Published July 2021

Linear alkylbenzene sulfonic acid (LABSA) is prepared commercially by sulfonating linear alkylbenzene (LAB). Linear alkylbenzene sulfonate (LAS), the world’s largest-volume synthetic surfactant, which includes the various salts of sulfonated alkylbenzenes, is widely used in household detergents as well as in numerous industrial applications. The LABSA market is driven by the markets for LAS, primarily household detergents. Linear alkylbenzene sulfonate was developed as a biodegradable replacement for nonlinear (branched) alkylbenzene sulfonate (BAS) and has largely replaced BAS in household detergents throughout the world.

The pattern of LAS consumption demonstrates the overwhelming preference by consumers for liquid laundry detergents in North America, whereas powders continue to be the dominant products in Western Europe, mainland China, and Northeast Asia (Japan, South Korea, and Taiwan). Comparable and reliable data in other world regions are generally unavailable, but in these less-developed world areas, LAS is essentially used only in laundry powders (particularly in India and Indonesia) and hand dishwashing liquids. The latter are often used as general-purpose cleaners.

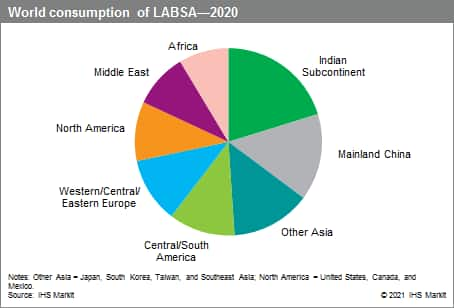

The following pie chart shows world consumption of LABSA:

Household cleaning products had a banner year in 2020 as consumers stocked up on cleaners, sanitizers, and disinfectants to help combat COVID-19. Demand will remain robust in 2021 with consumer’s heightened cleaning standards, but it is believed that there will be some pull-back in the frequency of household cleaning during the rest of the forecast period (especially if things on the pandemic front continue to improve—a situation that still remains highly dynamic at the time of writing this report).

Industrial, institutional, and commercial cleaners account for most of the other applications, but LAS is also used as an emulsifier (e.g., for agricultural herbicides and in emulsion polymerization) and as a wetting agent. Very small volumes are also used in personal care applications. Nonhousehold uses lost some market share in 2020 due to the COVID-19 pandemic, which provided a mixed bag of results for industrial and institutional cleaners. Those sectors that remained open or were deemed essential saw a surge in demand for cleaning products, while the lockdowns, travel restrictions, and the closure of public buildings and nonessential businesses led to significant decline in demand in those industries. With increased vaccinations, falling positive coronavirus cases, and the increased lifting of COVID-19 restrictions, LAS consumption should experience above-average growth in nonhousehold applications through 2025. However, this situation remains highly dynamic at the time of writing this report.

Although consumption of LAS will likely remain stable in the highly developed regions, it will increase by 3.0– 6.0% per year in some less-developed regions or countries, such as the Middle East, Africa, and India, where powder detergents are still a very large part of the laundry detergent market. As a result of the rapid growth of LAS demand in the Asia Pacific region, demand in the region accounted for approximately half of global demand in 2020.

LABSA/LAS production is also impacted by the supply situation for competing products—mainly alcohol ether sulfates (AES). Shortages in AES supply or its high price has usually favored the use of LABSA/LAS. In the developing world, LAS competes with soaps.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Linear Alkylbenzene Sulfonic Acid (LABSA)/Linear Alkylbenzene Sulfonate (LAS) is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Chemical Economics Handbook – Linear Alkylbenzene Sulfonic Acid (LABSA)/Linear Alkylbenzene Sulfonate (LAS) has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability