Published September 2024

Phosphoric acid (H3PO4) is the leading inorganic acid produced and consumed in terms of production value and it is the second largest in terms of volume — after sulfuric acid. By far its greatest use is in the manufacture of phosphate chemicals consumed primarily as carriers of phosphorus values in fertilizers. Use in the production of animal feeds is of secondary importance. Phosphoric acid is also used in the manufacture of phosphate chemicals for use in water treatment and detergent builders, dentifrices, fire control chemicals and a host of smaller markets. A fast-growing market is phosphoric acid consumption for the production of lithium iron phosphate (LFP) and lithium manganese iron phosphate (LMFP) batteries used in electric vehicles. Consumption of phosphoric acid for its acid properties is relatively small (e.g., treatment of metal surfaces, beverage acidulation). Phosphoric acid is the leading intermediate product or processing step between phosphate rock and the end markets for phosphorus in phosphate form.

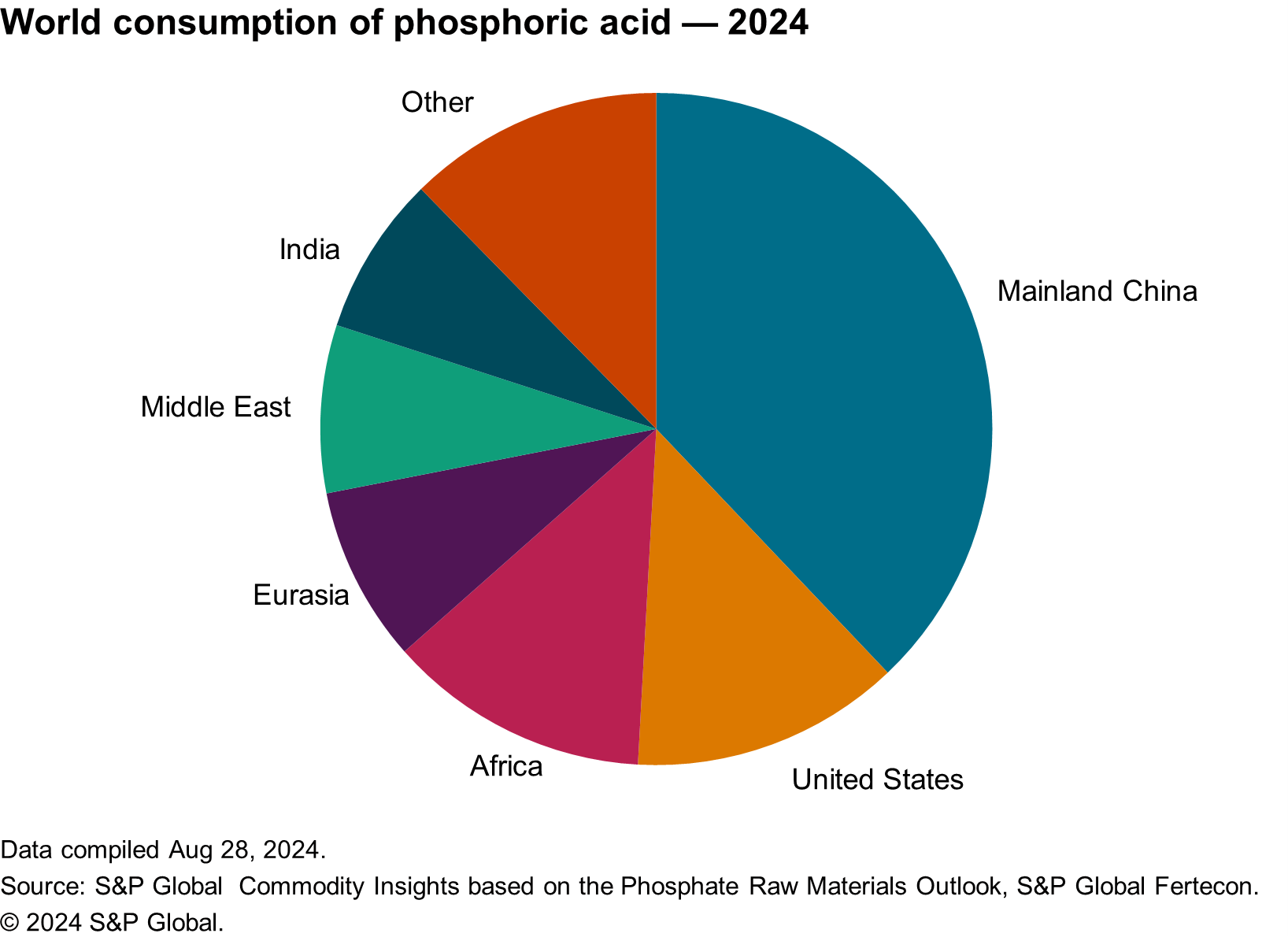

The following pie chart shows world consumption of phosphoric acid:

The primary market for phosphoric acid is the production of the phosphate fertilizer products — ammonium phosphates (MAP and DAP) and triple superphosphates (TSP). Fertilizer production accounts for an estimated 83% of the global market for phosphoric acid and animal feed for about 5%. The remainder is consumed in a variety of industrial applications.

The supply/demand balance for phosphoric acid is demand driven. If all the announced projects materialize, operating rates will decline. Emerging regions are heavily investing in downstream phosphate fertilizer production units. As a result, it is expected that older phosphoric acid production units in regions without indigenous phosphate rock reserves will come under additional pressure and will eventually be forced to close.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Phosphoric Acid is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Chemical Economics Handbook – Phosphoric Acid has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations and other factors on chemical profitability