Published November 2024

Synthetic lubricants (synlubes) are formulated products made from synthetic base stocks and additives, offering superior physical and chemical properties over conventional mineral oil–based lubricants. This makes them ideal for applications with demanding performance requirements. Synthetic lubricant base stocks are generally more expensive than conventional mineral oils, traditionally limiting their use to applications requiring high performance. However, industrial customers are increasingly considering long-term cost benefits, opting for synthetic lubricants to reduce maintenance; minimize disposal issues; and meet health, safety or environmental regulations.

Since the 1990s, the automotive sector has experienced significant growth in synlube adoption, fueled by promotional campaigns and evolving automaker requirements, especially in Europe. Additionally, synlubes are increasingly utilized as refrigerator oils, ensuring compatibility with newer refrigerants that have replaced harmful chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs). This trend reflects a broader commitment to sustainability and efficiency in industrial operations.

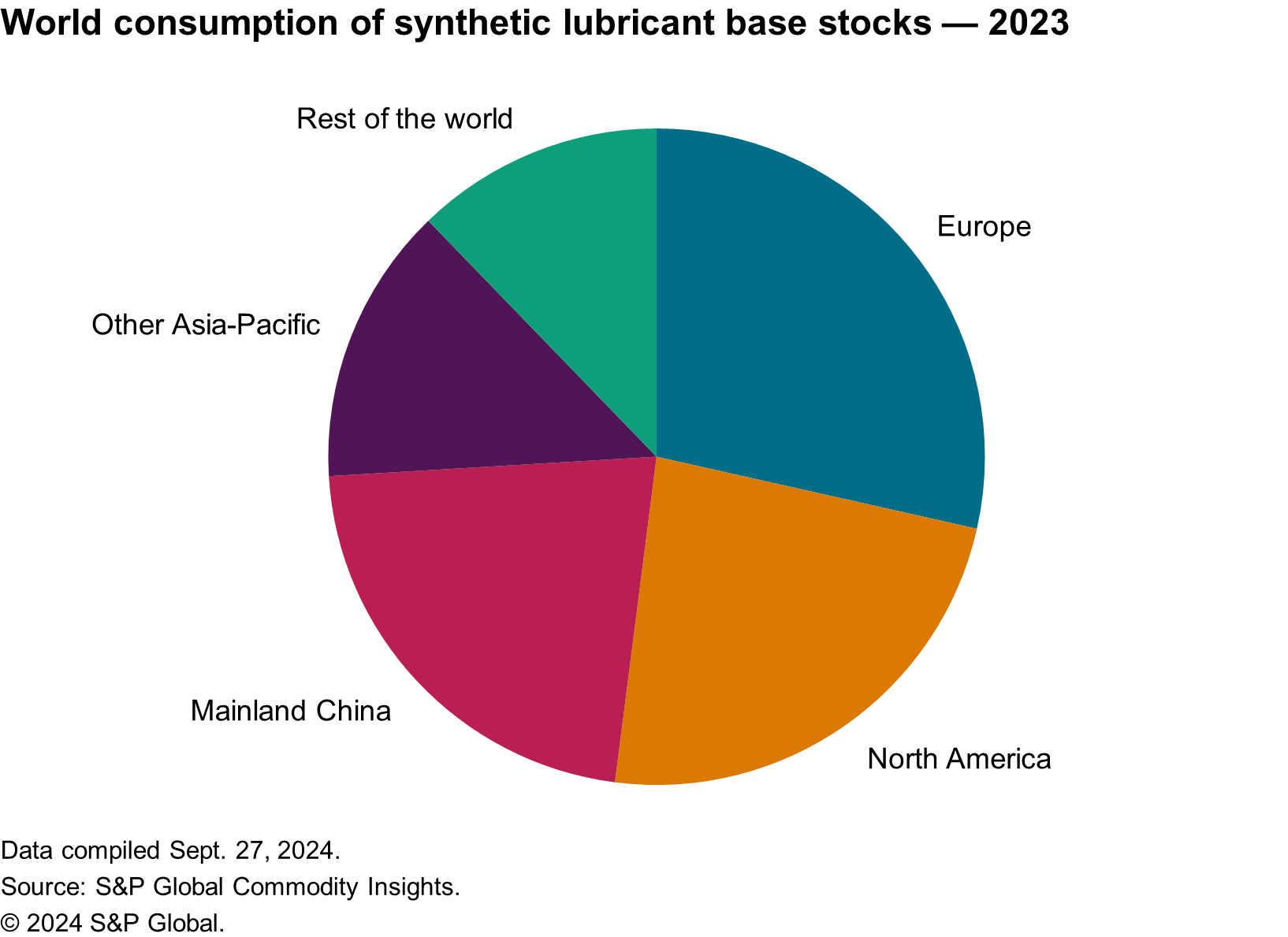

The following pie chart shows world consumption of synthetic lubricant base stocks on a volume basis:

The market for synthetic lubricant base stocks is dominated by three product groups — polyalphaolefins (PAO), esters and polyalkylene glycols (PAG). Their combined market share in 2023 was more than 87%. PAO is the most important synthetic lubricant base stock, used largely in automotive and aviation applications and in industrial compressor oils and hydraulic fluids. Esters have a much broader application range than all other synlube base stocks, with use in refrigeration and air conditioning, fire-resistant hydraulic fluids (FRHFs) and aviation turbines. The use of PAG in synlube applications represents only a minor share of total PAG production — between 5% and 10%, depending on the region. Industrial applications dominate usage of PAG as a lubricant, especially FRHFs, metalworking oils and process oils.

The total share of synthetic lubricant base stocks in the global lubricant base oil business is only around 4%, but their importance is growing as more applications demand a level of performance that is borderline or beyond the capabilities of conventional lubricants. Nearly all synlube base stocks enjoy growth rates that are higher than those of mineral oils, and many are growing faster than other specialty chemical product types.

For more detailed information, see the table of contents, shown below.

S&P Global’s Specialty Chemicals Update Program – Synthetic Lubricants is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program – Synthetic Lubricants has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade and economics.

This report can help you

- Identify the competitive environment and key players

- Assess key issues facing both suppliers and their end-use customers

- Understand industry integration strategies

- Keep abreast of industry structure changes, regulatory requirements, and other factors affecting profitability

- Identify new business opportunities and threats

- Follow important commercial developments

- Recognize trends and driving forces influencing specialty chemical markets