Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 28, 2024

BriefCASE: Climate politics - France's carbon footprint incentive stirs debate on global EV supply chains

The French government launched a program earlier this year to promote electric car adoption among low-income households, but the overwhelming response exceeded supply. The program offered leasing options and subsidies, contributing to increased electric vehicle sales. The program includes a carbon footprint incentive penalizing batteries produced in countries with carbon-intensive grids.

The original initiative offered leasing options for 25,000 European-manufactured EVs at a monthly rate of €100-€150, without a deposit. However, the response was overwhelming, with 90,000 applications received within weeks, surpassing the available supply.

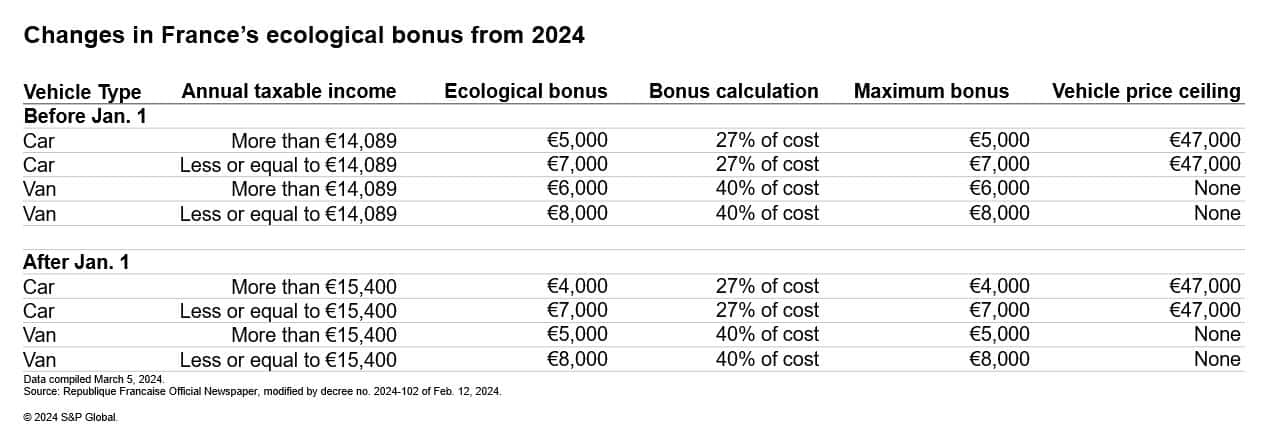

The program aimed to make EVs more accessible by providing subsidies of up to €13,000 per qualifying EV and affordable leasing options. Eligibility criteria included a maximum taxable household income of €15,400 per person and a retail price limit of €47,000.

Initially, the government allocated €1.5 billion for 20,000 leases, but owing to the high demand, it increased the number to 50,000. However, officials halted the scheme in 2024 with expectations that it will resume in 2025.

The program is an extension of France's "bonus ecologique" and has contributed to a huge increase in EV sales in the country. The government has since announced a 20% reduction in subsidies for higher-income car buyers of electric and hybrid vehicles, aiming to prevent budget overruns. This decision has raised concerns about potential declines in registrations, similar to what happened in Germany.

Although the ecological bonus has been instrumental in boosting EV sales, the recent subsidy cut has sparked opposition from some calling for the need for elected officials to prioritize the ecological transition.

Ali Adim, senior research analyst for batteries at S&P Global Mobility, said: "One of the innovative features of the ecological bonus is its consideration of the carbon footprint of vehicle components, such as batteries. This incentive not only targets the curtailment of tailpipe emissions by promoting EVs, but it also aims to lower emissions during the production phase. EVs are associated with significantly higher production emissions than internal combustion engine (ICE) cars due to their heavy and carbon-intensive battery packs. The new incentive mechanism in France directly addresses this gap and could serve as a role model for future legislation in other countries and regions. Applying a carbon footprint threshold to EV components (batteries) could have several implications. Batteries produced in countries with more carbon-intensive grids will be penalized. As a result, all Chinese vehicle models were disqualified for the eco-bonus last year."

S&P Global Mobility's Battery Carbon Footprint forecast shows that the average carbon footprint of batteries produced in China in 2023 was 72 kgCO2-eq/kWh, higher than Europe's 51 kgCO2-eq/kWh.

Diana Quezada, senior research analyst for EV charging at S&P Global Mobility, agrees that the government's incentives have been key in encouraging the installation of EV chargers, given their initial low return on investment to the charge point operators. "However, this will change with the increasing mass adoption of EVs in France, which is driven by the growth in the EV charging network across the country. To this end, the French government's Advenir program remains strategically important as it targets companies and communities keen on investing in EV charging infrastructure, especially the publicly available EV chargers installed on the roads."

Author:

Amit Panday - Senior Research Analyst, Supply Chain &

Technology, S&P Global Mobility

To read our detailed insight on the France EV policy for 2024, click here.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbriefcase-climate-politics-frances-carbon-footprint-incentive.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbriefcase-climate-politics-frances-carbon-footprint-incentive.html&text=BriefCASE%3a+Climate+politics+-+France%27s+carbon+footprint+incentive+stirs+debate+on+global+EV+supply+chains++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbriefcase-climate-politics-frances-carbon-footprint-incentive.html","enabled":true},{"name":"email","url":"?subject=BriefCASE: Climate politics - France's carbon footprint incentive stirs debate on global EV supply chains | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbriefcase-climate-politics-frances-carbon-footprint-incentive.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=BriefCASE%3a+Climate+politics+-+France%27s+carbon+footprint+incentive+stirs+debate+on+global+EV+supply+chains++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fbriefcase-climate-politics-frances-carbon-footprint-incentive.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}