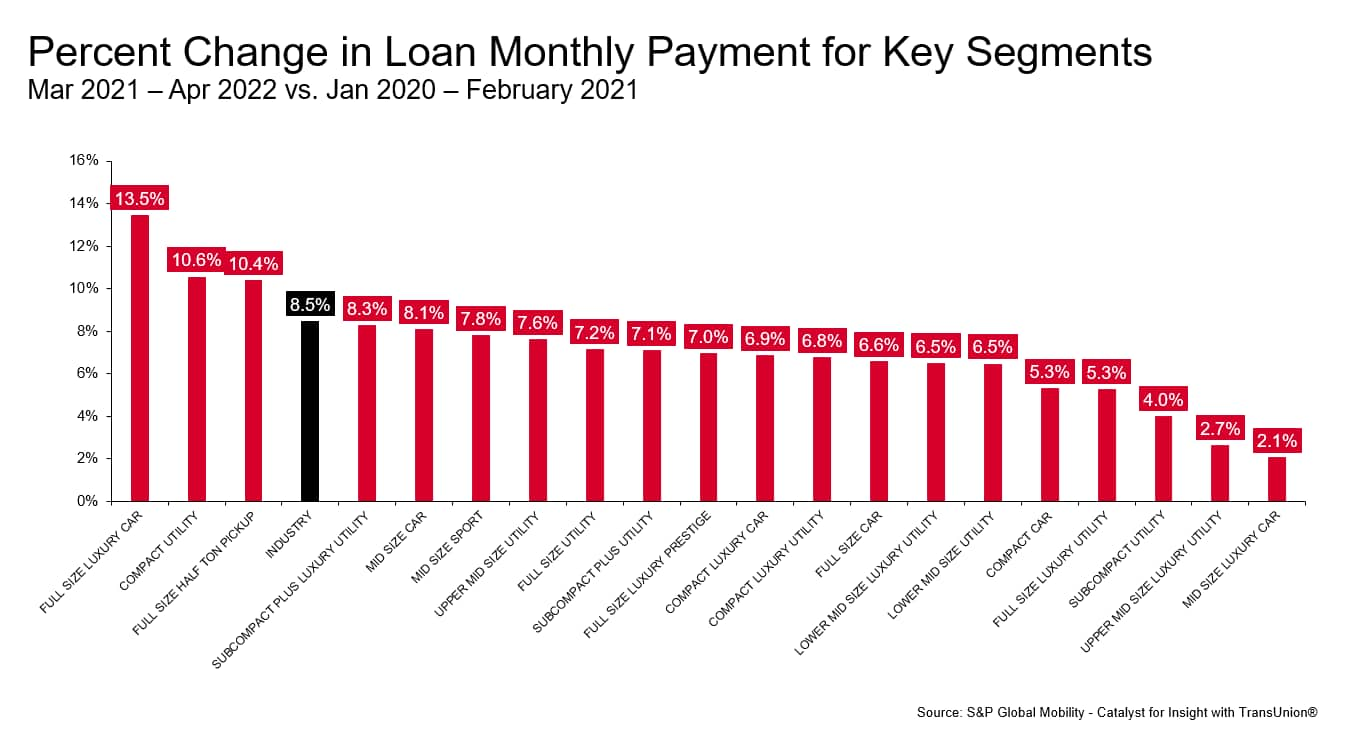

The Full-Size Luxury Car Segment's 13.5% monthly payment increase among owners surpasses that of any other segment and is 5 percentage points higher than the industry-wide jump (see chart below). The average Compact Utility Segment loan monthly payment ranks second with a 10.6% increase, followed by the Full-Size Half Ton Pickup Segment.

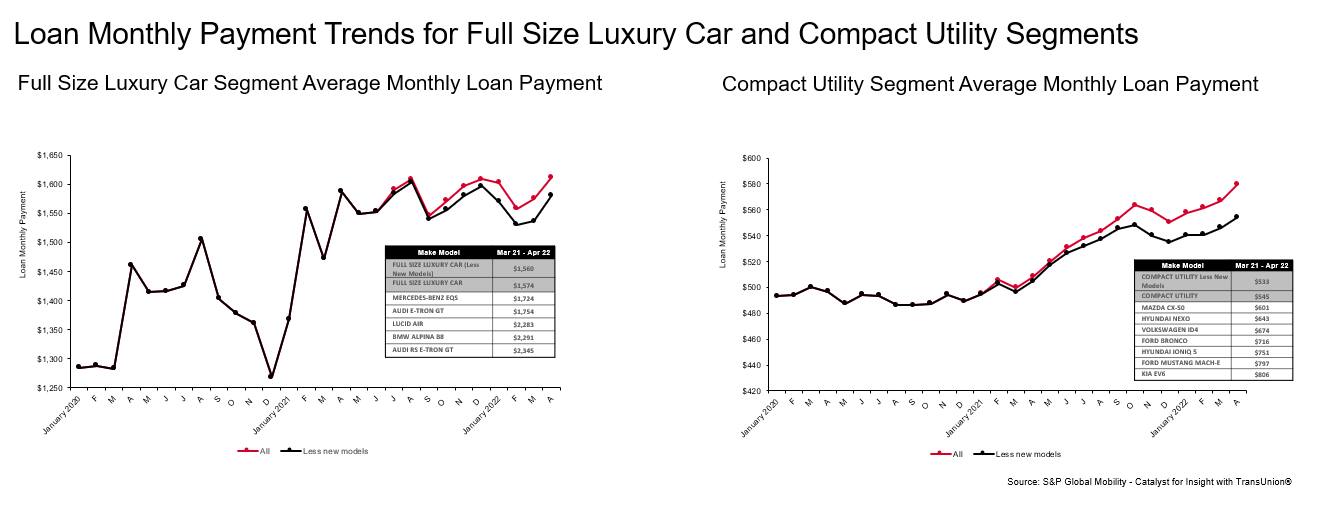

As the model-level data below illustrate, though, these averages mask noteworthy model-level dynamics. Specifically, the averages are pulled up by the recent introduction of several new, high-priced (and frequently EV) models in each of these two segments. When these recent entries are removed, the segment increases are more modest.

Going forward, as more electric vehicles are launched, we are likely to see their price points continue to pull up segment averages.

Sources: S&P Global Mobility - Catalyst for Insight with TransUnion, Autodata (days supply)

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.