Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 31, 2022

Mainland China’s Bus Production in the Shadow of COVID-19

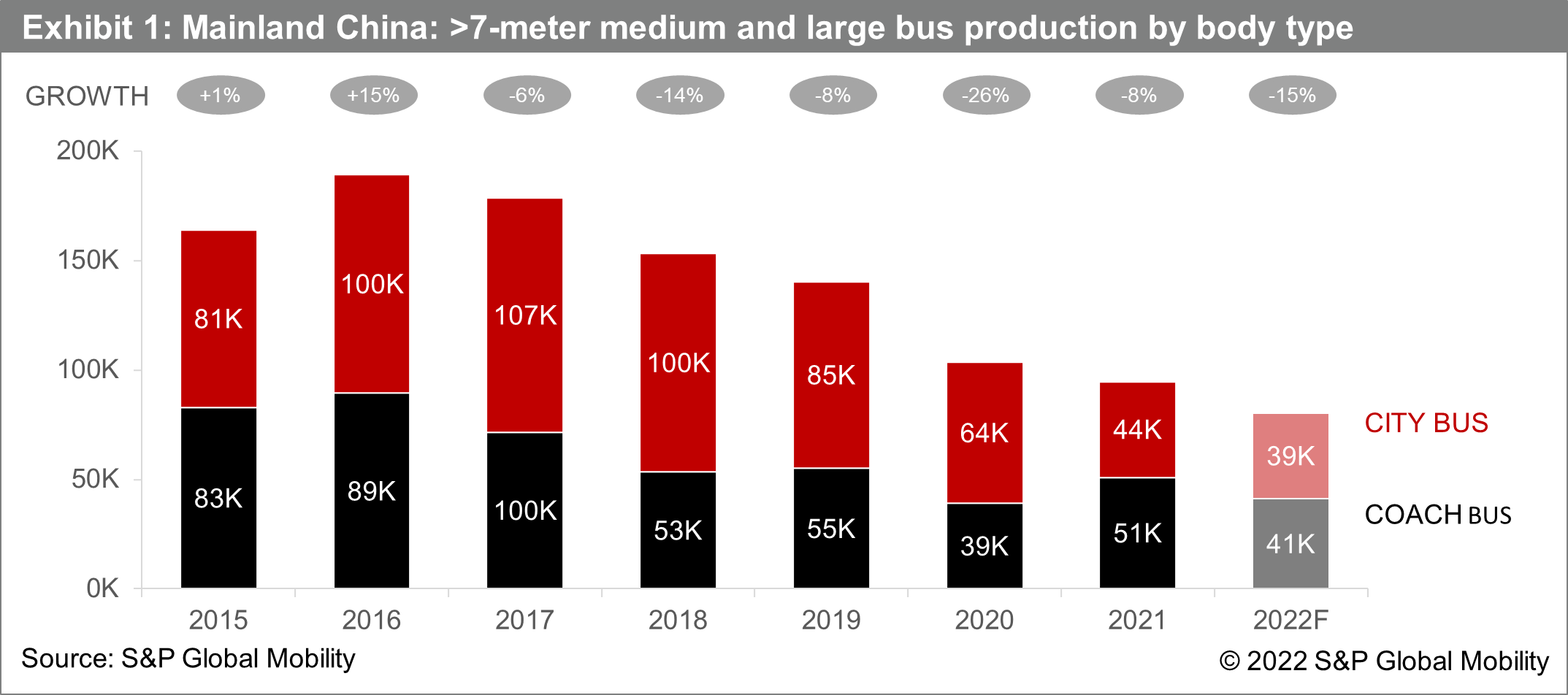

Mainland China, as the world's largest medium and large bus (length>7-meter) maker and market, is playing a leading role in the electrification of the commercial vehicle industry. Over the past few years, its bus market has remained worried by growing rates of car ownership, expanding ride-hailing and bike-sharing services, as well as spreading subway and high-speed train networks. Starting from 2020, the lingering COVID-19 pandemic and mobility restrictions further prevented people from commuting or touring by public transit system. In parallel, bus producers have encountered challenges from falling subsidies for new-energy vehicles (NEVs) and supply chain constraints. In our November forecast, we downgraded mainland China's bus production for 2022 by 5% to 80,000 units, a decline of 15% compared with 2021 and a nosedive of 43% compared with the pre-pandemic year 2019 (see Exhibit 1).

The city bus segment represents the major drag with market share falling significantly from 60% in 2020 to 45% in 2021. As most operators in the segment are state-owned, market performance is closely linked to the government's policies, particularly on electrification revolution. Although subsides for purchasing NEVs continue to accelerate city bus replacements, the boost is diminishing with allowances being slashed since 2016. In 2022, the average central subsidy per electric and plug-in electric bus is further downgraded by 20% from the 2021 level. Meanwhile, the prolonged pandemic and intermittent lockdowns have made local governments trim fiscal budget for the public transport sector. As a result, city bus production contracted by 8% year-on-year (y/y) throughout January-August even on a low-base effect. The pre-buy activities in preparation for the stoppage of NEV purchase subsidies in 2023 are expected to bring more output in the fourth quarter. However, the stimulus effect could be undermined by budget shortfalls. The ensuing demand overdrafts will likely put a strain on the segment in the first half of 2023, followed by a conventional recovery with support from export revival and domestic plans of building over 50 bus metropolis and improving electrification of public transport fleets from 66% by 2021 to 72% by 2025. More production will shift to the medium bus sector (7-10-meter buses) as incentive policies are leaning towards NEV application in suburban and rural public transportation.

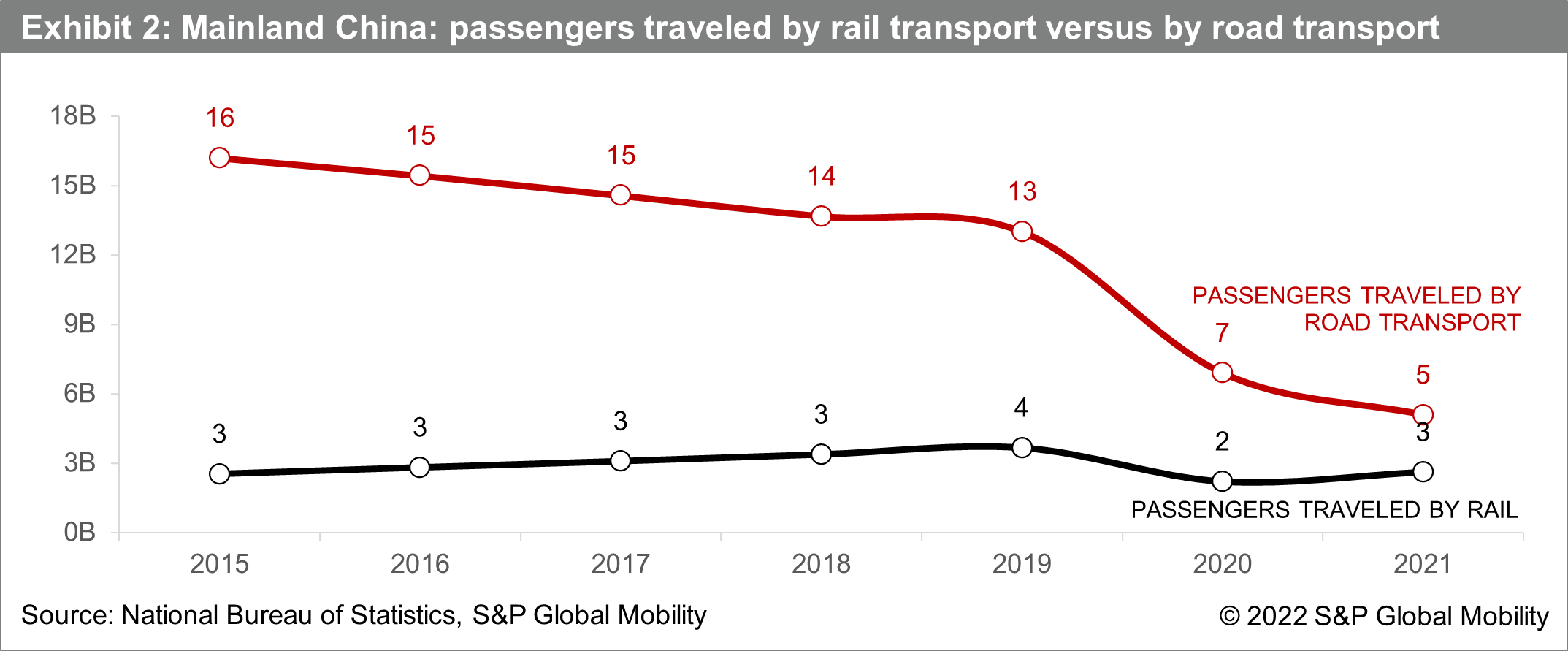

The coach bus segment won back the market dominance and accounted

for around 55% market share by 2021. Unlike city buses, coach buses

are usually applied in long-distance line services and therefore

not suitable to the battery-electric application given limitations

of battery mileage and charging infrastructure. The segment has

been dampened by the increasing penetration of high-speed trains as

evinced by the widening of "scissors gap" between passengers

traveled by coach (down 20% during 2015-2019) and by railway (up

44% during 2015-19; see Exhibit 2). Amid the pandemic since 2020,

the segment has been badly hit as mobility restrictions have almost

brought the public transit and tourism industries to a standstill.

The purchase ahead of nationwide shift to the CN6-a emission

standards for new vehicles, effective from July 2021, supported a

transitory reversal of the segment in the second quarter of 2021

before returning to depression throughout first eight months of

2022. The baseline weakness is anticipated to deepen into early

2023 under the continuation of "dynamic zero-COVID" approach

despite vaccination progress. Future recovery remains to be seen

and will depend on relaxation of containment measures and

enforcement of 2020-35 medium- and long-term plan for hydrogen

energy industry which specifies a target of 50,000 fuel-cell

electric vehicles in operation by 2025.

In addition to demand recession, bus makers are bearing similar

supply chain disruptions from inflationary pressures and

semi-conductor shortages as truck makers. In fact, bus makers

suffer more as customized products are unfavorable for modular

design and scale of economies. Although the market concentration

has become fairly high with top-10 bus makers taking around 85%

market share in 2021, there are still more than 30 players across

the nation, intensifying the industry competition. To break

through, bus makers have been working with operators to explore

diversified transport modes that integrate functions such as

freight delivery and ride-hailing services. On the other hand,

leading producers including Yutong, King Long, Golden Dragon, and

Higer have extended their business scope with truck manufacturing.

With the subsidy regime coming to an end, we anticipate more

consolidation in bus industry in the near term.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmainland-chinas-bus-production-in-the-shadow-of-covid19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmainland-chinas-bus-production-in-the-shadow-of-covid19.html&text=Mainland+China%e2%80%99s+Bus+Production+in+the+Shadow+of+COVID-19+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmainland-chinas-bus-production-in-the-shadow-of-covid19.html","enabled":true},{"name":"email","url":"?subject=Mainland China’s Bus Production in the Shadow of COVID-19 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmainland-chinas-bus-production-in-the-shadow-of-covid19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mainland+China%e2%80%99s+Bus+Production+in+the+Shadow+of+COVID-19+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2fmainland-chinas-bus-production-in-the-shadow-of-covid19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}