Published November 2023

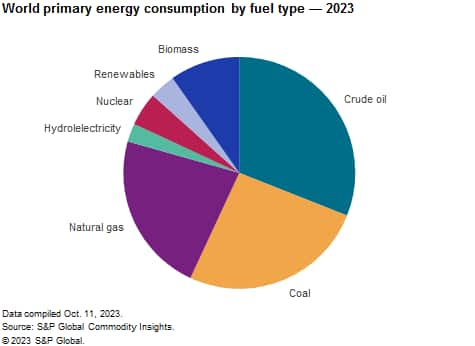

In 2023, fossil fuels continue to dominate global energy markets. While crude oil remains the major global source of transportation fuels, power and heat, the source of energy that has grown the most over the past decade has been natural gas. Increasing production and export capacity as well as its better environmental performance and strong policy support in key markets have led to rising natural gas consumption, particularly in North America, the Middle East and Northeast Asia. In the meantime, the development of renewables has been uneven across the world, largely dependent on supportive government policies as well as evolving technologies and improving cost of production.

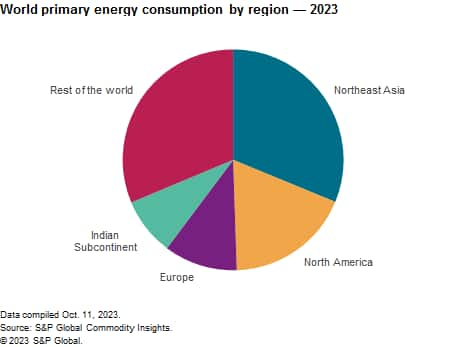

The following pie charts show world consumption of energy by region and by fuel:

Energy requirements continue to grow globally, driven by expanding population, improving living standards in heavily populated areas and continued urbanization. The rise in renewable energy has remained insufficient to tackle the global warming issues and durably curb GHG emissions. The COVID-19 pandemic also had a profound impact on global energy markets, with significant short-term declines seen across many sectors. Despite the fact that GHG emissions have slowed, the absolute level of emissions continues to increase, except for the unprecedented drop in 2020. Under the current macroeconomic and energy scenario, GHG emissions are projected to rise in the near-term (2024) before declining from 2025 onward.

This report provides S&P Global Commodity Insights’ base case scenario (the Inflections scenario) including the latest forecasts by fuel, sector and region. The energy inflections scenario is driven by four factors: price differential, environmental concerns, technology improvements and energy security.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Energy is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Chemical Economics Handbook – Energy has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability