Discover more about S&P Global's offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 14, 2022

Rising input costs squeezing out entry BEVs

The biggest challenge for OEMs rolling out new battery electric vehicles (BEVs) is rising input costs, which are affecting cost parity with traditionally powered vehicles. With prices of key raw materials used in BEVs having risen dramatically since 2019, S&P Global Mobility sees the potential for changes in consumer behaviour, although the projected long-term market share of BEVs is likely to be unchanged.

- Overall, we expect 2022 to be a year when rising raw material prices peak. However, we also expect automakers to be working with critical raw materials prices about 75% higher in 2030 than in 2019. Our forecasts for vehicle sales, powertrains, and components now reflect the impact of that expectation.

- In terms of the current make-up of the global passenger car market, we expect two major challenges for vehicles powered by traditional ICE technology. Firstly, stricter emissions regulations will increase the cost of vehicle technology and emissions controls. Secondly, in the shift to electrification, with decreasing volumes of ICE vehicles against increasing volumes of BEVs, this will erode the economies of scale of ICE vehicles and probably increase their cost base.

- Prior to the rise in critical raw materials costs, some price parity of BEVs with ICE and hybrid models had been expected by about 2025, excluding vehicles in entry-price-point segments. Such parity would probably result in some OEMs leaving the city car segment and increasingly narrowing options in terms of entry-level A-segment vehicles.

Market dynamics may see some change

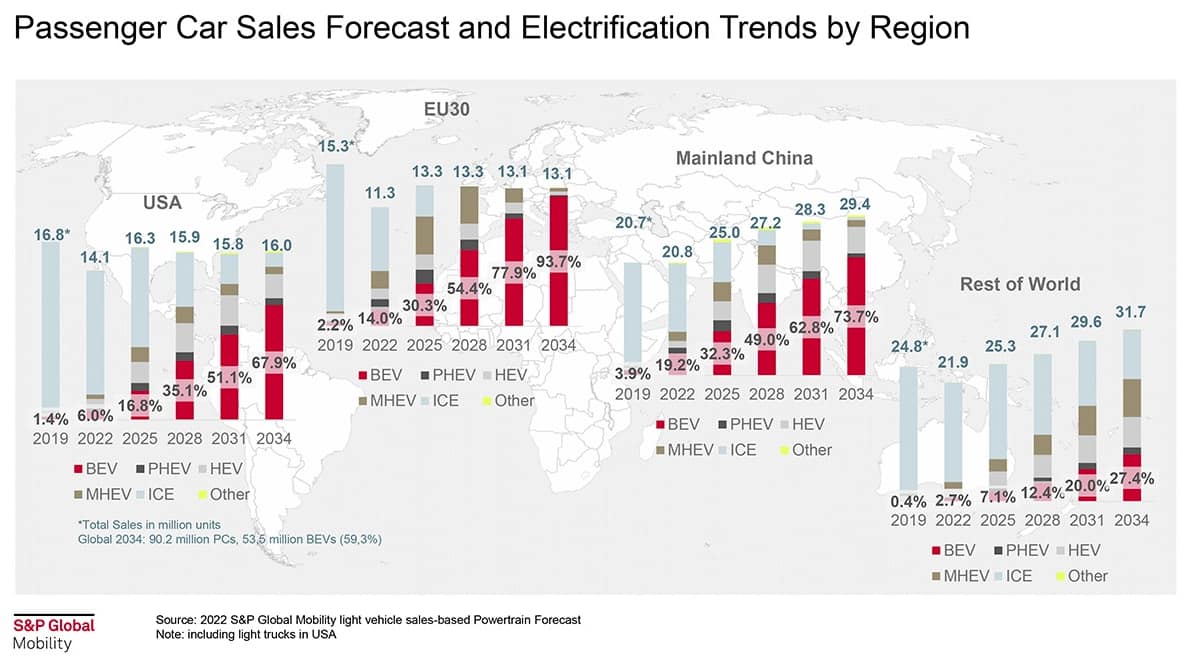

- S&P Global Mobility does not expect the pricing pressures

to have much impact on vehicle sales at the topline, despite

expectations that smaller vehicle segments will retain limited BEV

options as a result. In 2031, our latest forecast sees BEVs

reaching a 51.5% market share in the United States, nearly 78% in

Europe, and about 74% in China. However, the rest of the world is

expected to continue to lag and BEVs to have a market share of only

about 27%.

- OEMs have some tools available to them to keep BEV costs in

check. These include switching to less-expensive lithium iron

phosphate (LFP) battery chemistries. One potentially interesting

but untried option for managing residual values and lease rates is

a Toyota proposal for factory refreshing of used cars. OEMs may

also opt to reintroduce aggressive vehicle discounts, but in the

past few years, the industry has been moving away from doing

this.

- For consumers, there are also options. First, we will see a degree of acceptance of price increases. Consumers are most likely to accept price increases when they are in the form of moderate lease rates for less-price-sensitive buyers. Another outcome may be consumers switching to lower-positioned brands or segments. Consumers may also increase the holding period of a vehicle or opt to leave the new-car market. Both of those options have the potential to affect topline sales volumes over time, however.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2frising-input-costs-squeezing-out-entry-bevs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2frising-input-costs-squeezing-out-entry-bevs.html&text=Rising+input+costs+squeezing+out+entry+BEVs+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2frising-input-costs-squeezing-out-entry-bevs.html","enabled":true},{"name":"email","url":"?subject=Rising input costs squeezing out entry BEVs | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2frising-input-costs-squeezing-out-entry-bevs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Rising+input+costs+squeezing+out+entry+BEVs+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmobility%2fen%2fresearch-analysis%2frising-input-costs-squeezing-out-entry-bevs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}