Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 26, 2024

March 2024 US auto sales reflect uneasy progress

S&P Global Mobility projects that US auto sales in March will crest over 1.4 million units - just the second time since May 2021 that monthly volume has reached this level.

Key Takeaways

- US Auto Sales for March 2024 projected at 1.47 million units

- Dealer advertised inventories were up to 2.62 million units

- March BEV share expected to reach 8%

- S&P Global Mobility projects calendar-year 2024 light vehicle sales volume of 15.96 million units, a 3% increase from the 2023 tally

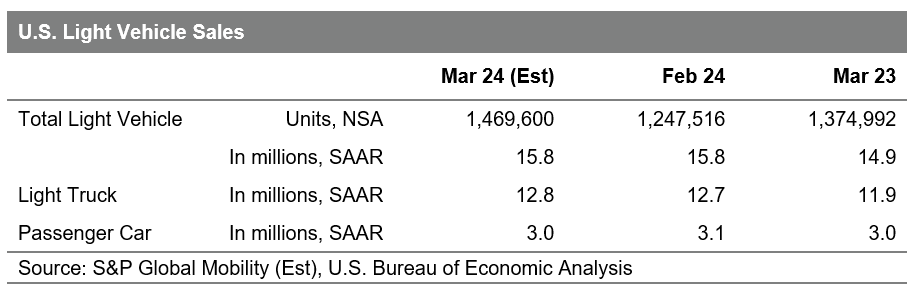

With volume for the month projected at 1.47 million units, March 2024 US auto sales are estimated to translate to an estimated sales pace of 15.8 million units (seasonally adjusted annual rate: SAAR). This would bring the SAAR average in the first quarter of the year to a level of 15.5 million units. While progress from a year-ago reading of 15 million units, it would reflect a step down from the 15.7 million unit reading of the fourth quarter of 2023, reflective of the volatile nature of the current auto demand environment.

"With inventory growing, incentives rising, and quarter-end sales targets to be met, March sales volume will be relatively positive, rising to over 1.4 million units for just the second time in the past 34 months," said Chris Hopson, principal analyst at S&P Global Mobility. "However, since the second quarter of 2023, the pace of sales has been in a prolonged holding period, given the current purchase environment facing auto consumers. High-interest rates, slowly receding vehicle prices, and uncertain economic conditions continue to push against any consistent upshift for demand levels."

Regarding inventory trends, Matt Trommer, associate director of Market Reporting at S&P Global Mobility said, "At the beginning of March, available dealer advertised inventories were up to 2.62 million units, an increase of 56% over last year and up 5% compared to the beginning of February 2023. Model-year (MY) 2024 vehicles represented 84% of that inventory, so pockets of MY2023 vehicles remain, setting up the potential for additional spring clearance activity."

The S&P Global Mobility US auto outlook for 2024 reflects sustained, but more moderate growth levels for light vehicle sales. Production levels are expected to continue to develop, especially early in the year as some automakers look to continue to restock in the wake of production shutdowns late in 2023 and decent December 2023 sales volume.

"Advancing production levels set the stage for incentives and inventory to continue to develop, potentially enticing new vehicle buyers who remain on the sidelines due to higher interest rates, but it will be a bumpy ride and month-to-month sales volatility is likely," said Hopson. "S&P Global Mobility projects calendar-year 2024 light vehicle sales volume of 15.96 million units, a 3% increase from the 2023 tally."

Continued development of battery-electric vehicle (BEV) sales remains an assumption in the longer-term S&P Global Mobility light vehicle sales forecast. In the immediate term, some month-to-month volatility is anticipated. March BEV share is expected to reach 8%, similar to the month prior reading as automakers, dealers, and consumers continue to digest the changes to IRA Federal tax credits to begin the new year. BEV share is expected to advance over the next several periods, pending the rollouts of vehicles such as the Chevrolet Equinox EV, Honda Prologue, and Fiat 500e, all scheduled for market introductions over the first half of 2024.

See the latest vehicle electrification trends.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmarch-2024-us-auto-sales-reflect-uneasy-progress.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmarch-2024-us-auto-sales-reflect-uneasy-progress.html&text=March+2024+US+auto+sales+reflect+uneasy+progress+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmarch-2024-us-auto-sales-reflect-uneasy-progress.html","enabled":true},{"name":"email","url":"?subject=March 2024 US auto sales reflect uneasy progress | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmarch-2024-us-auto-sales-reflect-uneasy-progress.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=March+2024+US+auto+sales+reflect+uneasy+progress+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmarch-2024-us-auto-sales-reflect-uneasy-progress.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}