Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsMay 2022 Tesla brand loyalty more than doubles year-over-year and leads all brands industry-wide

Tesla's May 2022 brand loyalty of 63% is exceptional when viewed from just about any perspective: it is more than double its May 2021 loyalty of 29.4%; it is the highest brand loyalty not only of any luxury brand but of any brand industry-wide in May; it is 12.3 PP above luxury runner-up Lincoln; it is one of only two positive year-over-year results among the 20 luxury brands (with Lincoln); it is the ninth consecutive monthly Tesla loyalty greater than 60%; finally, it is the only brand to break the 60% threshold in brand loyalty in the inventory shortage-impacted 2021 or May CYTD 2022 time periods.

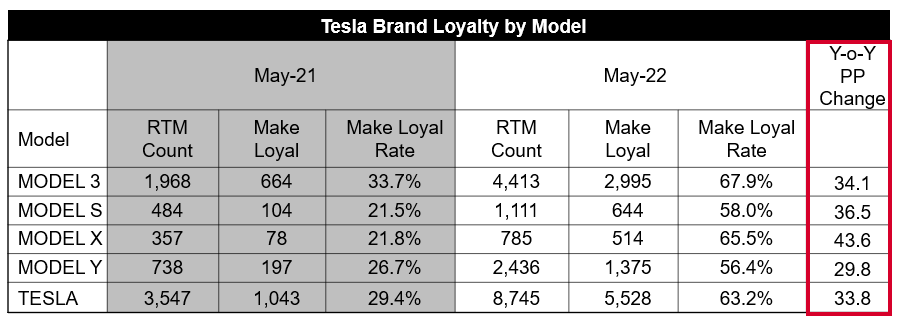

A review of Tesla model-level data in May reveals that while every model has experienced sizable year-over-year increases, the Model 3 results stand out. Model 3's May return-to-market volume of 4,413 is 51% of the brand's volume, making its results that much more important. Model 3 May brand loyalty of 67.9% is more than double the year-ago tally and the highest of any Tesla model (note that the smallest year-over-year jump of any Tesla model in May was 29.8 percentage points). Further, Model 3's brand loyalty is the second highest of any model in the industry, trailing only the Ford Edge. Also, Models 3 and X rank in the top ten models across the industry in May brand loyalty; Tesla joins Ford, Chevrolet, and Toyota as brands with two models in the top ten in May brand loyalty.

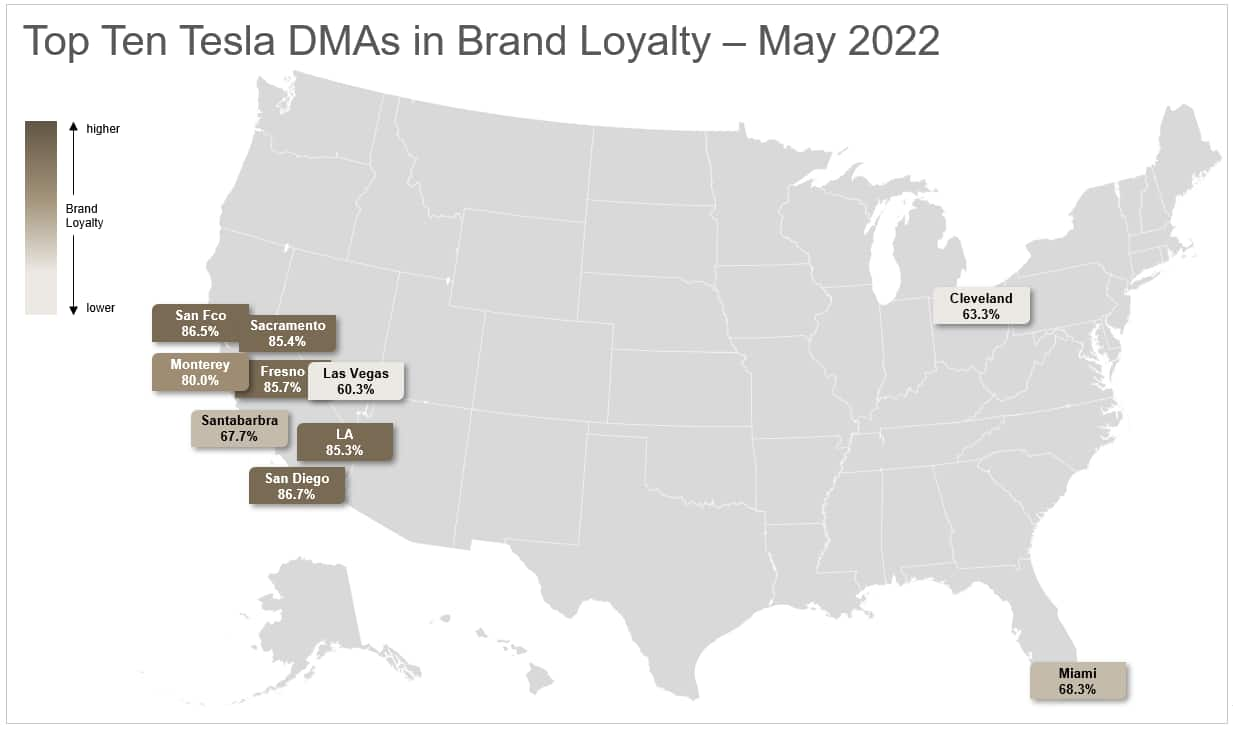

Lastly, these national Tesla loyalty results mask some extraordinary DMA-level results. Tesla brand loyalty in May exceeded 80% in six DMAs (all in California), including San Diego, San Francisco, Fresno, Sacramento, Los Angeles, and Monterey. To provide a broader perspective from which to acknowledge how exceptional these results are, national brand loyalty in May was 49.9%.

What does all this mean? In a nutshell, it means that Tesla not only is selling a lot of cars and crossovers (more than any other luxury brand in May), but that these buyers like their vehicles and are buying another one. These are ominous findings for the rest of the industry. Every brand - luxury and mainstream - needs to develop an effective competitive response to Tesla as soon as possible.

----------------------------------------------------

This automotive insight is part of our monthly Top

10 Trends Industry Report. The report findings are taken

from new and used registration and loyalty data.

To download the full report, please click below.

Our Mobility News and Assets Community page features the latest automotive insights, visit the page to learn more.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.