Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 18, 2022

October Forecast: As supply chain challenges ease, demand headwinds could impact global light vehicle production

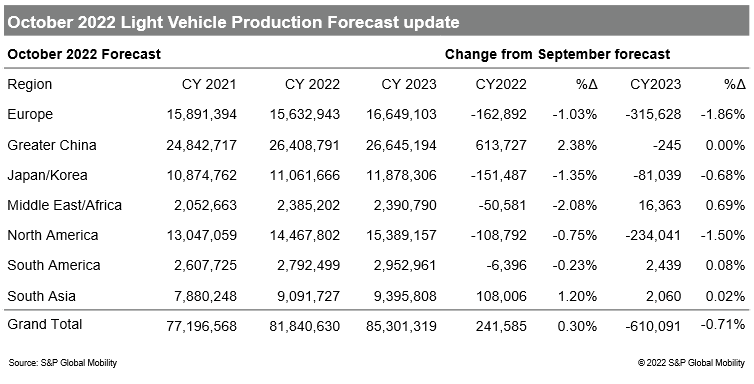

S&P Global Mobility experts have issued the latest global light vehicle production forecast update, with further reductions across several regions given ongoing supply chain challenges.

As ongoing supply chain challenges continue to gradually improve, markets are increasingly reckoning with the destructive forces of high inflation, rising interest rates and the specter of economic stagnation or outright contraction in key markets such as the US and West Europe pressuring fragile pent-up demand, according to the latest baseline light vehicle production forecast update from S&P Global Mobility.

While the immediate near-term outlook is supported by continued strong performance in Greater China and South Asia through the balance of 2022, perhaps more significant are the downward revisions for North America, Europe and other markets to reflect the impacts of heightened demand destruction.

In the longer term, vehicle pricing will remain a key consideration and a potential headwind to demand, particularly as many markets shift to much higher levels of electrification,

The October 2022 forecast update reflects near-term upgrades for Greater China on the strength of demand stimulus and South Asia as the region benefits from a stabilized supply chain supporting efforts to clear order backlogs.

"Greater China is rebounding strongly since the lockdowns of Q2 while OEMs in Europe and North America are still constrained by difficulty in securing component supplies," said Mark Fulthorpe, executive director, light vehicle production forecasting at S&P Global Mobility.

However, perhaps more important are the near-to-intermediate term downward revisions particularly focused on Europe, North America and Japan and eventually other regions.

While semiconductor availability remains an important consideration, demand destruction is expected to play a more fundamental role and accelerate in 2023 in several key markets, impacting production through the intermediate term and the magnitude/need for inventory restocking.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fdemand-headwinds-could-impact-global-light-vehicle-production.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fdemand-headwinds-could-impact-global-light-vehicle-production.html&text=October+Forecast%3a+As+supply+chain+challenges+ease%2c+demand+headwinds+could+impact+global+light+vehicle+production++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fdemand-headwinds-could-impact-global-light-vehicle-production.html","enabled":true},{"name":"email","url":"?subject=October Forecast: As supply chain challenges ease, demand headwinds could impact global light vehicle production | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fdemand-headwinds-could-impact-global-light-vehicle-production.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=October+Forecast%3a+As+supply+chain+challenges+ease%2c+demand+headwinds+could+impact+global+light+vehicle+production++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fdemand-headwinds-could-impact-global-light-vehicle-production.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}